The sustainable development strategy of the RUSAL United Company aims at making, by decoupling our business growth from the environmental footprint, sustainability affordable across the entire aluminium value chain and creating a new class of assets in the non-ferrous metal sector. This means building by 2035 such a business model that is future-fit and addresses the needs of low carbon and circular economy, is based on an agile, fair, safe and inclusive supply chain, and is built on the most advanced technologies.

Irina Bakhtina, Chief Sustainability Officer at Rusal

Therefore, a sustainable supply chain is at the heart of the Company's ESG transformation. Understanding our suppliers and the degree of their ESG maturity is the key element to start with.

RUSAL is sourcing raw materials, finished goods and services from as many as 16,000 large, medium and small-size suppliers from across the world, and the task is to assess their overall sustainability practices, including key impacts, risks and opportunities associated with it, never promised to be an easy one.

As a first step, the Sustainability team of RUSAL has agreed with the Procurement and Quality Management teams on a relatively focused panel of suppliers – those who supply to the Company some of the most critical non-alumina raw materials (by value) – to start with, and the methodology for a self-assessment, developed based on the core GRI standards with the help of AKRA PM – local analytical credit rating agency in Russia.

In July 2022, the invite to pass self-assessment of their ESG maturity on a specially designed online platform went to the 35 largest suppliers of the following 10 categories of non-alumina raw materials coming from Russia and China: alloys, aluminium fluoride, anode blocks, calcined petroleum coke, lignite, magnesium, manganese, pitch, raw pitch coke, and silica. The best transparency and cooperation were displayed by 14 out of 35 suppliers. For 9 other suppliers, the agency delivered research via publicly open sources, and for the remaining 10 companies, the ESG maturity rating turned out to be unacceptable due to no data.

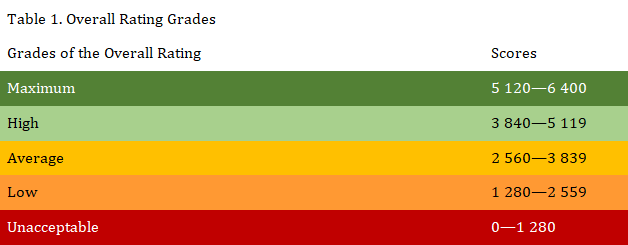

As part of the assessment, core RUSAL suppliers of the non-alumina raw materials had to fill in an online questionnaire covering 25 aspects (a total of 89 questions) under three topics: 'Environmental Footprint' (7 aspects), 'Social Impact' (12 aspects), 'Economic Impact and Corporate Governance' (6 aspects). For every aspect, a maximum possible score was defined as a sum of the maximum possible scores for responses to every question within the respective aspect. Based on the final score, every aspect of the company's activity got rated (80% plus – high, 50-79% – average, and below 50% – low). As a sum of all scores, every company's performance got their overall rating ranging across 5 grades (please refer to Table 1).

The questions covered by the assessment were focused on collecting the data disclosed by the companies as part of their non-financial reporting and existing ESG practices. Our suppliers were offered an opportunity to self-assess their practices without paper submission as a matter of data confirmation since in some cases papers could not be disclosed publicly outside a procedure of regular supplier audit.

As a result of the supplier panel assessment, RUSAL got three types of reports:

A threshold to single out the most problematic aspects for a particular supplier in the 'Environmental Footprint' block was set on par with a total average score aggregated by all companies inside this block, which turned out to be at 55% of the maximum possible score. In the 'Social Impact' block it turned out to be at 47% of the maximum possible score, and in 'Economic Impact and Corporate Governance' – at 60% of the maximum possible score.

For the purpose of the consolidated report, the best practices available on the market were sourced by the AKRA PM agency from the companies supplying the same categories of raw materials as RUSAL suppliers do, having public non-financial reporting and not being part of the RUSAL supplier pool.

As a result of the assessment, the average score for 25 companies who submitted their data in full or partially, reached 3,555 out of the 6,500 maximum possible. This score has been taken as a benchmark displaying the actual level of ESG maturity of the RUSAL raw material suppliers. It also serves as a threshold for the 2023-2024 roadmaps on risk mitigation, the gap to be covered by the companies whose scores happened to be below. The average score for 'Environmental Footprint' turned out to be 1,334 out of 2,500 maximum possible, for 'Social Impact' – at 1,504 out of 2,650, and for 'Economic Impact and Corporate Governance' – at 702 out of 1,250. Best transparency and maturity in the space of ESG meanwhile have been demonstrated by the Chinese suppliers of raw materials (ranging between 5,475 and 6,050 scores).

Under the 'Environmental Footprint' topic, the strongest competence of RUSAL's suppliers of non-alumina raw materials turned out to be all the aspects under the 'Waste Management' umbrella. 9% of the companies have got the maximum possible scores for this aspect. The areas for improvement defined here, are 'Materials Supplied for RUSAL Needs' meaning lack of recycled or recyclable materials, 'Greenhouse Gases' and 'Energy Sourcing'. Recommendations that are advisable to translate into the roadmap format to improve the ESG maturity of our suppliers, cover the need to increase the proportion of secondary material resources and renewable energy sources, increase the number of publicly disclosed environmental performance indicators, and develop the biodiversity conservation programs for their production sites.

Under the 'Social Impact' topic, the strongest ESG governance is observed in the aspects of 'Training and Education' where 24% of the RUSAL suppliers have got the maximum scores. Meanwhile, the areas for immediate improvement are associated with such aspects as 'Diversity and Equal Opportunities', 'Huma Rights', and 'Marketing and Labelling'. Our suppliers of critical raw materials are recommended, as part of the risk mitigation roadmaps, to pay special focus to diversifying their workforce, ensuring human rights assessment at the workplace, developing and adopting corporate policies to stop discrimination and deliver equal opportunities for their employees, as well as to regulate marketing communications.

Finally, under the 'Economic Impact and Corporate Governance' topic, the best-developed areas turned out to be our suppliers' practices of the antitrust and fair competition court dispute disclosure, as well as the investment in local communities, while the particular area for improvement is non-sufficient attention to climate risk and opportunities potent of material impact over their operations, revenue and cost (as part of the 'Economic Performance' aspect). The roadmaps to cover the gap, therefore, should be focused on an immediate and detailed analysis of the climate-related risks capable of affecting the business processes and undermining the existing operational infrastructure.

Responses