您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

China’s manufacturing industry, which has been the world’s largest for fifteen consecutive years, appears to be sputtering in 2025, weighed down by global trade tensions and waning domestic demand. Yet amid the broader industrial slowdown, one segment has quietly kept the aluminium sector afloat and that is the country’s resilient automobile industry.

Manufacturing momentum falters

Accounting for nearly 30 per cent of global manufacturing value and 26 per cent of the domestic GDP, China’s manufacturing sector has long been the backbone of the nation’s economy. However, since early 2025, signs of fatigue have been unmistakable.

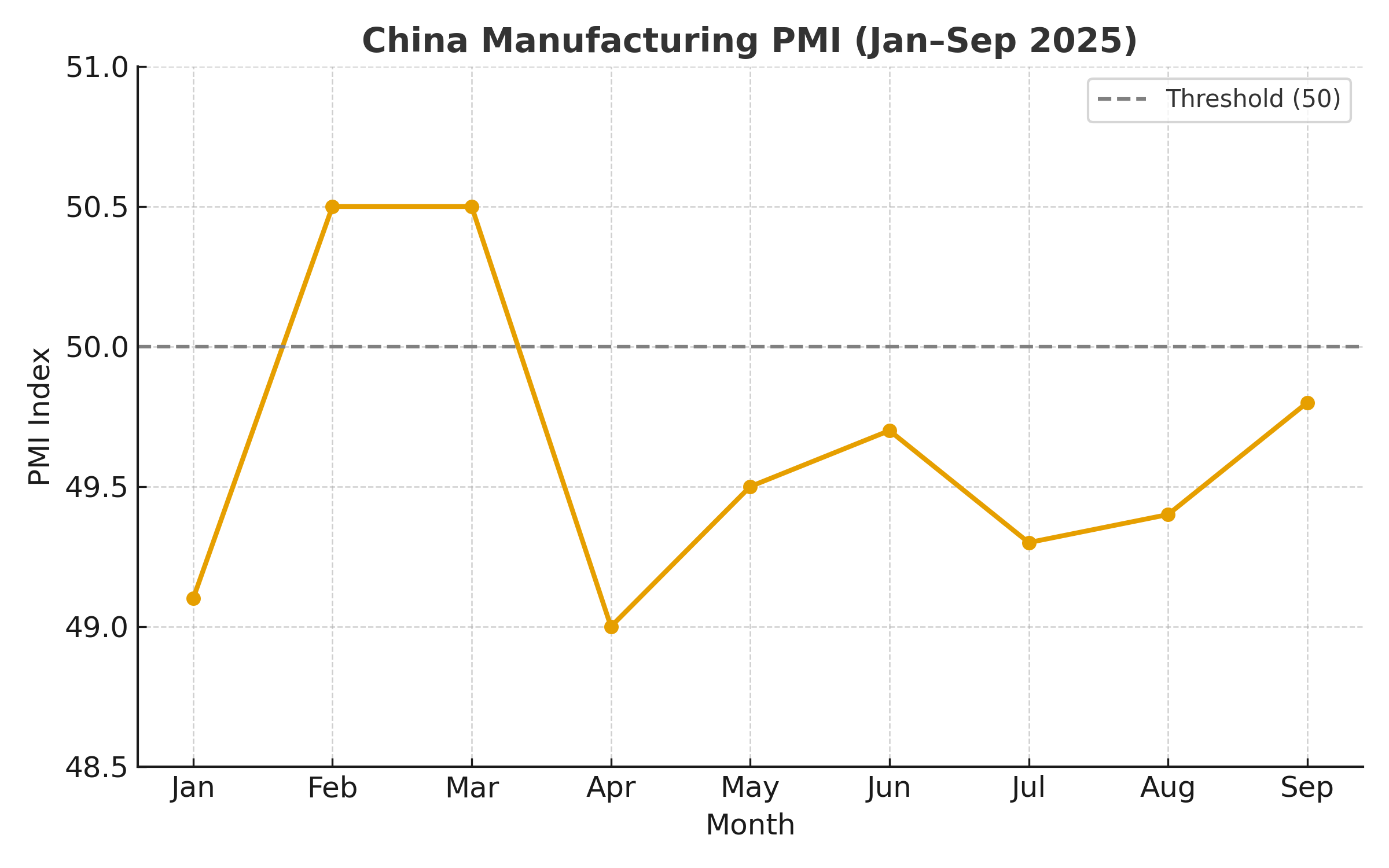

The Purchasing Manager’s index (PMI) – a key gauge of industrial activity - started the year in contraction, standing at 49.1 in January, according to the data released by the National Bureau of Statistics (NBS). Although it rebounded slightly above threshold in February and March growing up to 50.5, it contracted at its fastest pace in 16 months in April 2025, returning to 49, as per the NBS data. In May and June, the PMI gained modestly, but remained below the threshold figure of 50, averaging 49.5 and 49.7, respectively. In July and August, it slipped to 49.3 and 49.4, and again grew in September to 49.8, reaching the second-highest level in 2025 after March. Overall, China’s manufacturing index averaged at 49.5 through the first nine months of 2025, compared to the average PMI of 49.8 through 2024, which underpinned nothing but weakening manufacturing activity.

…and so much more!

SIGN UP / LOGINResponses