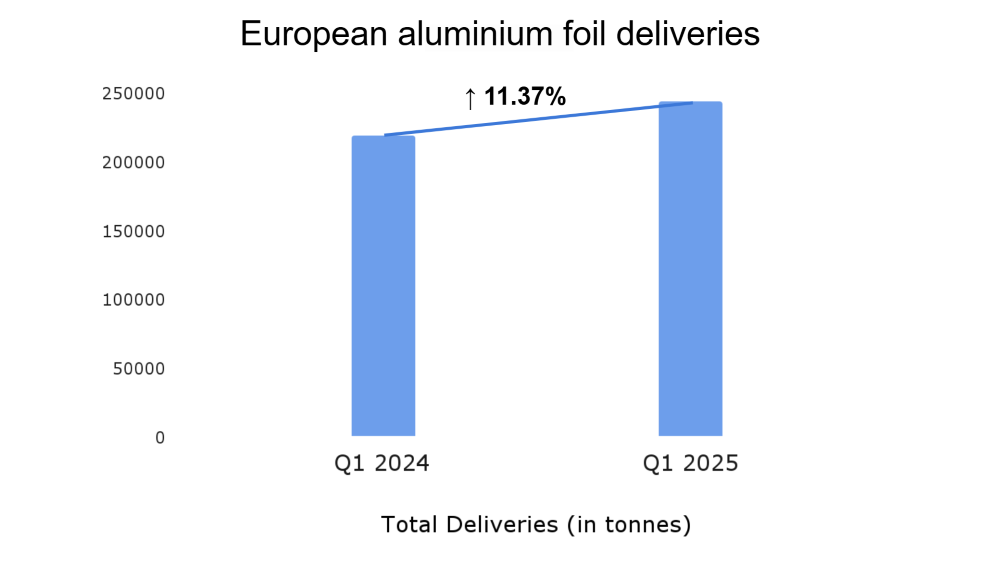

In the first quarter of 2025, European aluminium foil rollers experienced a significant uptick in demand. According to the European Aluminium Foil Association (EAFA), total deliveries reached 243,900 tonnes, marking an 11.4 per cent increase compared to the same period in 2024. This growth was driven by heightened demand within Europe and in export markets.

Domestic deliveries within Europe rose by nearly 11 per cent, while exports saw an approximate 18 per cent increase. The export surge is partly attributed to anticipatory effects stemming from current trade policies, especially in the Americas. Concerns over potential cost increases from impending aluminium foil tariffs may have prompted many American companies to ramp up their stockpiles. This robust performance contrasts sharply with the first quarter of 2024, when total deliveries stood at 217,800 tonnes, reflecting a 6.2% decline from the year 2023.

Thinner aluminium foils, primarily used in flexible packaging and household applications, exhibited strong performance with nearly 14 per cent growth. Deliveries of thicker foils, utilised in technical applications and industrial use, increased by almost 8 per cent. However, ongoing weaknesses in the construction and automotive sectors slightly tempered growth in this segment.

Restocking activities played a role, as many customers increased inventories at the beginning of the year. Despite uncertain economic conditions, resilient consumer demand in end markets supported the overall positive trend.

Reflecting on the industry's performance, Guido Aufdemkamp, Managing Director of EAFA, stated, "The industry is very satisfied with the start to the year." He emphasised, "The European aluminium foil industry remains agile in these uncertain and challenging times and is helping its customers to best manage market conditions. Even though we expect some slowdown in growth towards the end of the year, we assess the current market situation as stable."

This recovery in 2025 builds upon the industry's performance in 2024, where total deliveries surged to 892,500 tonnes, a 7.3 per cent increase from 2023's 831,700 tonnes. The resurgence was primarily driven by a marked uptick in demand from the packaging sector, which helped balance the industry’s recovery.

Deliveries within Europe grew by 7.8 per cent, while exports beyond the EAFA region saw a moderate rise of 3.5 per cent. Thicker aluminium foils (61–200μ), commonly used in food containers and technical sectors, recorded a strong 9.5 per cent increase in domestic shipments. Thinner foils (<60μ), mainly used for household and flexible packaging, climbed by 6.9 per cent.

The packaging sector played a key role in the recovery, demonstrating strong resilience despite high inflation and evolving consumer behaviour. Demand for aluminium foil in food containers surged by 23.8 per cent, while household foil experienced a steady rise of 0.2 per cent. As consumers adjusted their spending in response to inflation, aluminium foil emerged as a practical and sustainable packaging choice.

Both thin and thick aluminium foils registered growth, though at varying rates. Thin foil production rose by 6.8 per cent, primarily driven by demand for packaging films in food and household uses. In contrast, thicker foils experienced a stronger increase of 8.1 per cent, supported by rising demand in food delivery, pet food and coffee capsule packaging sectors.

The positive trajectory observed in early 2025 suggests a continued recovery and growth in the European aluminium foil market, building upon the foundations laid in 2024.

Responses