您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Ball Corporation, the world’s leading aluminium packaging manufacturer for beverage, personal care and household products, has announced the first quarter 2025 results, reporting a year-on-year decline in net earnings attributable to the corporation. According to the data revealed, net earnings in Q1 2025 were USD 179 million, compared to USD 3.69 billion a year ago.

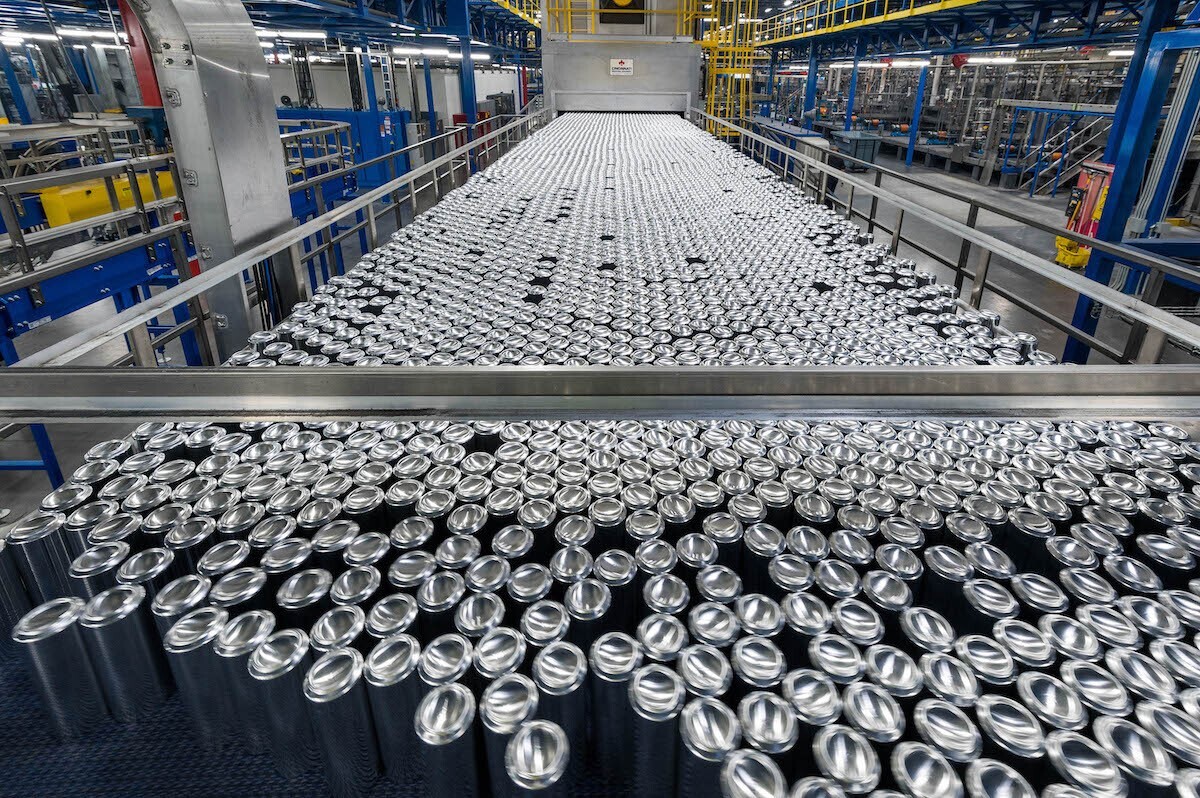

Image source: Ball Corporation

Notably, net earnings decreased over the year despite increased sales from USD 2.87 billion in Q1 2024 to USD 3.1 billion in Q1 2025. However, the company’s comparable net earnings were relatively stable on a Y-o-Y basis, amounting to USD 216 million in Q1 2025 versus USD 217 million in Q1 2024.

Ball’s chairman and chief executive officer, Daniel W. Fisher, acknowledges this decline is due to heightened geopolitical uncertainty in select markets. At the same time, he has expressed his confidence in meeting the 2025 objectives.

Fisher said, “Our commitment to operational excellence remains central to our strategy. We continue to unlock manufacturing efficiencies, invest in innovation and sustainability, and tightly manage our cost structure. These actions position us well to navigate near-term challenges and consistently deliver long-term value for our shareholders.”

Region-wise earnings

In North and Central America’s beverage packaging segment, Ball Corporation earned comparable operating earnings of USD 195 million in Q1 2025 on USD 1.46 billion of sales, compared to USD 192 million of comparable operating earnings on USD 1.4 billion of sales a year ago.

From the same sector in Europe, Middle East, and Africa, Ball earned comparable operating earnings of USD 96 million on USD 903 million of sales, compared to USD 85 million on USD 810 million sales in the previous year.

In North and Central America as well as EMEA regions, comparable operating earnings increased in Q1 2025, and so happened in South America where comparable operating earnings in Q1 2025 were USD 69 million on sales of USD 544 million, compared to USD 55 million on sales of USD 482 million during the corresponding period of the earlier year.

Future speculations

For the remaining year, the company estimates the continuation of the evolving trade landscape and its implications due to the US tariffs imposed on aluminium and aluminium product imports. Accordingly, the company decides to take strategic measures and work closely with customers to mitigate the effects of market volatility caused by tariffs. Ball Corporation will curb its reliance on foreign goods and focus more on local sourcing and manufacturing.

The company has also apprised that no direct effects of tariffs are currently being felt for the second quarter, and would continue to watch the market closely for the further months and quarters.

"Our global business performance remains strong, and we are well positioned to meet or exceed our stated financial goals. We are on track to return at least $1.5 billion to shareholders in 2025. This reflects our continued focus on disciplined execution, operational excellence, and a culture of continuous improvement. Our free cash flow generation underscores the resilience of our business model and provides us with the flexibility to both deliver meaningful shareholder returns and invest strategically in long-term growth. We remain committed to maintaining a robust financial position that supports value creation today and in the years ahead," said Howard Yu, executive vice president and chief financial officer.

"Building on our strong start to the year, we remain confident in the strength and resilience of our business. The momentum from our first quarter performance reinforces our ability to execute with discipline and agility, and it positions us well to deliver on our plans of 11-14% comparable diluted earnings per share growth in 2025. Our team is focused on advancing sustainable aluminum packaging with purpose and pace, consistently delivering high-quality products, strong free cash flow, and EVA. At the same time, we remain committed to returning meaningful value to shareholders through share repurchases and dividends. Backed by the strength of the Ball Business System, our best-in-class global footprint, and the dedication of our talented employees, we are well-positioned to drive long-term growth and create enduring value in 2025 and beyond," Fisher said.

Responses