India’s electronics manufacturing sector has received a major boost when the Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) granted the benefit of concessional customs duty on aluminium-based copper-clad laminates used in producing metal-clad printed circuit boards (MCPCBs). This landmark ruling, which directly applies to cases involving Crompton Greaves Consumer Electricals Ltd. and B.S. Electronics Pvt. Ltd., is expected to lower material costs significantly and encourage greater domestic innovation in advanced electronics and LED technologies.

Case background and key issues

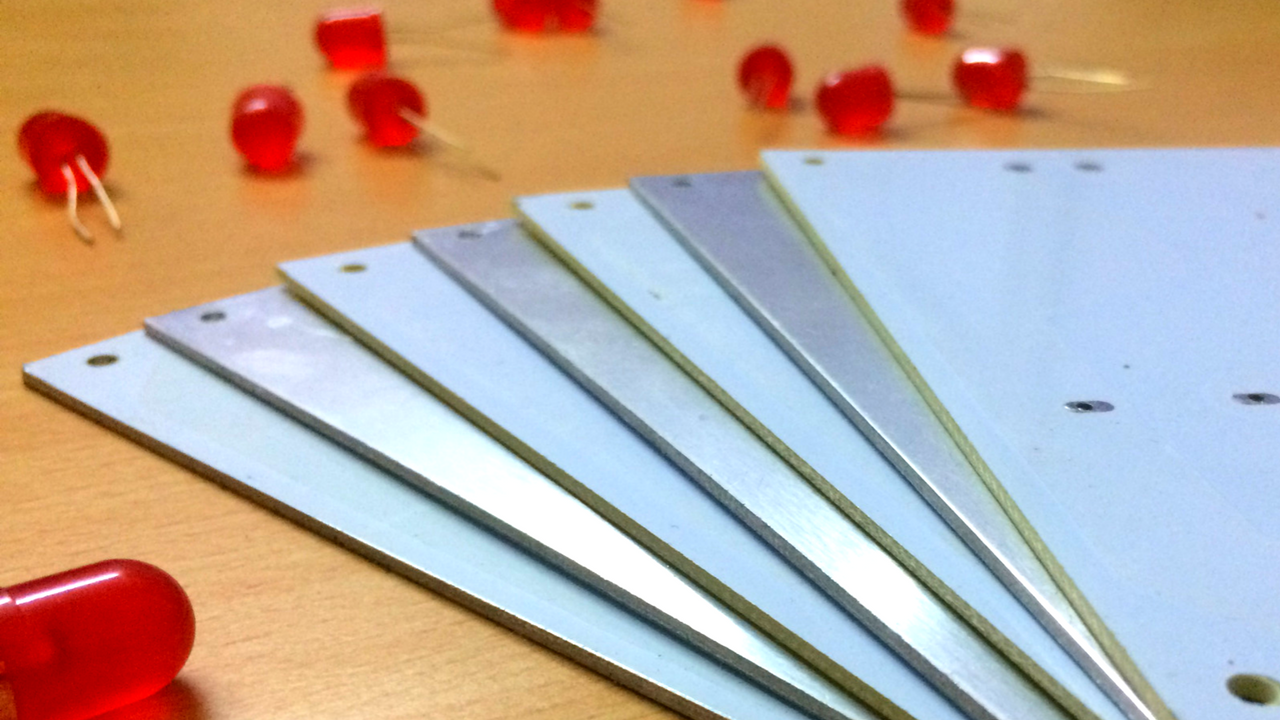

The core issue in the case was whether aluminium-based laminates that were imported to manufacture MCPCBs could be described as Customs Tariff Item (CTI) 8534 00 00, which would be eligible for concessional duty on Serial No. 39 of Notification No. 24/2005-Cus. They claimed they were essential raw materials for MCPCBs, which themselves are types of printed circuit boards (PCBs).

Initially, the Customs Department classified these laminates under CTI 9405 99 00. This classification denied the manufacturers the benefit of the duty refund. This would have substantially increased manufacturers' costs, inhibiting competitiveness in a market that is increasingly reliant on advanced LED lighting and highly powered electronics.

Also read: Study finds paper-aluminium laminate a sustainable alternative to plastic-line takeout containers

Judicial consistency and industry implications

Following the precedents laid down in Crompton Greaves Consumer Electricals Ltd. and B.S. Electronics Pvt. Ltd., a two-member bench comprising Justice Dilip Gupta and P.V. Subba Rao confirmed that MCPCBs are PCBs, and, accordingly, they get a concession rate. The Supreme Court had dismissed the Department's appeal against these decisions in November 2024, deciding to do so on the grounds of delay and no merit, strengthening the position of manufacturers substantially.

CESTAT set aside the Commissioner's unfavourable order because, as Justice Gupta remarked during the hearing, the technical interpretation should not hinder industrial development when the plain meaning of the statutory language supports a broad interpretation that is beneficial to manufacturing.

Strategic boost to local electronics production

This decision will not only lower the projected costs of imports for companies like Crompton and BS Electronics, but it will also send a robust signal to global investors intent on filtering in on India's momentum in high-tech manufacturing. Crucially, MCPCBs serve as the backbone of efficient LED systems, power converters and automotive lighting, and the inputs will not be comparatively cheaper and suitable as a substitute for mid-range in electrical and smart lighting categories to place Indian products more favourably in the global markets.

Additionally, this ruling supports the government's existing “Make in India” and electronics-oriented PLI (Production Linked Incentive) schemes, which encourage increasingly valuable, in-country, value-adding manufacturing.

Industry observers believe that this clarification on the legal status of MCPCBs will lead to new investments in manufacturing infrastructure for MCPCBs and will enable companies to rely less on imported finished boards. Companies can now plan for the expansion of capacity with less uncertainty of retrospective duties.

Responses