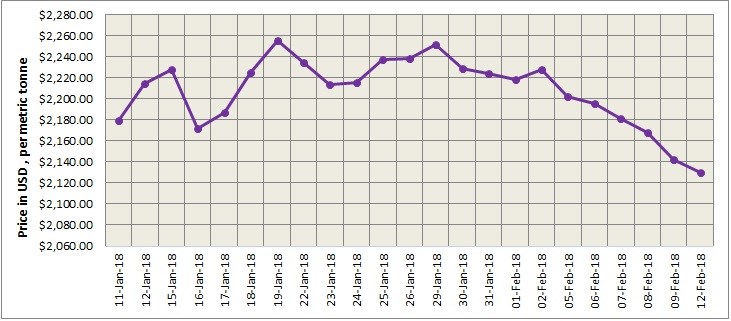

Benchmark aluminium price on London Metal Exchange dropped 0.58 per cent as inventory rose due to surging Chinese export. The light metal contract closed at US$2,129.50 per tonne on Monday, February 12, down from US$2,142 per tonne last Friday, February 9.

Shanghai Metals Market forecasts that LME aluminium will continue to trade low in the short term. The price will move in the range of US$2,120-2,155 per tonne on Tuesday, February 13.

{alcircleadd}

As on February 12, LME official cash buyer aluminium price (Bid Price) stands at US$2,129 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,129.50 per tonne, 3M Bid Price is US$2,129.50 per tonne, 3M Offer Price is US$2,130 per tonne, Dec1 Bid Price is US$2,178 per tonne, and Dec1 Offer Price is US$2,183 per tonne. LME aluminium opening stock stands at 1116575 tonnes, total Live Warrants is 899750 tonnes, and Cancelled Warrants total at 216825 tonnes.

LME aluminium Asian reference price three-months ABR is given asUS$2,141.30 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has increased from US$2,202 per tonne on February 12 to US$2,216 per tonne on February 13.

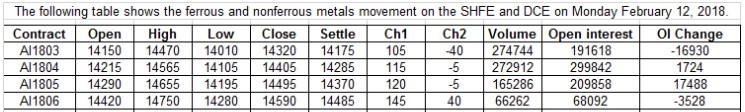

On Shanghai Futures Exchange, aluminium touched a mid-day high at RMB 14,565 per tonne yesterday but met resistance at the 10-day moving average. The movement of the contract as updated by SMM was as follows:

SMM thinks SHFE aluminium will continue testing upwards in the short term as downstream sector purchasing will resume in a full-fledged manner only after the Chinese New Year Holidays. SHFE aluminium is expected to trade at RMB 14,300-14,500 per tonne on Tuesday, February 13.

Discounts on spot aluminium are likely to stay stable at RMB 240-200 per tonne today, SMM said.

Responses