Just after Ball Corporation celebrated 90 years in the can manufacturing business, stakeholders cautiously rejoiced yet again as its third quarter felt a lot less like a wobble and more like a careful pivot wherein numbers whispered “steady” if anyone listened closely.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

Why cautious? The turmoil of tariffs is yet to blow off. Then why rejoice? For the third quarter of 2025, which ended on September 30, 2025, Ball Corporation reported net earnings attributable to the company of USD 321 million, or total diluted earnings per share of USD 1.18 on sales of USD 3.38 billion.

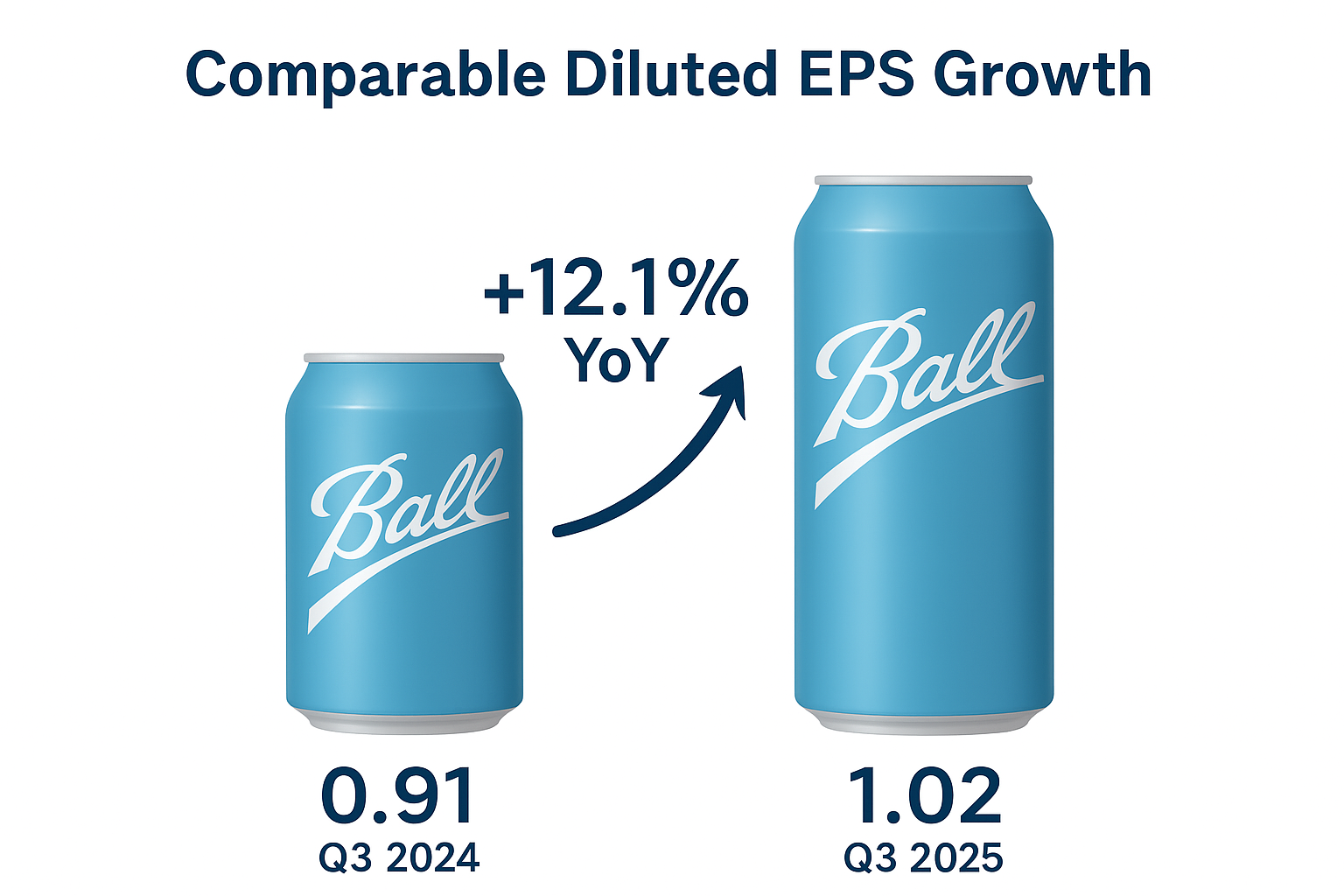

Dig beneath the headline and you find the shape of a business that is squeezing more activity from the same geography-and-product map. The company started (with a different name) 144 years ago, only with an investment of a mere USD 200, now witnesses comparable diluted earnings per share of USD 1.02 in Q3, up from USD 0.91 a year earlier, a rise of 12.1 per cent.

In the meantime, global aluminium packaging shipments grew 3.9 per cent in the quarter, evidence that volume, not just price, is driving momentum.

Volume and price both mattered

In its Q3 2025 result revelation announcement, Ball says the USD 297 million uplift in Q3 sales versus the prior year broke down into roughly USD 145 million from higher volume, USD 120 million from price and mix (largely reflecting higher aluminium prices), and USD 64 million from currency translation. That mix helped push reportable segment sales to USD 3.205 billion for the quarter, led by North and Central America at USD 1.638 billion, EMEA at USD 1.059 billion and South America at USD 508 million.

Responses