Egypt’s Arab Aluminium Company (AAC), known for manufacturing extruded aluminium profiles for a wide range of industries like industrial and architectural, has reported a steep reversal in fortunes in the first half of 2025. It has moved from healthy profits last year to a net loss after tax of EGP 5.742 million (approximately USD 117,950), according to its latest financial disclosures.

The loss per share was EGP 0.14 in the period ending June 2025, as compared to a profit per share of EGP 0.33 (0.0068 USD) in the equivalent period a year earlier. The change followed a difficult start to the year for AAC, where the company had already recorded a Q1 loss of EGP 6 million (USD 120,760), reversing a Q1 2024 net profit of EGP 6.1 million (USD 120,904)

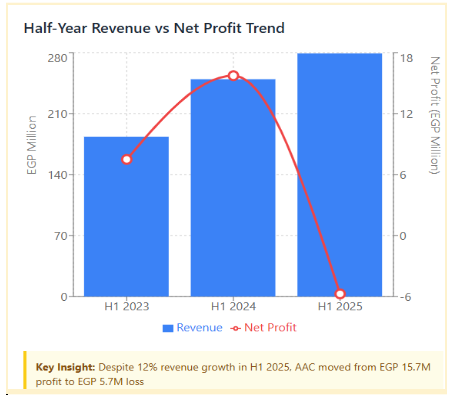

Interestingly, the losses occurred despite a better performance in sales. Revenues were up 12 per cent year-on-year in H1 2025 to EGP 279.021 million (USD 5.76 million), up from EGP 249.435 million (USD 5.15 million) in H1 2024. In Q1 alone, revenue grew to EGP 127.162 million (USD 2.63 million), up from EGP 98.351 million (USD 2.03 million) the prior year. The market capitalisation of AAC is about EGP 568.88 million (USD 11.74 million), and its share price was around EGP 13.98 (USD 0.29) on 13 August 2025.

Also read: Constellium posts $4.1B H1 revenue amid profit slump; lifts 2025 EBITDA outlook to $650M

A sharp contrast to last year’s boom

The decline is all the more severe by virtue of AAC’s results from a year earlier. AAC’s net profit after tax was EGP 15.729 million (USD 324,606) in H1 2024, which had increased by 110 per cent from EGP 7.489 million (USD 154,573.7) in H1 2023. Revenue grew 36 per cent over the prior year to EGP 249.435 million (USD 5.16 million), helped by increased demand for extruded aluminium profiles in both the industrial and architectural sectors.

AAC’s activities include billet casting, die manufacturing, extruding, alloy rolling, painting and anodising. It is part of a wider aluminium industry in Egypt, which is one of the country’s important export industries, with main markets in Europe, North Africa and the Gulf.

Industry headwinds and opportunities

Analysts believe that AAC’s move into the red in 2025 is possibly a result of input cost pressures, price volatility for aluminium globally and shifts in regional demand cycles. The aluminium producers in Egypt are also faced with government-led privatisation plans that could alter the competitors' landscape. Egyptalum has been specifically flagged for part stake sales.

The larger Middle Eastern aluminium sector has seen mixed success. Ma’aden in Saudi Arabia recorded a 160 per cent increase in net profit to SAR 2 billion (USD 533.12 million) in H1 2024, which reflects regional demand strength but also illustrates that competitive pressure varies regionally.

AAC’s sales growth indicates that there is some resilience in its order book, but the cost pressures on its bottom line indicate a clear imperative to manage costs and improve efficiencies to return to profitability. If demand momentum continues and commodity prices stabilise, AAC could still expect a recovery; nevertheless, investor sentiment will depend on earnings over the next few quarters.

To read our report on Aluminium Foil and its End Uses, click here.

Responses