Ardagh Group S.A. has reportedly made a final decision on a USD 5.8 billion worth recapitalisation that will reduce its debt position and extend loan maturities, with backing from financial support from almost all of its creditors.

The restructuring includes a USD 4.3 billion debt-for-equity exchange, the issue of USD 1.5 billion in new first-lien senior secured notes maturing in 2030, and an extension of the company’s USD 0.5 billion asset-based lending facility to the same year. Following the transaction, the ownership has been transferred to the company’s lenders, consisting of major financial institutions and investment funds.

Must read: Key industry individuals share their thoughts on the trending topics

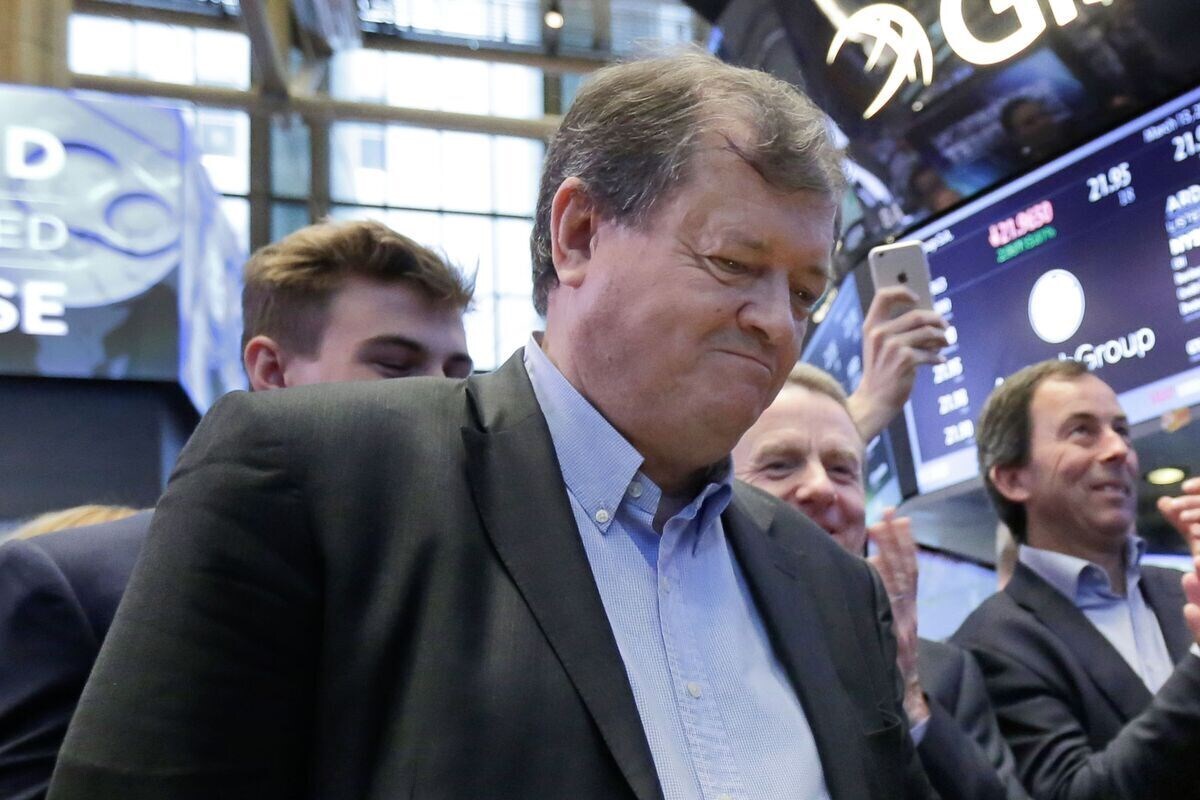

Reports in the Irish Independent state that the recapitalisation of the firm also results in the departure of founder Paul Coulson. He is reportedly leaving with an estimated payout of around USD 100 million.

As part of the leadership transition, Mark Porto has assumed the role of Executive Chairman, and Jean-Pierre Floris has joined the board. Several board members have stepped down, including Paul Coulson, Gavin Coulson, James Donath, Gerald Moloney and John Sheehan.

Departing Chairman Herman Troskie said the agreement “creates a sustainable platform for future growth” and commented that the company is “very pleased to have concluded this transformational recapitalisation” as it moves ahead with its business plan under new ownership.

Don't miss out- Buyers are looking for your products on our B2B platform

Responses