According to a report from Platts, China may add 5-6 million new alumina capacity by the end of 2018, the processing of which has started in the third quarter of 2018.

Shandong Xinfa Group was said to have started up 1 million-1.2 million tpy new capacities in Shanxi. Henan East Hope is expected to start up 1 million-1.2 million tpy new capacities next month, also in Shanxi. State Power Investment's 1 million tpy project in Guizhou and Tianshan's 1 million tpy plant in Guangxi were expected to start by the end of 2018.

According to a company source, Shandong Weiqiao has completed 1-2 million tpy expansion though it has not been started. They are awaiting proper approvals. Traders expect Guizhou and Guangxi projects to start in Q2 2019.

"We heard Xinfa is expected to see first output from its new operation this month," a Beijing trader said.

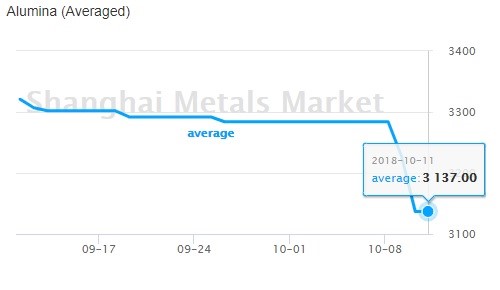

The news of capacity expansion has put pressure on domestic alumina prices. According to Shanghai Metals Market, the average spot alumina price in China dropped to RMB 3137 per tonne today from RMB 3284 per tonne on October 8.

"Pressure is coming from all the anticipated new capacities. The government has eased policies on new capacities. As long as its approved by the environmental department, there is no limit. Winter cuts are also likely less than expected overall this year," a Shanxi refiner said.

Bauxite supply remains a concern in the domestic market due to environmental checks on mine. According to sources, East Hope is yet to start up mainly due to a lack of bauxite. The sources also said that bauxite supply was only tight in parts of the north, and not in Guangxi, Guizhou and Shandong.

According to Beijing Antaike, China's total alumina production capacity is expected to reach 86 million tonnes in 2018, up from 81 million tonnes in 2017. Actual alumina output was expected to total 74 million tonnes in 2018, up from around 70 million tonnes in 2017, the analyst firm said.

Responses