您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

For more than a decade, China aluminium foil sector has been quietly reshaping the global marketplace — expanding capacity, feeding a growing domestic appetite and pushing exports deeper into different regions, even as anti-dumping barriers rise around it. In 2024, the world’s aluminium foil market stood at USD 38.55 billion and was projected to grow at a 5.05 per cent CAGR by 2030, and in this projection, China plays a very important role.

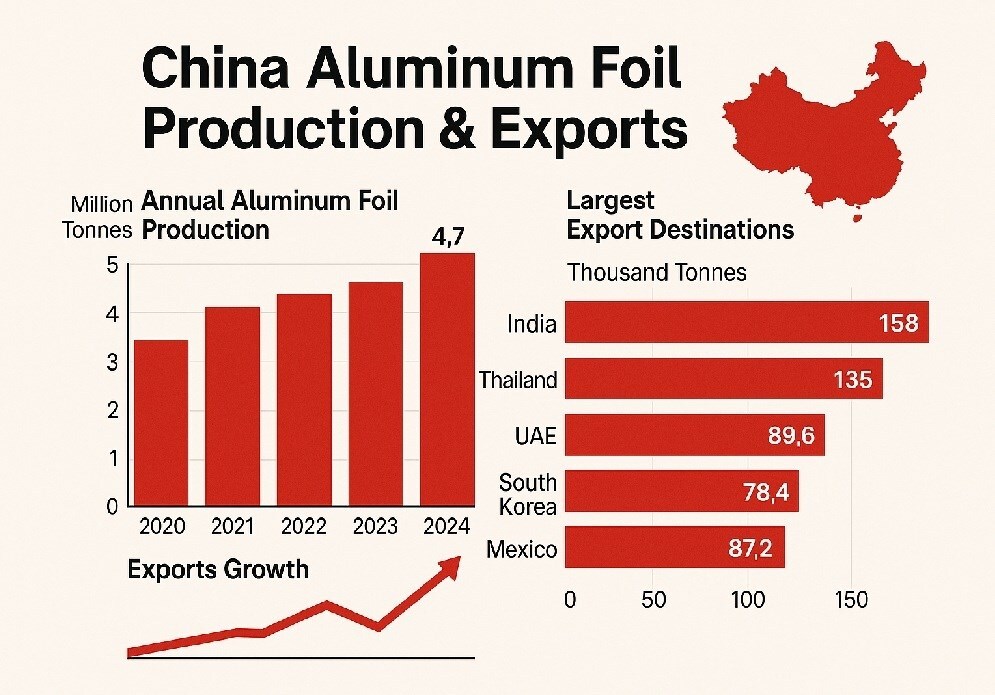

The country’s dominance is not accidental. By 2023, China was already producing 4.31 million tonnes of aluminium foil, and output climbed further to 4.7 million tonnes in 2024, which was around 70 per cent of global production. More than 160 rolling mills form the backbone of this industry, offering between 6.1 and 6.5 million tonnes of capacity, and over 1 million tonnes of that has been added in just the past four years.

What’s happening underneath this expansion is a technological shift: China is gearing up for the EV’s in which the lithium battery is the most important part and for it aluminium foil is required. Between 2022 and 2025, 15 to 17 new battery foil plants are expected to come online, adding 600 to 800 thousand tonnes of specialised output. Established foil giants — Dingsheng Group, Gränges, Anhui Zhongji and Chalco — are even considering converting traditional lines into battery foil production as demand accelerates.

Export story of China

…and so much more!

SIGN UP / LOGINResponses