您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Europe, including Russia, recorded a 2.2 per cent year-on-year growth in primary aluminium production during the first four months of 2025, driven by consistent growth in almost every month barring February when the output was 537,000 tonnes this year, compared to 540,000 tonnes in February 2024. Interestingly, the production pattern in 2025 closely mirrored that of the previous year, following a similar trajectory—dipping in February, rebounding in March, and tapering again in April – yet concluded the first four months with a rise from 2.26 million tonnes to 2.31 million tonnes, according to data releaved by the International Aluminium Institute.

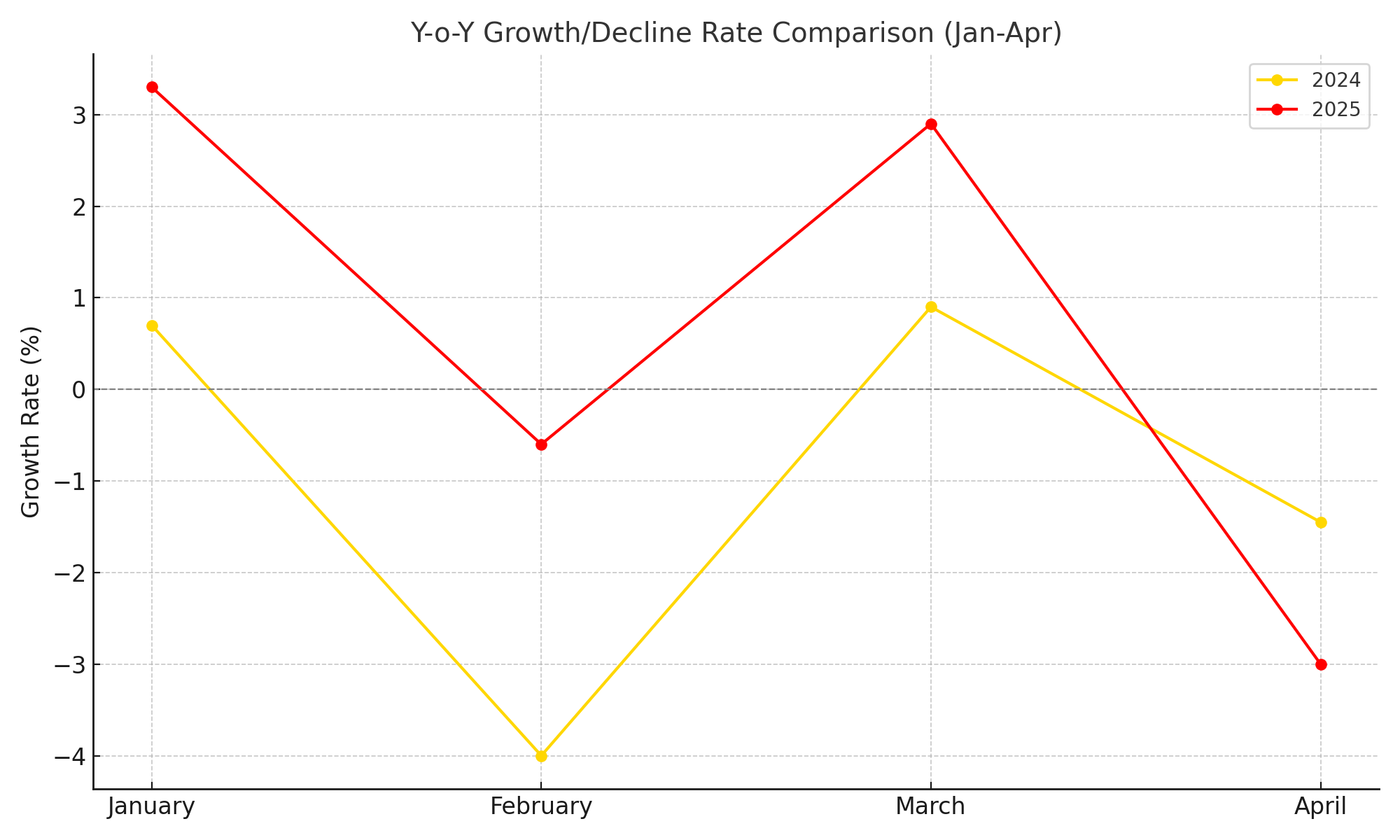

This increase was particularly due to a stronger growth momentum in production through April 2025 compared to the previous year. For instance, the output in January 2025 climbed up by 3.3 per cent year-on-year, reaching 597,000 tonnes, versus the modest growth rate of 0.7 per cent seen during the same month of 2024. Even in March 2025, the growth intensity was more than in the previous year, recording at 2.9 per cent compared to 0.9 per cent in March 2024. April also sustained the pace, with output expanding by 3 per cent year-on-year, outpacing the 1.45 per cent growth recorded in April 2024.

Also read: The US delay on EU duties signals strategy, not softening ‘brinkmanship’

The monthly production pattern of Europe’s primary aluminium sector from January to April 2025 also closely echoed that of the earlier year. However, the only difference was the percentage of growth or decline. In February 2025, Europe saw a notable fall of 10 per cent in primary aluminium production, compared to a 7 per cent decline recorded in February 2024. In March 2025, the output rebounded, rising by the same percentage as the decline, mirroring a similar recovery pattern observed the previous year. April 2025 followed suit, with production easing by 2.9 per cent from March, once again aligning with the month-on-month trend seen in 2024.

Thus, it is safe to say that a seasonal production cycle remained consistent year over year in 2025, despite differences in the scale of monthly fluctuations. In fact, the production pattern not only remained the same but grew in volume at the end of the fourth month.

An economist and market analyst had suggested in February this year that increased aluminium prices coupled with lower production costs might incentivise Europe’s aluminium smelters to ramp up their output in 2024 and 2025. Throughout the first three months of 2025, primary aluminium price on LME hovered between USD 2,500 per tonne and USD 2,700 per tonne, reaching as high as USD 2,725 per tonne. That could be a driving force for European smelters to ramp up their primary aluminium production.

Even Uday Patel, Senior Research Manager - Metals and Mining - Aluminium, Wood Mackenzie, had noted in one of his interviews with AL Circle that sustained higher LME prices could lead to the reactivation of smelters.

Also read: Primary aluminium production in Q1 2025 grows but at a lower rate– factors uncovered here

Responses