您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

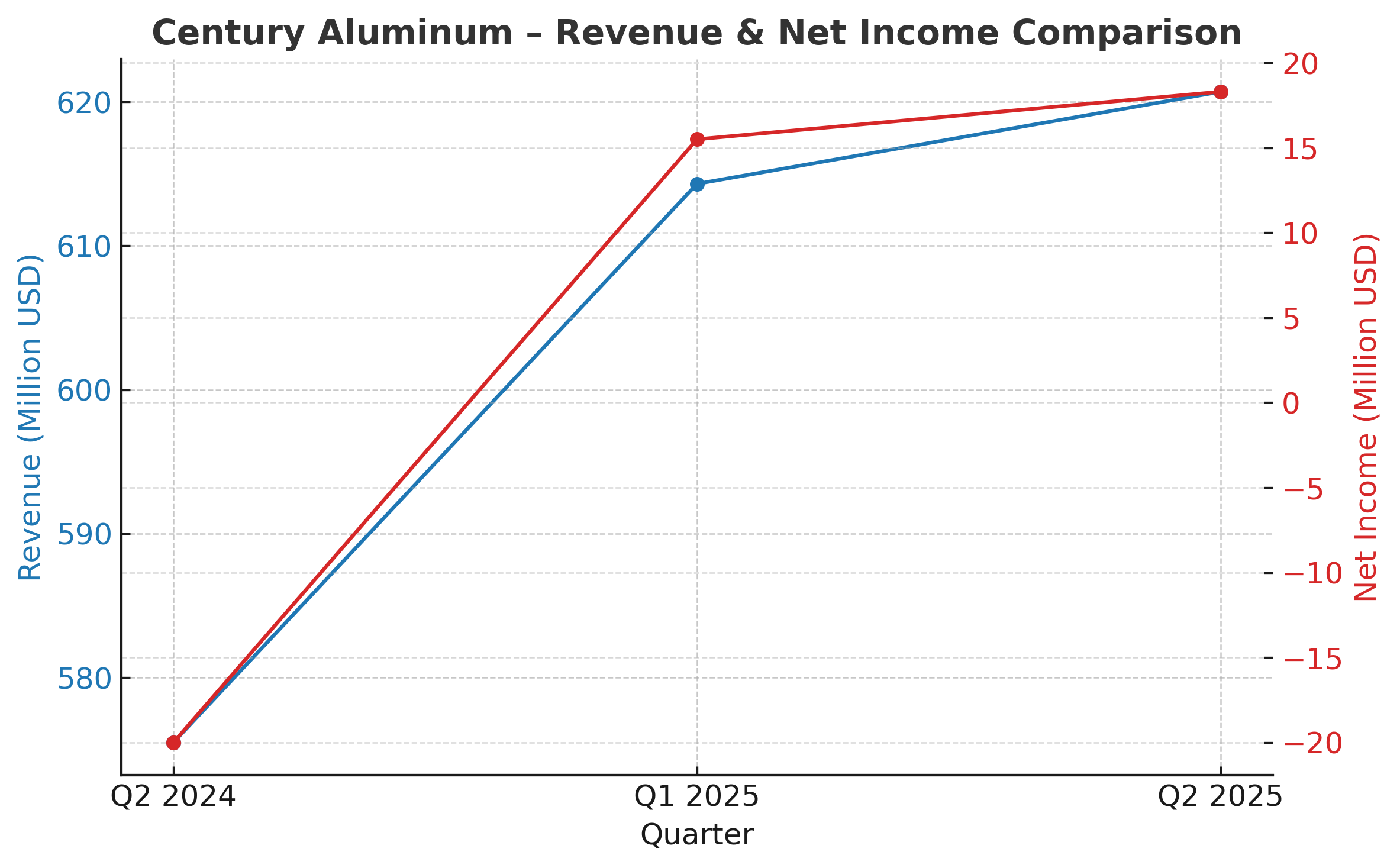

Century Aluminum Co. (NASDAQ: CENX) reported a Q2 2025 net loss of USD 4.6 million (USD 0.05 per share), reversing a USD 29.7 million profit in Q1 and down from USD 20.2 million in Q2 2024. The swing was driven by USD 35 million in one-off costs, including derivative losses, an Iceland inventory adjustment, operational inefficiencies, and a transformer failure.

Shipments were 175,741 tonnes, up 4.2per cent Q-o-Q and 4.7per cent Y-o-Y, reflecting stable production in US and Icelandic operations. Net sales stood at USD 628.1 million, down 0.9per cent Q-o-Q but up 12per cent Y-o-Y, supported by higher aluminium prices and US Midwest premiums despite lower alumina sales.

Adjusted net income was USD 30.4 million (USD 0.30 per share), down 17per cent Q-o-Q but sharply higher than USD 6.8 million a year earlier. Adjusted EBITDA came in at USD 74.3 million, down 4.7per cent Q-o-Q but more than double the USD 34.2 million in Q2 2024.

The results came amid major US trade policy changes. The Section 232 tariff on aluminium imports was raised from 25per cent in March to 50 per cent on June 4, aiming to curb inflows from China via third countries. The move lifted US Midwest premiums and tightened domestic supply.

Get insights into the primary aluminium sector from our globally acknowledged report: Global Upstream Aluminium Industry Outlook 2025

“Century’s announcement to restart the last 50,000 tonnes of capacity at our Mt. Holly smelter is a direct result of President Trump’s unwavering commitment to onshoring manufacturing and protecting American jobs,” said CEO Jesse Gary. “This project will increase US primary aluminium production by nearly 10 per cent and would not have been possible without the Section 232 program, which is working to secure our national security needs.”

During the quarter, Century refinanced its 7.5 per cent secured notes at 6.87 per cent, extending maturity to 2032 to lower financing costs and strengthen liquidity.

Management projects Q3 adjusted EBITDA at USD 115-125 million, a 55-68per cent Q-o-Q increase, supported by higher volumes from Mt. Holly, operational improvements, and continued tariff-driven price strength.

Analysts have responded with upgrades — BMO Capital lifted its target to USD 26 (Outperform) and B. Riley to USD 25. Century’s Relative Strength Rating rose to 92, placing it among the stronger performers in the metals and mining sector.

Also read: Ball Corporation launches USD 750M senior notes offering to strengthen liquidity

Responses