Over the past five years, increased construction activity and expanded energy infrastructure have reportedly spurred the demand for aluminium wires and cables. Thus, the world aluminium wire rod usage increased consequently from 5.87 million tonnes in 2014 to about 6.26 million tonnes in 2017. The usage is further estimated to grow to 6.45 million tonnes in 2018 and by 2025 it is anticipated to reach 8 million tonnes.

{newsStudioGallery}

{alcircleadd}According to a research report by Global Market Insights, Inc., global aluminium wire market revenue is slated to exceed US$ 65 billion by 2024.

Among some of the top aluminium wire producing countries, Canada is a notable one. Intral Inc., Noramco, Northern Cables are some noteworthy companies in Canada who produce a significant amount of aluminium wire.

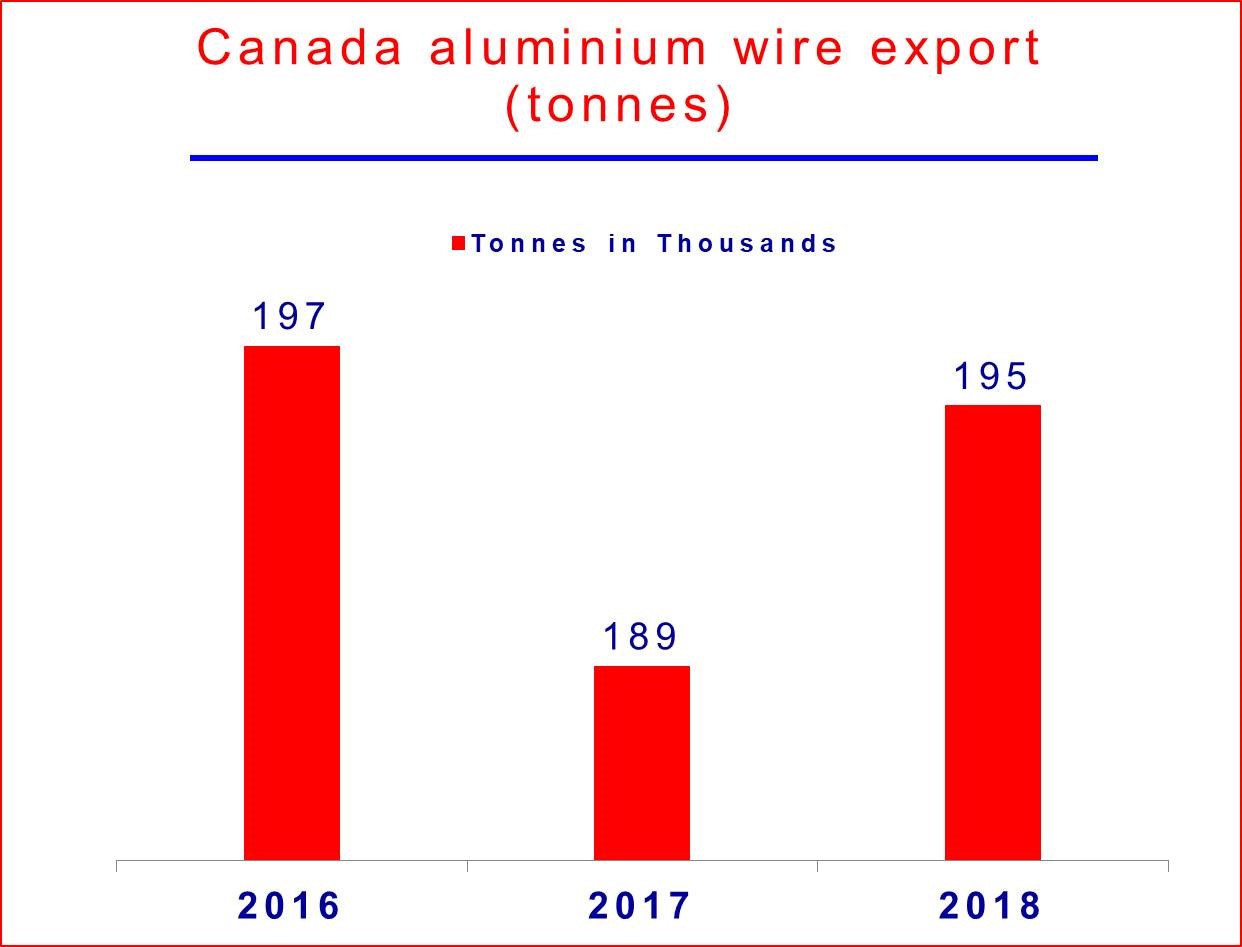

After a slight drop in aluminium wire export last year, Canada this year is expected to see a rise again, found the global export-import data. The volume is estimated to increase by around 4 per cent from 189,043 tonnes in 2017 to 195,811 tonnes in 2018. In 2016, the country had exported approximately 197,370 tonnes of aluminium wire in total, which was 4.4 per cent higher from the estimated amount of 2017 and 1 per cent from 2018.

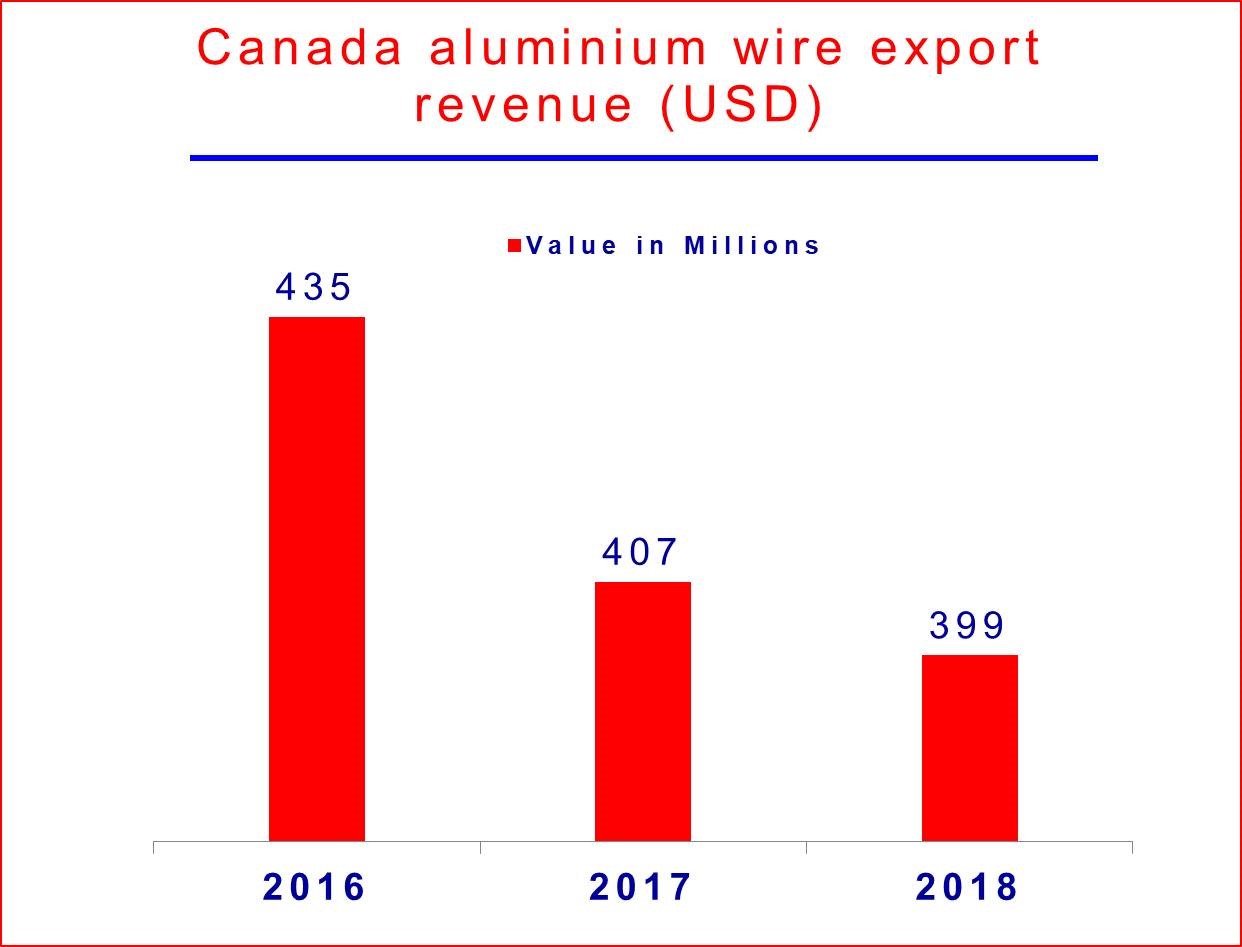

But despite a growth in volume this year, the report anticipates a drop in export revenue for China. The value is likely to drop year-on-year. In 2017, Canada’s estimated aluminium wire export revenue was at US$ 407 million while this year the revenue is forecast to stand at US$ 399 million. This marks a fall of 2 per cent. In 2016, on the other hand, the revenue value was at US$ 435 million, which means the value would drop 8 per cent this year from that of 2016.

According to a survey report, Canada is among the countries that export the highest dollar value worth of aluminium. In 2017, Canada’s aluminium export valued US$6.3 billion, 11.3 per cent of total exported aluminium.

Responses