India’s energy transition is not a linear march from coal to renewables. It is a high-wire act where efficiency, geopolitics, and industrial decarbonisation collide. From the creation of a revolving fund for energy efficiency to the scramble for discounted Russian oil, and from solar and hydrogen pushes to aluminium’s green makeover, the country’s choices are shaping both domestic industry and global trade flows.

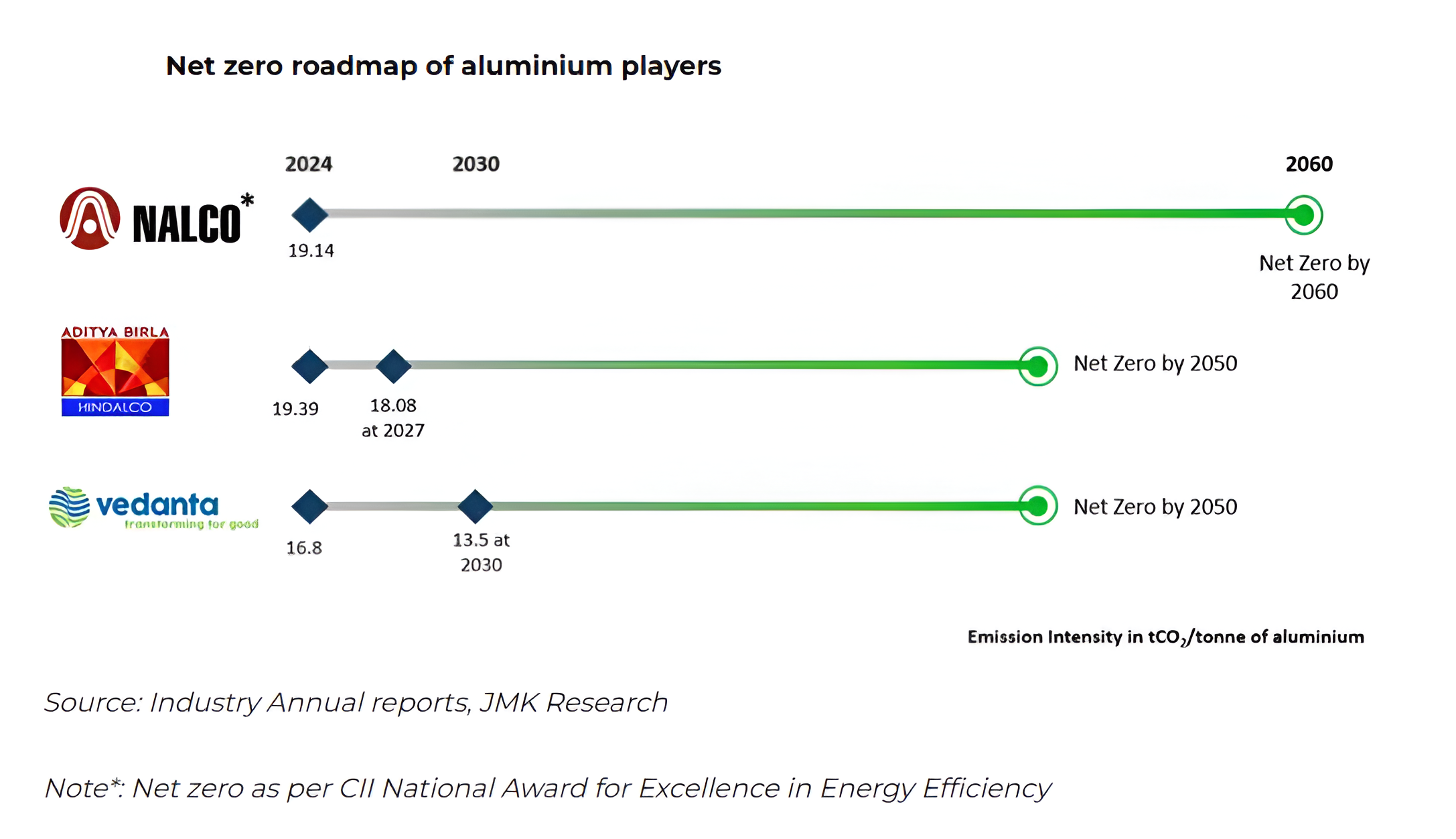

Image source: JMK Research

Image source: JMK Research

Revolving capital, not one-off grants

At the heart of India’s efficiency strategy is the Energy Efficiency Revolving Fund (EERF), seeded with USD 13 million from the Global Environment Facility (GEF). Managed by Energy Efficiency Services Limited (EESL) with support from the Asian Development Bank (ADB), the fund deploys capital into efficient motors, cooling systems, smart meters, and grid innovations.

Unlike traditional donor grants that vanish once used, the EERF recycles repayments into new projects. The broader GEF–EESL programme is mobilising over USD 453 million in blended capital, creating a self-sustaining mechanism that lowers upfront risks and keeps money flowing into demand-reducing technologies. For energy-intensive industries, including aluminium, this lowers barriers to adopting efficiency at scale.

The Russian oil discount and its ripple effect

However, efficiency gains are being tested against volatile crude markets. Before 2022, Russian oil barely figured in India’s energy mix, accounting for less than 1 per cent of imports. Today, it makes up 36-38 per cent, driven by discounts of USD 1.5-2 per barrel. That pricing advantage has shielded Indian refiners in the short term, but it has also drawn fire from Washington.

Responses