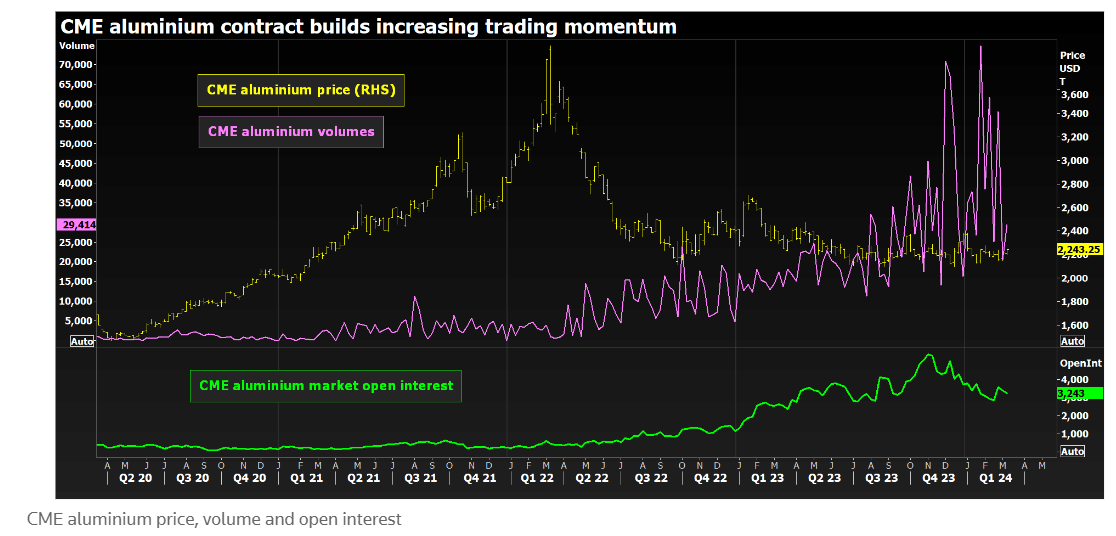

Activity in the CME's aluminium contract has significantly intensified in recent months, marked by a volume surge and a widening participant base, as the world's most recognised news media agency reported.

However, it remains relatively small compared to the London Metal Exchange (LME), which maintains its position as the primary benchmark price-setter. Similarly, the Shanghai Futures Exchange (ShFE) remains the predominant futures price reference for China's substantial aluminium sector, indicating no imminent change in its status.

Let us know more about CME Group Inc.

CME Group Inc. provides a derivatives marketplace. The Company enables clients to trade futures, options, cash and over-the-counter (OTC) markets, optimise portfolios, and analyse data. Its exchanges offer a range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. It offers futures and options for futures trading through the CME Globex platform, fixed-income trading via BrokerTec, and foreign exchange trading on the EBS platform.

Rising importance of CME's aluminium contract

The rapid expansion of CME's aluminium contract reflects the evolving dynamics of the aluminium market. A noticeable trend is the decreasing global market globalisation, with the United States gradually distancing itself from other regions. This shift is driven by import tariffs and punitive duties imposed on Russian metal and Chinese goods. Establishing a North American pricing point signifies a logical progression within this transformative restructuring of the market landscape.

Acceleration in CME aluminium contract

In 2013, the CME introduced a contract for the U.S. Midwest premium, which was succeeded by European and Japanese premium contracts in the following years. The volume traded across these four contracts totalled nearly four million tonnes last year. In contrast, the LME's premium contracts, launched later, recorded volumes of only 202,000 tonnes in the same period.

The Midwest premium briefly aligned with global rates before widening significantly in 2018 when the Trump Administration imposed a 10 per cent import duty.

The Biden Administration's strategy of reducing supply risk by cutting off Russian imports has solidified the growing gap in economic structures with other global regions. American purchasers currently face a premium of approximately $387 per metric ton over the futures price for metal, while their European counterparts are paying roughly $250 and Japanese buyers just $120. The futures price, traditionally established on the LME, may soon see a shift in its dominance.

A time of rapid development

In 2014, CME attempted to revive its future contract to align with its premium products. However, it fell out of favour and saw no trading activity until July 2019. The resurgence of interest was sparked by the CME's decision to extend its delivery network beyond U.S. locations to international ports, particularly those offering physical arbitrage opportunities with the LME warehousing network. Before June 2019, registered stocks were non-existent. They stand at 45,905 tonnes, mainly in heavily-utilised LME locations such as Port Klang in Malaysia and Gwangyang in South Korea.

With the increase in inventory, trading volume has also risen. Activity in the aluminium contract nearly tripled last year to reach 30.6 million tons. While this pales in comparison to the 1.4 billion tonnes traded on the LME, it's important to note the disparity is amplified by the LME's distinctive trading system. A more relevant comparison lies with the ShFE, which, like the CME, offers a standard cash-settled futures contract.

CME volumes for the first two months of this year totalled 9.3 million tonnes, whereas Shanghai saw 44.0 million tonnes traded during the same period. Despite this, the U.S. product continues to experience rapid growth. Moreover, the number of users has surged, with over 600 recorded last year compared to 357 in 2022, according to the exchange.

Additionally, the CME has introduced aluminium options, which achieved their highest volume month in February.

CME all-in aluminium

The surge in aluminium fortunes on the CME has traditionally been tied to its rival market across the Atlantic. However, indications suggest that the contract's success is gaining domestic traction.

Previously, physical buyers would hedge their basis risk on the LME and their premium risk on the CME. However, with the introduction of this new pricing tool, both components can now be managed on the CME platform.

Domestic entities like PerenniAL Aluminium have begun offering buyers a CME all-in price reference in this year's term supply contracts. Brian Hesse, CEO of PerenniAL Aluminium, highlighted this development in a CME update on the contract.

Not only industrial users but also investors are showing interest. In October, the United States Commodity Fund (USCF) unveiled the USCF Aluminium Strategy Fund, which will trade based on the CME contract. This move aims to attract investors seeking exposure to aluminium as a crucial metal in the energy transition.

Although featured in major commodity indices, aluminium has struggled to attract much speculative interest from retail investors. However, with CME offering investor-friendly micro products in precious metals and copper, it is an appealing option for smaller players who cannot access the wholesale market in London.

CME is laying the groundwork to establish itself as the price-setter for aluminium in the North American market.

Responses