According to the Shanghai Metals Market, primary aluminium inventories in China witnessed a steep downfall of 26,000 tonnes week-on-week across eight major consumption areas, including SHFE warrants. Therefore, on Thursday, July 14, the inventories totalled 697,000 tonnes, which in comparison with the month’s first Monday, July 4, shrunk by a substantial 37,000 tonnes. As of now, the inventories in June stooped at 136,000 tonnes lower than in the same period last year.

An increased downstream dip-buying was witnessed this week. The inventory in Wuxi got cleared out owing to pandemic-related arrival problems and smooth cargo outflows from warehouses. The South China inventory restrained growth and began to decline as lesser aluminium prices are appealing to consumers. Activities related to trading took pace as soon as the aluminium price dropped to RMB 17,000 per tonne. Anyhow, the destocking factor would have to rely on the resurrection of downstream orders.

{alcircleadd}Last week, on July 7, primary aluminium inventories fell by 11,000 tonnes from the week before across eight major consumption areas to come in at 723,000 tonnes.

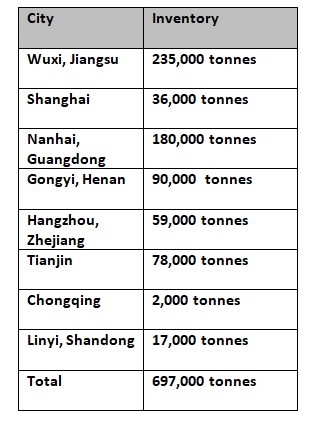

The chart below indicates the current status of primary aluminium inventories across China in more detail:

The aluminium ingot inventories plunged the highest in Wuxi by 10,000 tonnes over a week to 235,000 tonnes from 245,000 tonnes recorded last Thursday. Meanwhile, primary aluminium inventories in Gongyi shed 9,000 tonnes to rest at 90,000 tonnes. In Nanhai, inventories decreased by 4,000 tonnes to stand at 180,000 tonnes. Tianjin saw a dip of 1,000 tonnes week-on-week to come in at 78,000 tonnes, while inventories in Hangzhou and Chongqing also inched down by 1,000 tonnes to 59,000 tonnes and 2,000 tonnes, respectively.

Inventories in Shanghai and Linyi remained restrained at 36,000 tonnes and 17,000 tonnes, found SMM.

Responses