The United States Geological Survey (USGS) data suggests that Canada and Mexico have emerged as two of the biggest aluminium scrap exporters to the USA. Firstly, the global emphasis on sustainability and eco-friendly practices has encouraged increased recycling efforts. As aluminium is renowned for its recyclability without compromising quality, the demand for scrap as a raw material has witnessed a notable upswing.

Additionally, the escalating costs of primary aluminium production have prompted manufacturers to explore cost-effective alternatives, making recycled aluminium an attractive choice. Furthermore, evolving trade relationships and market conditions have created a volatile scenario where importing aluminium scrap becomes a viable and strategic option for meeting USA's growing OEM and electric vehicle sector demand.

In November 2023, the US imports (for consumption) from Canada stood at 30,200 tonnes, down 4,500 tonnes or 12.97 per cent M-o-M from 34,700 tonnes recorded in October 2023. USGS data shows that on a Q-o-Q scale, it has fallen by 5,700 tonnes or 15.88 per cent from 35,900 tonnes recorded in August 2023. If we consider the yearly quota, there has been a massive Y-o-Y drop of 49,000 tonnes or 62.11 per cent from 79,700 tonnes marked in November 2022.

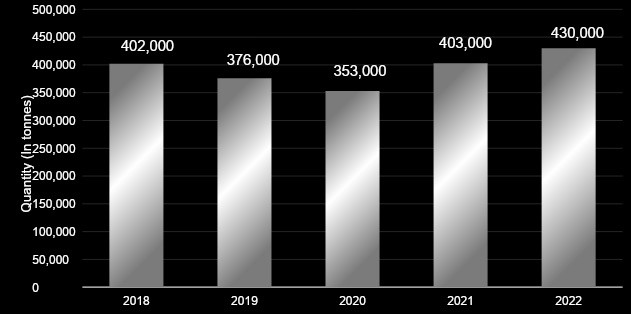

US imports from Canada

Despite the dwindling conditions, which can be mainly attributed to rising geo-political dilemmas, soaring energy costs and impending aluminium industry regulations like CBAM, the CAGR of US imports from Canada (2018-2022) has been 1.36 per cent.

The US imports (for consumption) from Mexico in October 2023 was almost 18,600 tonnes, which dropped 3,700 tonnes or 19.89 per cent M-o-M to halt at 14,900 tonnes in November, same year. On a Q-o-Q basis, there has been a slump of 6,500 tonnes or 30.37 per cent from the registered haul of 21,400 tonnes during August 2023. Only in Mexico's case, there has been a Y-o-Y spike of 1,900 tonnes or 14.61 per cent from 13,000 recorded in November 2022.

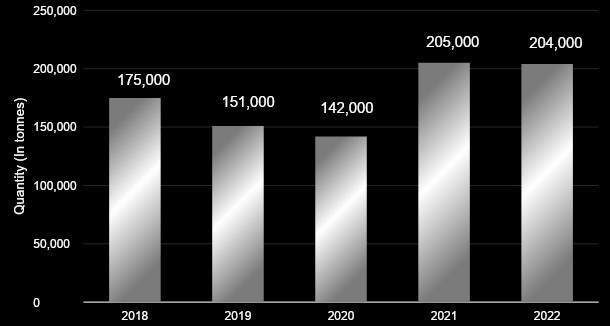

US imports from Mexico

Considering the five-year timeline from 2018 to 2022, we can witness a CAGR of 3.11 per cent regarding US imports from Mexico. If you are interested in learning more about the prevailing trends in the aluminium industry, please have a look at AL Circle's special report, Global Aluminium Industry Key Trends 2030.

Responses