The US dollar rose on Thursday on Donald Trump’s slightly positive tone on the US-China trade war Wednesday despite the threat of increased tariffs. Growing expectations of an interest rate cut limited gains in the greenback. LME base metals closed mixed while aluminium edged down. SHFE base metals saw mixed performance and aluminium declined 0.3%.

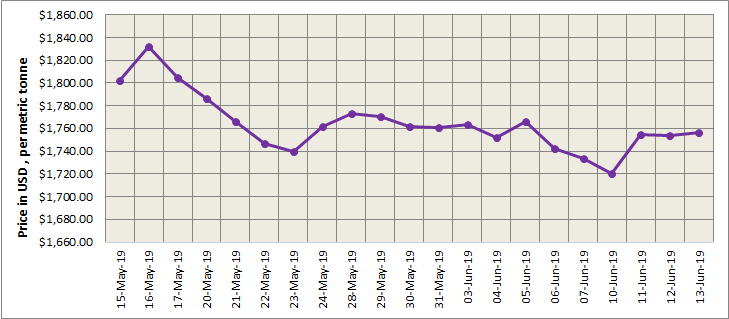

LME aluminium settled the day’s trading higher than the previous day at US$1756 per tonne but lost the gains overnight. With the rising US dollar the three-month LME aluminium lost earlier gains to close lower at US$1,786 per tonne on Thursday.

{alcircleadd}

As on June 13, Thursday, LME aluminium cash (bid) price stood at US$ 1755.50 per tonne, LME official settlement price stands at US$ 1756 per tonne; 3-months bid price stands at US$ 1787 per tonne, 3-months offer price is US$ 1788 per tonne; Dec 20 bid price stands at US$ 1905 per tonne, and Dec 20 offer price stands at US$ 1910 per tonne.

The LME aluminium opening stock dropped to 1075750 tonnes. Live Warrants totalled at 706050 tonnes, and Cancelled Warrants were 369700 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1783 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange (SME) dropped today to US$ 2010 per tonne from US$ 2018 per tonne on Wednesday.

The SHFE August contract rebounded after it fell below the daily moving average, but pressure from the 60-day moving average stemmed its increase at RMB 13,965 per tonne, and lowered it to an intraday low of RMB 13,925 per tonne. It lost 0.14% on the day and finished at RMB 13,955 per tonne, below the 10-day moving average. The August contract then reversed earlier gains and fell below the five-day moving average to close 0.32% lower at RMB 13,910 per tonne overnight. SHFE aluminium continued its rangebound pattern and is expected to hover between RMB 13,800-14,200 per tonne today, with spot premiums of up to RMB 20 per tonne over the June contract.

Responses