India-based mircocap company, Baheti Recycling Industry Limited, specialised in recycling aluminium scrap into various aluminium alloys, reportedly concluded the day on June 9, 2025, at a 1.43 per cent higher than its previous closing price. The company’s share price clocked at INR 602 (USD 7.03) after ranging between INR 604.50 (USD 7.05) and INR 591.00 (USD 6.89) throughout the day.

Image source: Baheti Recycling Industries Limited

Image source: Baheti Recycling Industries Limited

Baheti’s share price has been performing very strongly, returning 52.96 per cent this year and 5.01 per cent in the past five days. The recycling firm has TTM P/E ratio 33.47 as compared to the sector P/E of 20.16.

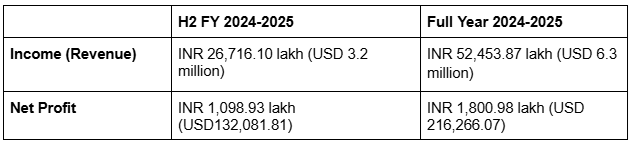

Ever since, Baheti has declared its robust financial performance, with a net profit significantly up by 159 per cent at the end of H2 FY2025, the company is witnessing a consistent rise in its share price, indicating a strong buying sentiment. The company’s net profit totalled INR 1,098.93 lakh (USD 1.32 million), while its revenue amounted to INR 26,716.10 lakh (USD 31.15 million), up 20 per cent Y-o-Y.

This strong performance reflects the company’s operational efficiency and the growing demand for recycled aluminium products. Looking at the whole fiscal year, Baheti's net profit shot up 150 per cent to INR 1,800.98 lakh (USD 2.10 million) and revenue increased to INR 52,453.87 lakh (USD 6.3 million), gaining 22.1 per cent over the year.

Also read: India launches aluminium recycling portal amid circular economy push and global trade shifts

Net income for the year stood at INR 10.99 crore (USD 1.28 million), further indicating the company’s fiscal strength.

What’s Driving Baheti’s Success?

Baheti's secret code to success has always been its great commitment towards sustainability and operational excellence. According to Yash Shah, Joint Managing Director of Baheti Recycling Industries Limited, “The robust results demonstrate the resilience of our company and the rising demand for sustainable recycling techniques in India. Our commitment to operational excellence remains firm and we want to contribute even more to the circular economy."

Also read:13 companies leading the global aluminium recycling sector

Responses