您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

Maan Aluminium has undergone a valuation grade change as a microcap in the non-ferrous metals industry. Its grade moved from fair to expensive, with a PE of 42.18. It also has an enterprise value (EV) to EBITDA of 26.40, suggesting some premium relative to its peers. Its recent quarterly results provide evidence of declining fundamentals despite the high multiples.

The stock trend for the firm has changed from just slightly bearish to flat. Technical indicators such as the MACD show bearish signs on a weekly basis, indicating uncertain sentiment. Investors have seen a return of 197.97 per cent over three years. But the stock is down - 8.28 per cent year-to-date. This separation illustrates the difficulty of valuing fast-paced microcaps. It also states the fact that if the growth momentum stalls, it can be detrimental.

Also read: North India emerges as the backbone of India’s aluminium extrusion industry

Profitability continues to be an issue. The latest quarterly disclosures display a significant drop in profit both before and after tax, while operating margins remain thin. For long-term investors, weaker earnings create a disparity with high valuation, which is a classic red flag for cyclical sectors like aluminium.

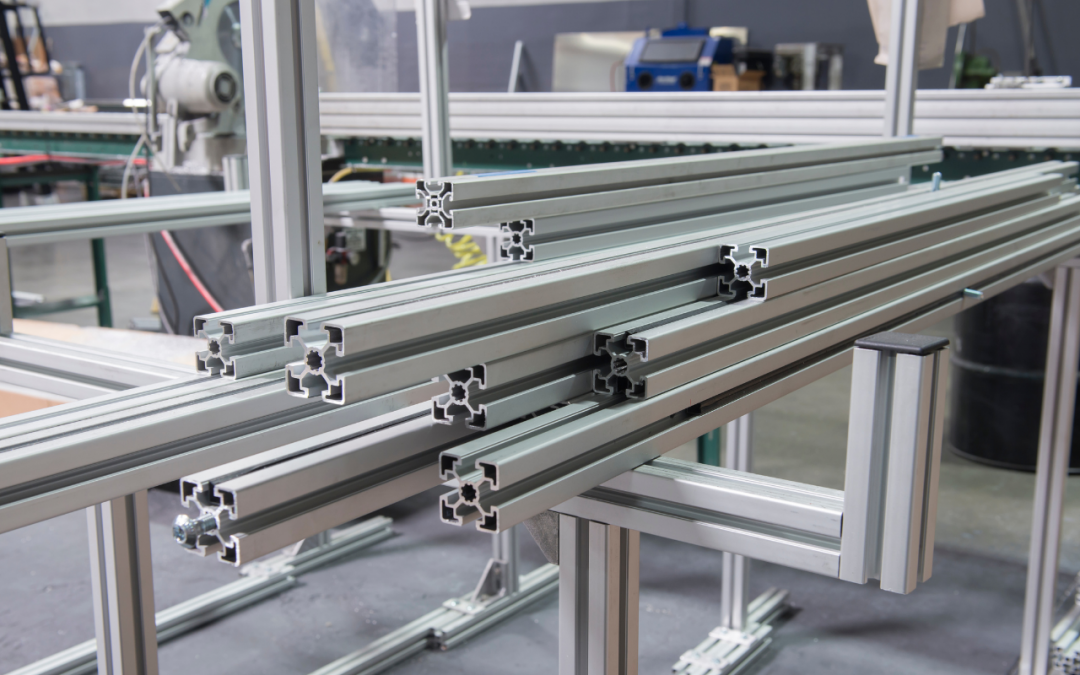

To compound the challenges, Q1 FY2025 saw a 66.79 per cent decline in year-over-year net profit. This also includes the EPS falling from INR 1.88 to INR 0.63 (USD 0.0226 to 0.0076). Revenue fell by 14.75 per cent, due in large part to operational costs. On the other hand, the company invested INR 8.75 crore (USD 1.05 million) in the construction of a new facility at Devas, Madhya Pradesh, during the first quarter of 2025. This will also enhance aluminium extrusion capacity. This is part of a strategy aligned with growth segments in electric vehicles, solar and defence, and also this is where the demand for aluminium will remain strong.

Also read: Smart moves, not shortcuts: Why the next decade in aluminium extrusion belongs to AI

Responses