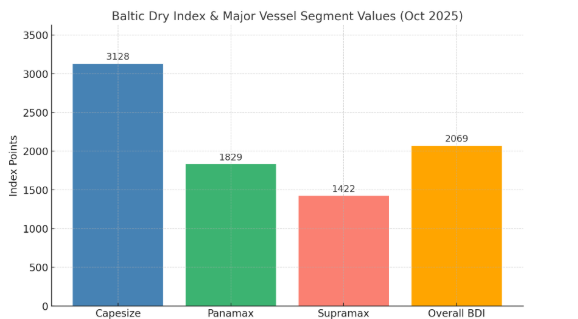

The Baltic Exchange’s dry bulk sea freight index remained unchanged at 2,069 points on Monday. It is regarded as the world’s leading independent benchmark for dry bulk maritime freight rates. The index is used for trading and settling physical and derivative shipping contracts. Monday’s flat reading signals a period of calm across major vessel classes.

Despite stable overall conditions, the Capesize segment showed modest strength, rising seven points or 0.2 per cent to 3,128, marking a one-week high. Average daily earnings for these large vessels, which typically transport iron ore and coal, edged up from USD 62 to USD 25,944.

The index’s steadiness reflects a measured balance between gains in larger vessels and softer performance in smaller carriers, suggesting that freight demand remains resilient but evenly matched by supply across global trade routes.

Larger vessel gains offset by smaller segment weakness

According to Trading Economics and Baird Maritime, modest advances in the Capesize and Panamax segments were countered by softer rates in smaller carriers. The Panamax index rose by two points to 1,829, extending its ten-day winning streak, with daily earnings up USD 14 to USD 16,460. In contrast, the Supramax index fell six points to 1,422, tempering overall index momentum.

The market finds equilibrium as freight rates balance out

While the BDI held steady, it has slipped 4.7 per cent month-on-month, yet remains 33.8 per cent higher year-on-year, underscoring a strong recovery earlier in 2025. Analysts suggest this reflects a delicate equilibrium between medium vessel demand and softer small-tonnage utilisation.

Commodity sentiment also weighed in. Iron ore futures dipped, following weak Chinese data that fuelled concern over industrial demand for steel inputs. However, persistent grain and coal cargo movement in the Panamax class helped stabilise freight activity.

Despite short-term calm, forecasts from Trading Economics indicate the Baltic Dry Index may rise to around 2,143 by end-Q4 2025, supported by steady trade flows and a potential recovery in commodity volumes.

Read More: Globus Maritime shareholders back director, auditor and reverse stock split plan

Responses