The World Economic Forum (WEF) has released its Net Zero Industry Tracker 2023, the report's second edition. The report holds significant implications for the aluminium industry, particularly its efforts to achieve sustainability and reduce emissions.

Focusing on heavy industrial and transport sectors, which contribute over 40 per cent of global greenhouse gas emissions, the report emphasises the need for multifaceted solutions, accelerated technology development, supportive infrastructure, and increased capital to achieve net-zero emissions by 2050.

{alcircleadd}Key highlights of the report:

Readiness and Challenges:

Technology roadmap: To align with net-zero goals, the industry prioritises clean power adoption, increased use of recycled aluminium, and the advancement of low-emission smelting and refining technologies. However, the transition comes with a caveat - the production costs for low-emission aluminium can surge up to 40 per cent, posing a financial challenge.

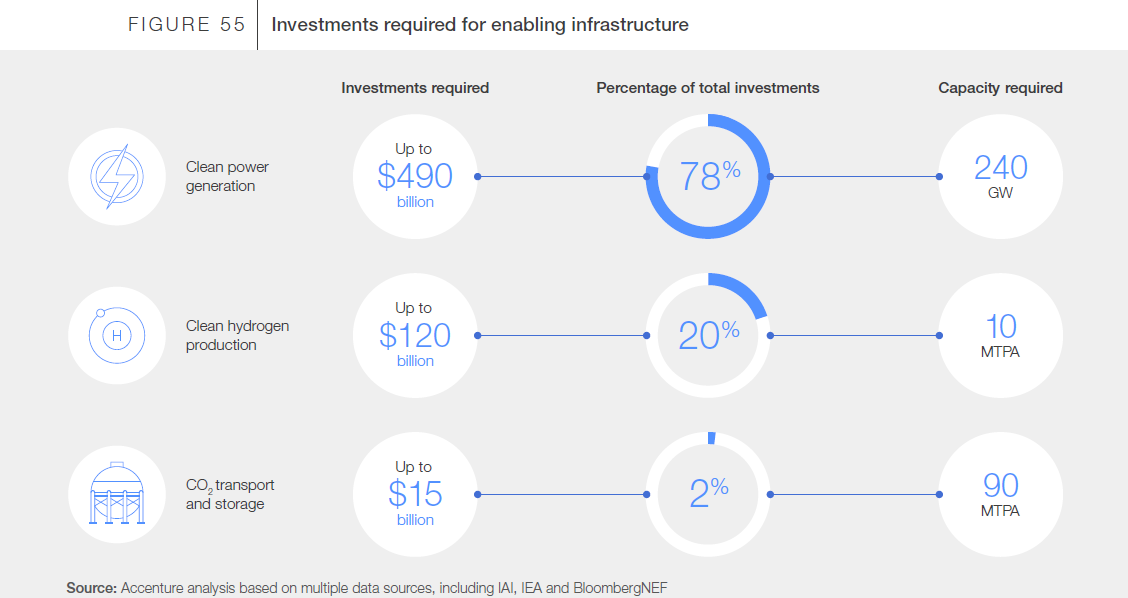

Infrastructure hurdles: Infrastructure readiness emerges as a critical bottleneck. While only 30 per cent of the required clean power infrastructure is in place, hydrogen and CO2 transport infrastructure must catch up to the necessary threshold. The hefty investment of up to $560 billion is indispensable to accelerate the development of requisite infrastructure.

Demand dynamics: In 2022, low-emission aluminium held a mere 1 per cent market share, with potential demand signals suggesting a required B2B green premium of around 40 per cent. However, the market's capacity to absorb this premium still needs to be verified. Companies like Apple are steering towards sourcing low-emission aluminium, indicating a growing interest in sustainable supply chains.

Policy imperatives: The industry's global nature necessitates robust regulations for both domestic and international players. Key producing countries, especially China, require tangible policies to enhance access to clean power infrastructure, emphasising the urgency for comprehensive policy frameworks.

Capital conundrum: With over $200 billion needed in capital expenditure by 2050, the industry faces a precarious situation. The weak business case, coupled with an 8 per cent industry profit margin and 9 per cent weighted average cost of capital (WACC), underscores the financial complexities of transitioning to low-emission technologies.

Sector priorities:

Existing assets optimisation: To reduce near-term emissions intensity, the industry focuses on switching to clean power sources and retrofitting existing fossil-fuel-based assets with Carbon Capture, Utilisation, and Storage (CCUS). Maximising end-user scrap collection rates is also a pivotal strategy to bolster secondary production.

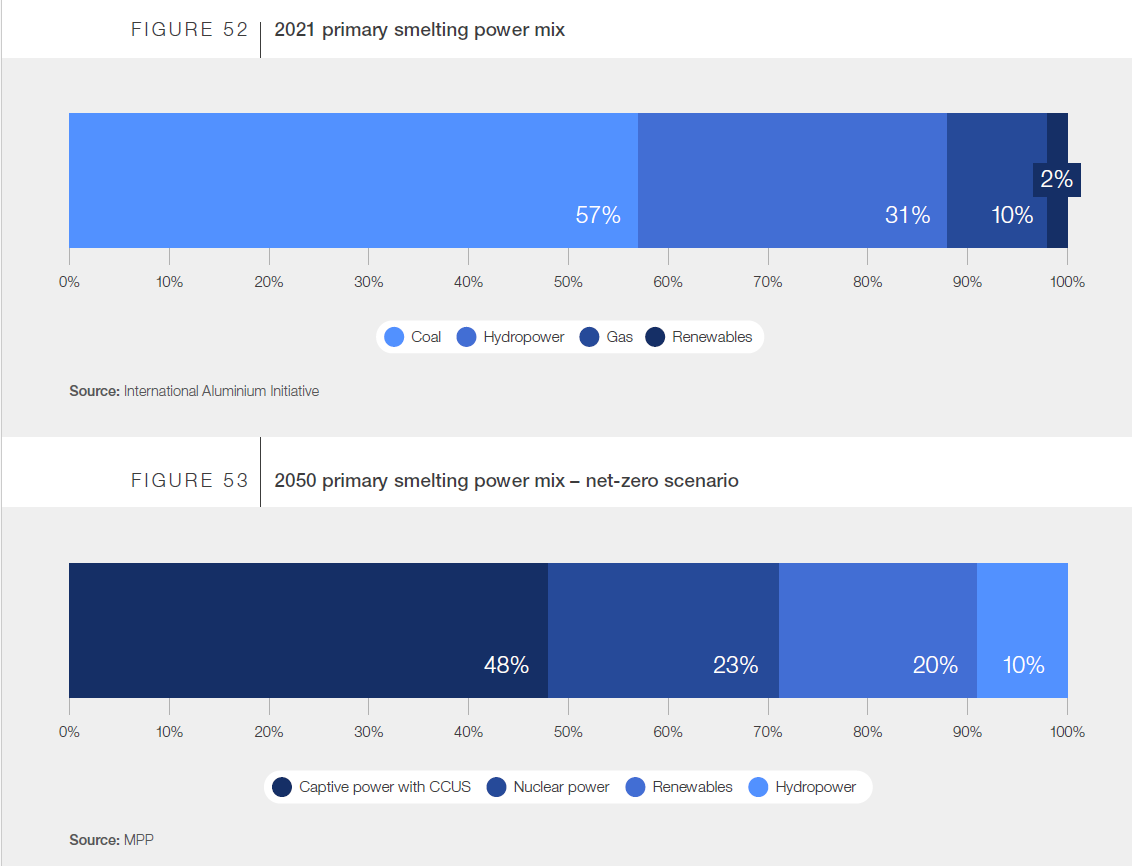

The chart illustrates the anticipated transition of primary smelting power from 2021 to 2050.

Next-generation investments: Accelerating technology and infrastructure development is crucial for achieving absolute emissions reduction. Investments in clean power grid capacity, low-emission smelting, and refining technologies are paramount for the industry's evolution.

Ecosystem collaboration: To de-risk capital investment, policymakers are urged to implement measures that level the playing field for low-emission technologies. Encouraging shared infrastructure and fostering supply chain stability through strategic partnerships is vital for sustained progress.

Performance metrics: Electricity consumption during smelting contributes nearly 70 per cent of emissions, making it a focal point for emission reduction strategies. While stable in recent years, the industry's energy intensity remains challenging, with primary aluminium being more energy-intensive than steel and cement.

Charting the path forward: To attain net zero by 2050, the aluminium industry must reduce absolute emissions by 80 per cent. This involves a dual approach - transitioning to completely clean power sources for smelting and accelerating the adoption of secondary aluminium, projected to constitute 50 per cent of production by 2050.

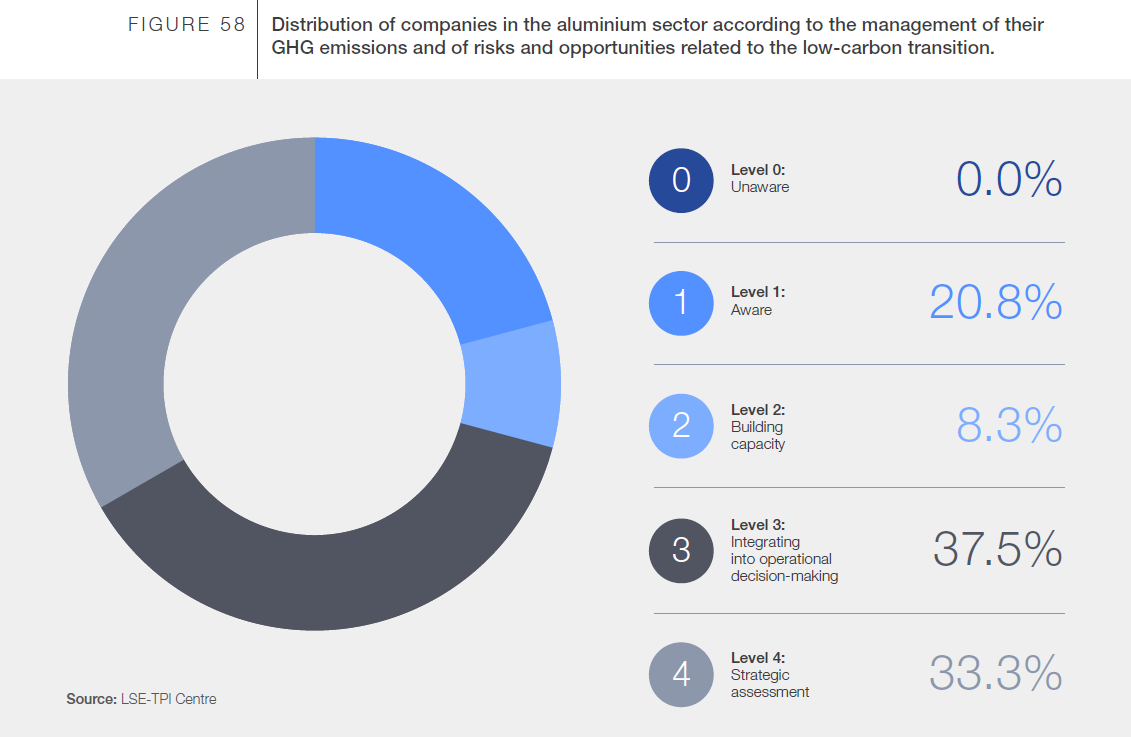

The data above indicates that most of aluminium companies' management is aware and already taking action to transition to low-carbon aluminium.

Challenges and imperatives mark the aluminium industry's journey towards net zero. As it navigates the complexities of technology adoption, infrastructure development, policy formulation, and capital investment, the industry is at a crucial juncture where strategic decisions will shape its trajectory toward a sustainable and low-emission future.

To read the full report, visit here.

Responses