您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

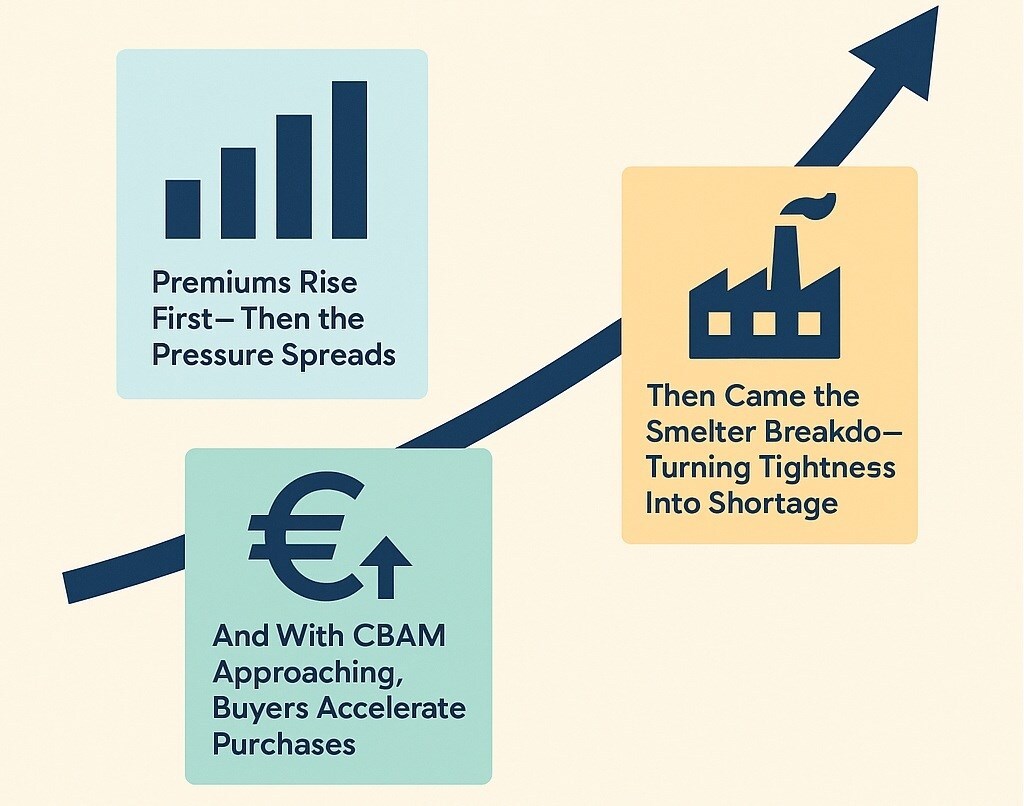

Europe’s aluminium market is being squeezed from three sides at once: soaring premiums, a major smelter shutdown and the countdown to CBAM. Together, these pressures are tightening supply, inflating costs and reshaping trade flows across the continent as 2025 draws to a close.

Premiums surge as supply tightens across Europe

The first sign came from the premium market. By November 2025, Europe’s duty-paid premium had climbed to USD 324.38 per tonne, after touching a nine-month high of USD 330 per tonne on November 3. Forecasts for December point to roughly USD 335.50 per tonne, with 2026 estimates sitting between USD 327.25 and USD 330.50 per tonne. The rise did not come from a single trigger but from a combination of tightening supply, higher freight rates and early adjustments to carbon-related costs.

As premiums rise, the impact is quickly rippling through Europe’s manufacturing chain. Automotive, construction and packaging companies are facing higher raw material costs, squeezing margins and difficult procurement decisions. Smaller manufacturers are feeling the strain most sharply. Traders are dealing with bigger working capital requirements and more volatile pricing, while Europe’s secondary aluminium producers are reducing billet output because high scrap and ingot prices are making operations less viable. Large consumers such as Ball Corporation and Crown Holdings are bracing for higher costs of goods sold, pressure that is likely to feed through to retail prices.

…and so much more!

SIGN UP / LOGINResponses