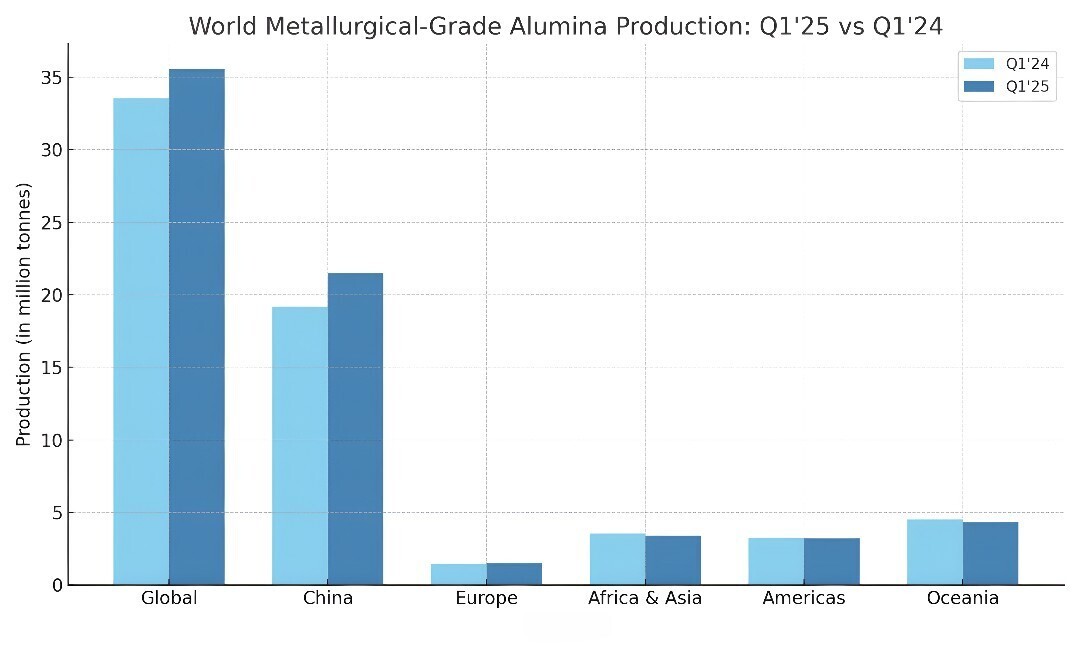

According to the International Aluminium Institute, the world alumina production concluded the first quarter of 2025 with an annual increase of 5.61 per cent, totalling 75.42 million tonnes versus 71.41 million tonnes. This output volume encompassed both chemical and metallurgical-grade alumina. While the output of chemical-grade alumina amounted to 2.17 million tonnes, accounting for 2.9 per cent, the production of metallurgical-grade totalled 35.538 million tonnes, contributing 47.18 per cent to the total alumina output volume.

Year-on-year, the world’s metallurgical-grade alumina production rose each month through the first quarter of 2025, demonstrating an increase of 5.9 per cent Y-o-Y from 33.552 million tonnes. In January, output rose 8 per cent over the year from 11.379 million tonnes to 12.290 million tonnes, followed by a 3.96 per cent increase in February from 10.664 million tonnes to 11.086 million tonnes. In March, the production continued to climb up by 5.67 per cent Y-o-Y from 11.509 million tonnes to 12.162 million tonnes, showed IAI.

However, according to monthly calculations, the world’s metallurgical-grade alumina production in March recorded a decline of 1.04 per cent compared to January’s output of 12.290 million tonnes.

China – the major driver of world alumina production growth

The year-on-year increase in global alumina production in March 2025 was primarily driven by China, recording a surge of 12 per cent from 6.641 million tonnes to 7.437 million tonnes. By the end of March 2025, China’s metallurgical-grade alumina production capacity reached 105.02 million tonnes, according to SMM. Throughout the quarter, previously commissioned capacities in Shandong and Guangxi achieved output, while some producers opted for maintenance due to a sharp decline in alumina prices. Nonetheless, the output remained steady for the entire period from January to March 2025.

However, a close watch is required for April 2025 as many refineries have reported maintenance plans for the said month, while at the same time some planned commissioning of new capacities in Guangxi and Hebei is approaching. But overall, the operating capacity is likely to decline, coming in at 87.23 million tonnes per year.

Events

Events

e-Magazines

e-Magazines

Reports

Reports

Responses