The Australian mining and exploration company Metro Mining announced its 2024 annual results, highlighting the successful commissioning of the Ikamba Offshore Floating Terminal (OFT) and port infrastructure upgrades.

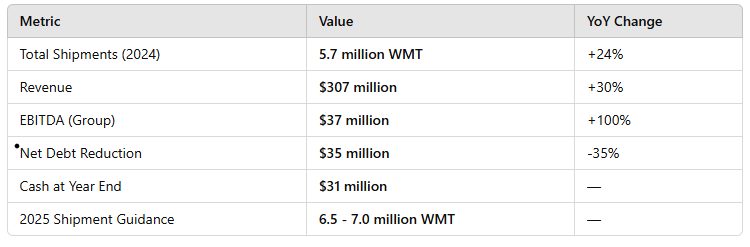

Following the commissioning in Q2, the Bauxite Hills Mine achieved a steady operational capacity aligned with the expansion target of 7 million wet metric tonnes (WMT) per annum in the final quarter. This milestone contributed to a total shipped production of 5.7 million WMT for the year, marking a 24 per cent increase compared to the previous year.

Metro recorded 30 per cent year-on-year revenue growth, reaching $307 million, driven by record shipments and a strong pricing environment. Site EBITDA margins stood at $13.8 per WMT in Q3 and improved to $17.4 per WMT in Q4, leading to a 100 per cent increase in underlying group EBITDA to $37 million.

Metro Mining: Financials and Performance Overview

•Note: Net debt at December 31, 2024 is the sum of the Nebari loan facility less cash and cash equivalents.

The company fully repaid its junior debt of $39 million, reducing net debt by 35 per cent to $44 million, with $31 million in cash at year-end.

Simon Wensley, CEO & MD of Metro Mining, said, "Metro has turned in a combination of record results for 2024, especially in the second half, as we ramped up the expansion. I expect to see further economies of scale flowing through in 2025 as we lift production by a further 20 per cent, with continued strong traded bauxite demand flowing through to improved margins."

Metro successfully completed its $36 million expansion project, implementing a full flow sheet that includes a new haulage fleet, enhanced loading capacity at both the pit and port, a new wobbler screening circuit, two additional tugs, and the OFT. After a scheduled maintenance pause during the wet season, operations are set to resume in the second half of March, with a shipment forecast of 6.5 to 7.0 million WMT for 2025.

Global bauxite market size and production

The global metallurgical bauxite for aluminium market is expected to grow significantly between 2023-2030. According to estimates, the market was worth USD $15.5 billion in 2023. However, it is anticipated to grow substantially by 2030, reaching USD $19.6 billion at a CAGR of 2.41 per cent.

This projected growth can be attributed to several factors, including rising global demand for aluminium, particularly in sectors like transportation, construction, energy transition (green energy), and packaging.

Guinea and Australia continued to be the world’s top bauxite exporters in 2024, while China, India, Ireland and a few more alumina-producing nations primarily topped the list of leading importers. In line with the growth in primary aluminium production, the demand for bauxite increased in 2024, although its supply remained uneven, driven by expanded output at the world’s leading mining companies.

Image credit: Transhipment Services Australia

Information credit: Metro Mining, Global Aluminium Industry Outlook 2025

Responses