您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

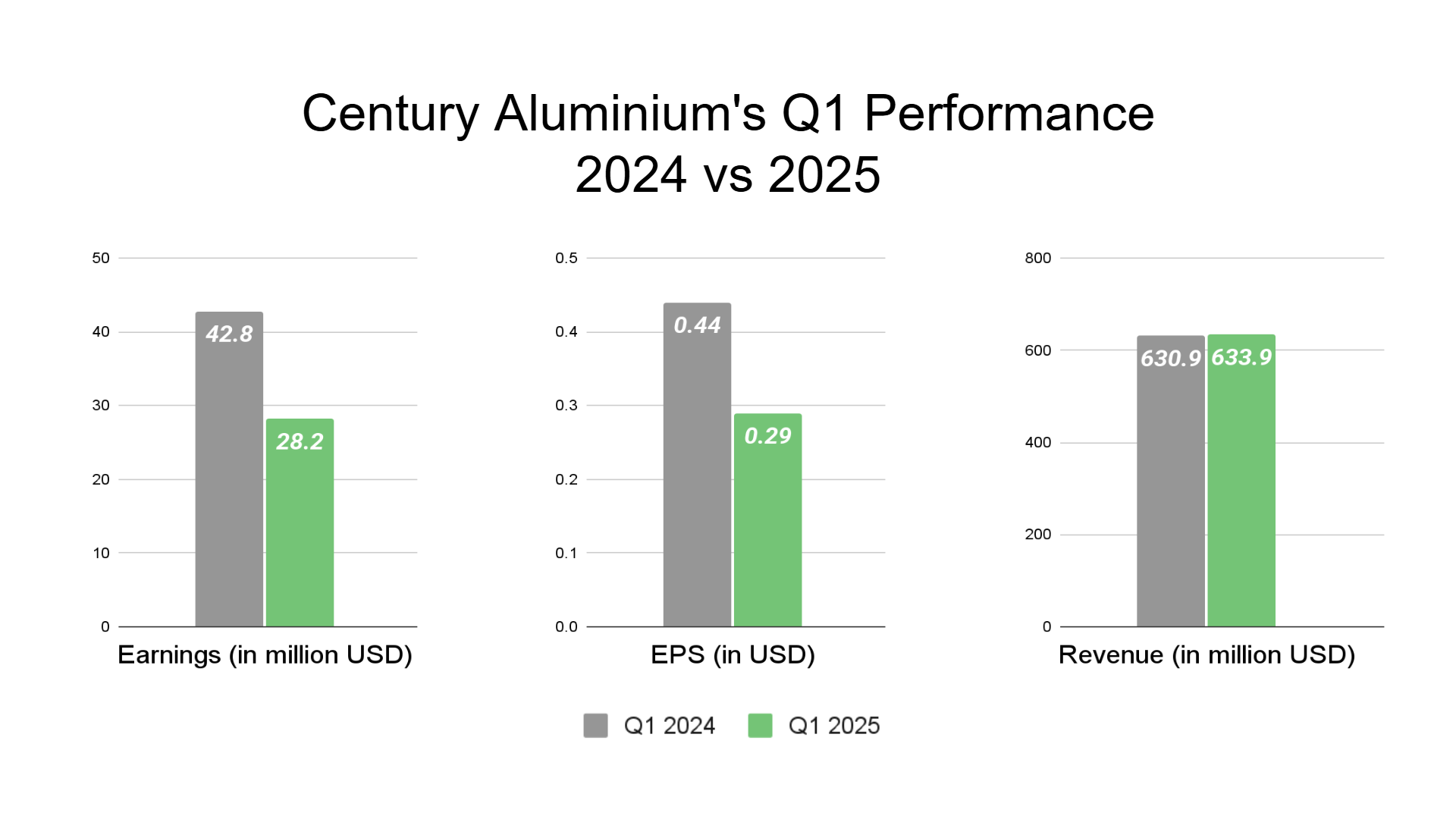

Century Aluminum Company, boasting a potent market capitalisation of USD 1.47 billion, reported its first-quarter 2025 earnings, revealing a substantial miss in earnings per share or EPS (USD 0.29 vs USD 0.44 last year) compared to expectations. The company’s adjusted EPS stood at USD 0.36, falling short of the projected USD 0.61. Revenue surpassed forecasts, coming in at USD 634 million against an anticipated USD 577.2 million, marking a 0.48 per cent year-on-year (Y-o-Y) uptick from USD 630.9 million in Q1 2024.

Following the announcement, Century Aluminum’s stock declined 5.18 per cent in after-hours trading, closing at USD 15. With a beta of 2.7, the stock demonstrates higher volatility relative to the broader market. The stock’s movement positions it closer to its 52-week low of USD 11.40, diverging from prevailing market trends.

Positive components of Q1 business highlights

Staggering financials

Net sales for the first quarter ended March 31, 2025, rose by USD 3.0 million sequentially, primarily driven by a higher LME aluminium price, stronger regional premiums, and favourable volume and product mix, partially offset by a reduction in third-party alumina sales.

Century reported net income attributable to Century stockholders of USD 29.7 million for the first quarter of 2025, representing a USD 15.5 million sequential decline. The drop in net income during the quarter was chiefly due to elevated input costs and losses on derivative instruments, partially mitigated by improved metal and regional premium pricing.

First quarter results were further impacted by USD 8.4 million in net exceptional items, including USD 3.5 million in emergency energy charges at the Mt. Holly smelter, and USD 3.0 million in unrealised losses on derivative instruments, net of tax. Consequently, Century reported adjusted net income of USD 36.6 million for the first quarter of 2025, down USD 6.9 million sequentially.

Adjusted EBITDA attributable to Century stockholders for the first quarter of 2025 was USD 78 million. This marked a decrease of USD 2.9 million from the preceding quarter, primarily due to higher energy and raw material costs, partially offset by enhanced realised LME and regional premium pricing.

Century’s liquidity position as of March 31, 2025, stood at USD 339.1 million, comprising cash and cash equivalents of USD 44.9 million and USD 294.2 million in available borrowing capacity.

Outlook for Q2

CEO Jesse Geary expressed optimism regarding aluminium price trends, stating, “We continue to believe aluminium prices will continue to rise in the near to medium future.” CFO Peter Trzipkowski underscored the company’s strategic resilience, saying, “We remain well-positioned to navigate near-term market dynamics and deliver long-term value for our shareholders.”

The company anticipates second-quarter adjusted EBITDA to range between USD 80 and USD 90 million, underpinned by an increased Midwest regional premium and lower energy costs, partially offset by planned major maintenance activities and seasonal labour-related expenditures.

Responses