“2024 was an important year for the apt Group in many respects, characterised by strategic decisions and operational development. Our path toward achieving climate neutrality by the end of 2044 continued,” wrote Manon Gahmann, Director of CSR Compliance. This statement comes amid the European aluminium industry facing a historic pivot of climate legislation and escalating energy prices. It demands circularity that is no longer a choice but an existential factor shaping business models. And Apt Group stands out in this landscape as a regional leader with four production sites across Germany, the Netherlands, and the Czech Republic, pressing 44,393 tonnes of rods and selling 43,392 aluminium profiles for construction, transport, automotive, and industry sectors. In 2024, the company generated EUR 209 million in revenue and employed 757 people.

Image source: https://www.apt-alu-products.com/

Image source: https://www.apt-alu-products.com/

Also read: India slashes GST on renewables to 5%, boosting solar growth and aluminium demand

Setting science-based targets

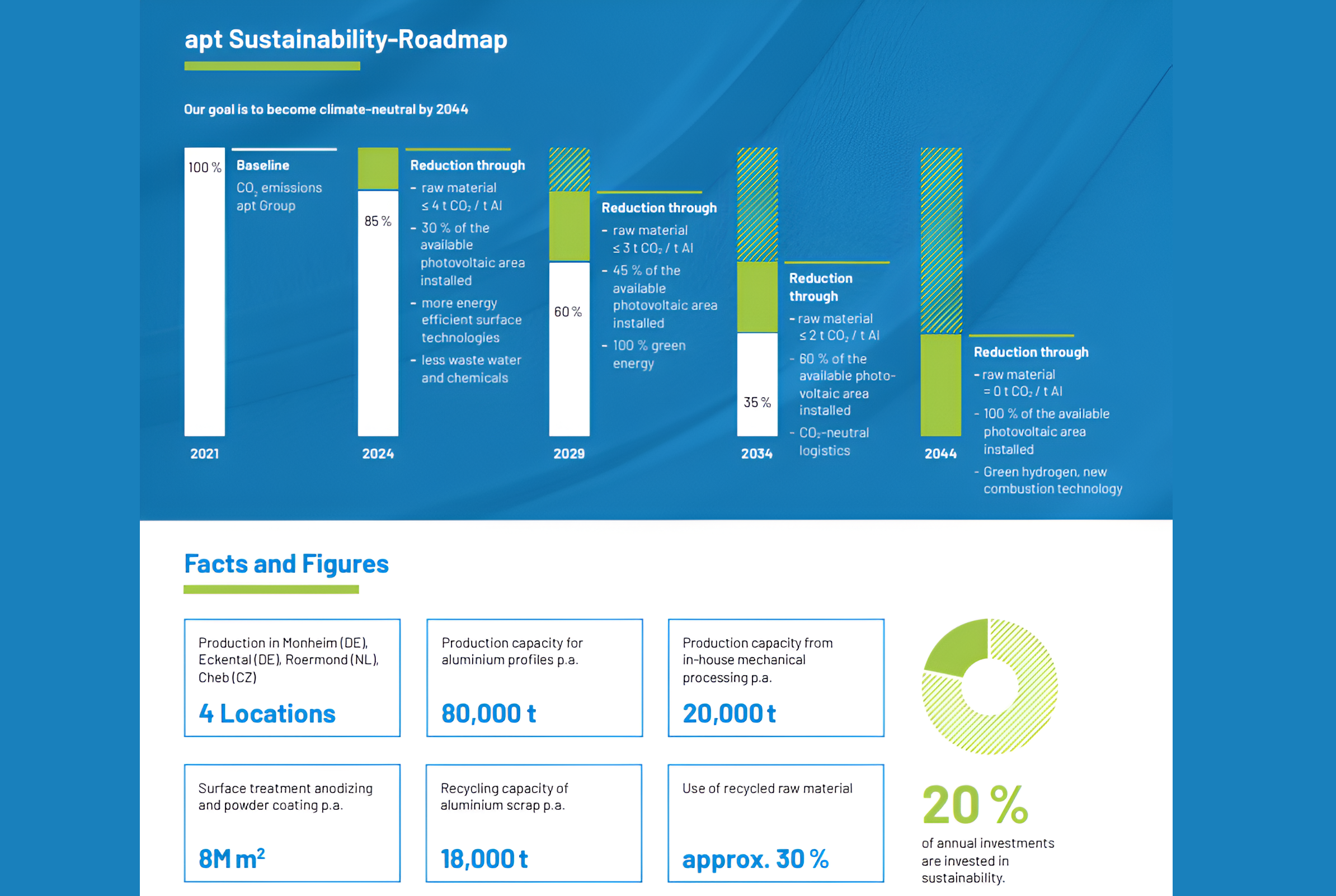

From a climate impact perspective, Apt Group’s strategy is grounded in the Paris Agreement’s 1.5°C roadmap. Their GHG reduction targets are explicit: “Reduce carbon emissions associated with the use of raw materials 4 tonnes of CO₂ per tonne Al by 2024 and 3 tonnes of CO₂ per tonne Al by 2029.” The transition plan sets key milestones: utilising 45 per cent of available land for PV systems by 2029 and switching fully to green electricity by 2030. In 2024, PV installations at the Monheim am Rhein site produced 383,013 kWh, modelling the region’s low-carbon shift.

The company’s gross Scope 1 emissions dropped by 13.21 per cent to 10,705 tonnes, Scope 2 by 15.97 per cent (to 7,623 tonnes of CO₂e), and Scope 3 by 22.07 per cent. Total GHG emissions declined 21.44 per cent to 225,608 tonnes of CO₂e, translating to a GHG intensity of just 4.79 tonnes of CO₂e per profile produced.

For comparison, the European aluminium sector’s average carbon footprint for primary aluminium is now 6.3 kg CO₂ per kg — nearly 60 per cent below the global average, and 78 per cent of European smelters operate with renewable electricity. Europe is expected to see low-carbon power demand by the aluminium industry rise 82 per cent by 2050 as decarbonisation accelerates.

Responses