The year 2018 saw the global aluminium industry being impacted by various factors including constraints in supply of raw materials and imposition of various trade restrictions and sanctions by the US Government. Prices saw some never-before-seen highs and lows and a trade war between the U.S. and its allies created concern in the international market.

Now, as the five months of the year 2019 are over, the industry has started consolidating. Most of these issues surrounding the aluminium industry are expected to be resolved and supply as well as price is stabilizing during the first half of the year. The start of 2019 has already witnessed the lifting of sanctions on Rusal by the US Government and trade negotiations between the U.S. and China are taking shape in a positive manner. The US has lifted the tariffs on Canada and Mexico paving the way for an amicable trade equation within the North American supply chain. Concerns over raw material insecurity is also slowing down with Alunorte refinery about to start full production by the second quarter of 2019 and Alcoa’s worker issues getting solved. Going forward, while the outlook for aluminium industry in 2019 is expected to be moderately optimistic on the supply concerns, it is also expected to be bearish on the price part.

{alcircleadd}Here is an estimated projection on how all the verticals of the aluminium value chain are likely to perform in the rest of the year in terms of demand and supply and prices.

Bauxite:

Bauxite production in the first five months of 2019 remained stable with all major miners reporting production growth on upward curve. Rio Tinto, Alcoa and Nalco reported production growth. The market had abundant supply and prices continued to slide over the first five months.

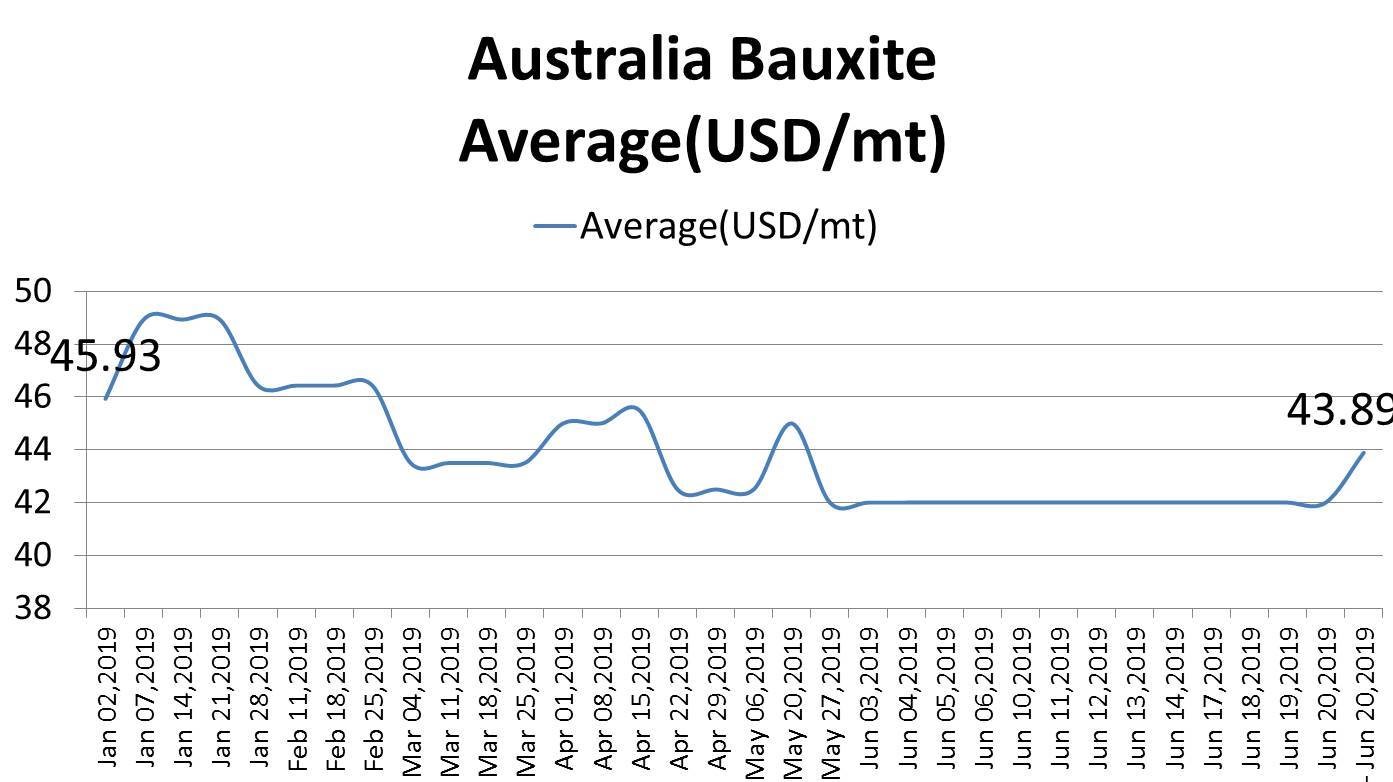

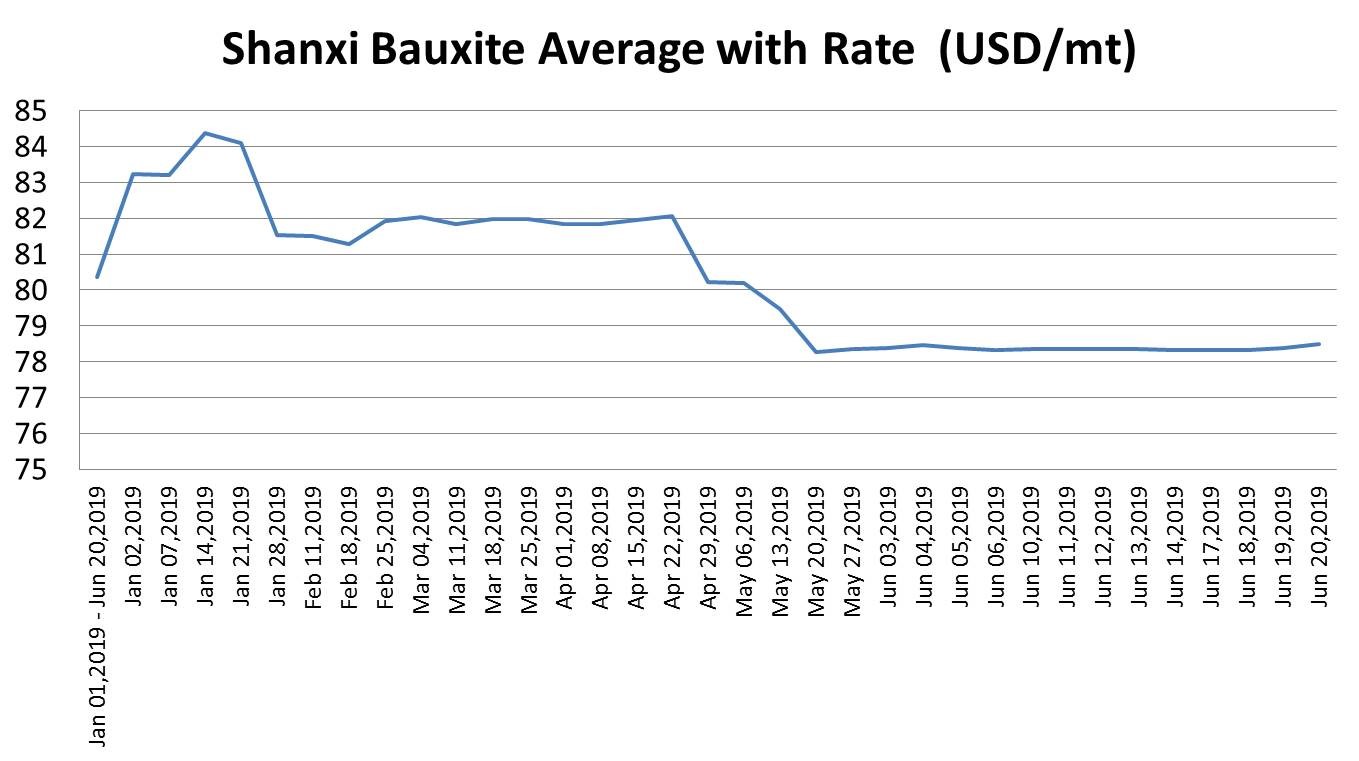

CIF China Australlian Bauxite price started the New Year 2019 at US$45.93 per tonne and currently it is staying flat at US$ 42 per tonne. There was a bullish phase in January and after that the prices continued on a downward curve with occasional rise in April and May. China’s domestic bauxite price (Shanxi 6.0≤Al/Si 7.0) continued to hover at US$83 per tonne from January 2 to January 27, 2019. After moving steadily on a downward curve, currently, the price stands at US$ 78.35 per tonne.

The domestic market in China will continue to remain bullish compared to the international price as the depleting reserve and environmental shutdown will keep the supply tight. However, there is limited upward movement in 2019, amidst the ample supply of imported bauxite to China with new projects from Alufer and Rio Tinto. China’s bauxite import registered 35.9 per cent growth in the first four months of 2019 compared with the same period last year. Total bauxite import came in at 35.58 million tonnes in that period and the import is going to increase further due to upcoming alumina capacities in the country.

Australia, Guinea & Indonesia would continue to lead bauxite mining in 2019 and ahead. The bauxite market is expected to have a surplus ranging between 8 million and 12 million metric tonnes, as higher production would only be partially offset by higher demand in China. We see limited upward movement for global bauxite price in 2019.

Alumina:

Alumina market got over the price volatility of last year, which was driven by 50% capacity cuts in Alunorte alumina refinery, workers strike and sanctions against Rusal. China’s domestic market is also not tight despite the capacity cuts. Alumina output during January-May remained 4.29 per cent higher YoY and stood at 29.56 million tonnes. Global alumina output for the period stood at 43.16 million tonnes, lower than 53.67 million tonnes in the same period of 2018.

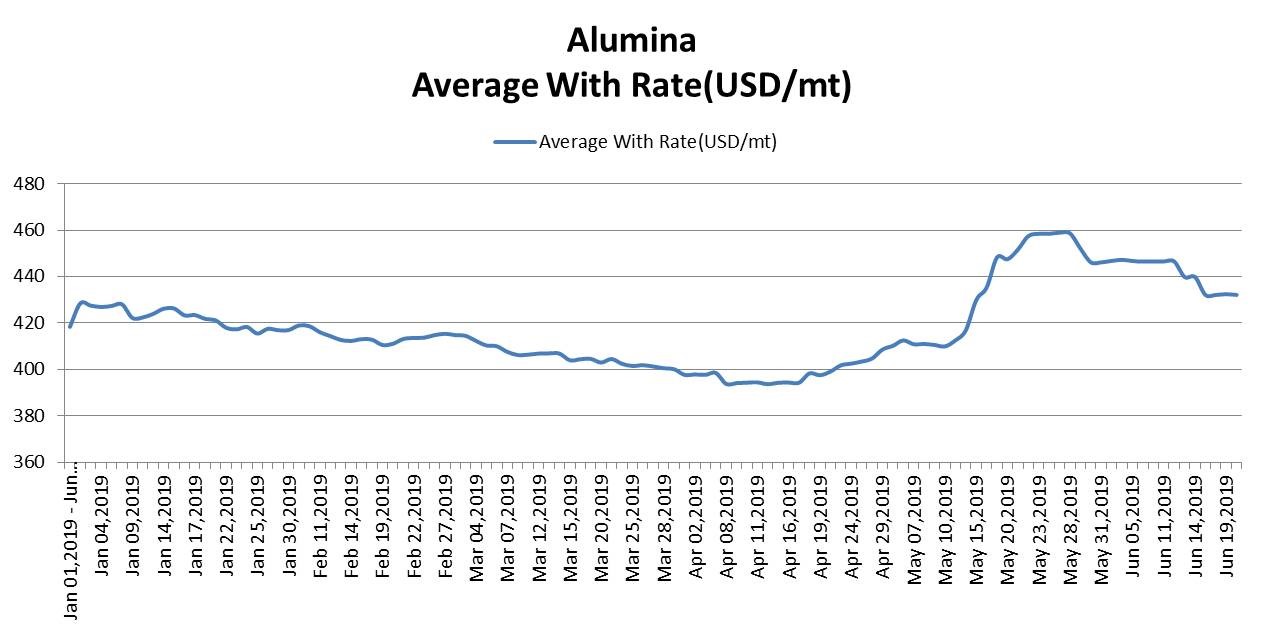

As shown by Shanghai Metals Market’s data, China’s alumina price has been continuing its downward trend. It was predicted that the domestic alumina price will go up after Xinfa’s Jiaokou refinery stopped production in June. Despite the output drop of 1.4% in May and expected production drop in June, alumina prices are still on a downward curve. The average spot alumina price at China’s domestic market continued to fall through June touching the lowest in April. Though capacity cuts have buoyed the prices, pushing it to a high of US$ 459 towards the end of May, the price again came down to stand currently at US$432 per tonne. Australian alumina FOB price also dropped to an average of US$ 338 per tonne in June starting the year with US$ 415 per tonne.

Aluminium production in China is expected to drop in 2019 due to a number of factors like suspension and relocation of operations, winter production cuts, and flexible production schedules driven by reduced demand. These factors are likely to lead to a build-up in alumina stocks in China and a drop in prices in 2019

Alcoa projects a surplus global alumina market in 2019 in the range of 200 thousand tonnes to 1 million tonnes. Alcoa estimates around 1 million tonnes of Chinese alumina surplus in 2019 contributing to it. We see a balanced or a slightly surplus alumina market in 2019. Considering all the factors we expect the Australian alumina price to stay within a range of USD 300 per tonne to USD 350 per tonne in Q2 2019. Looking at the trend Chinese domestic alumina prices are likely to be at a range of USD 430 to USD 450 per tonne in Q2 2019.

Primary Aluminium

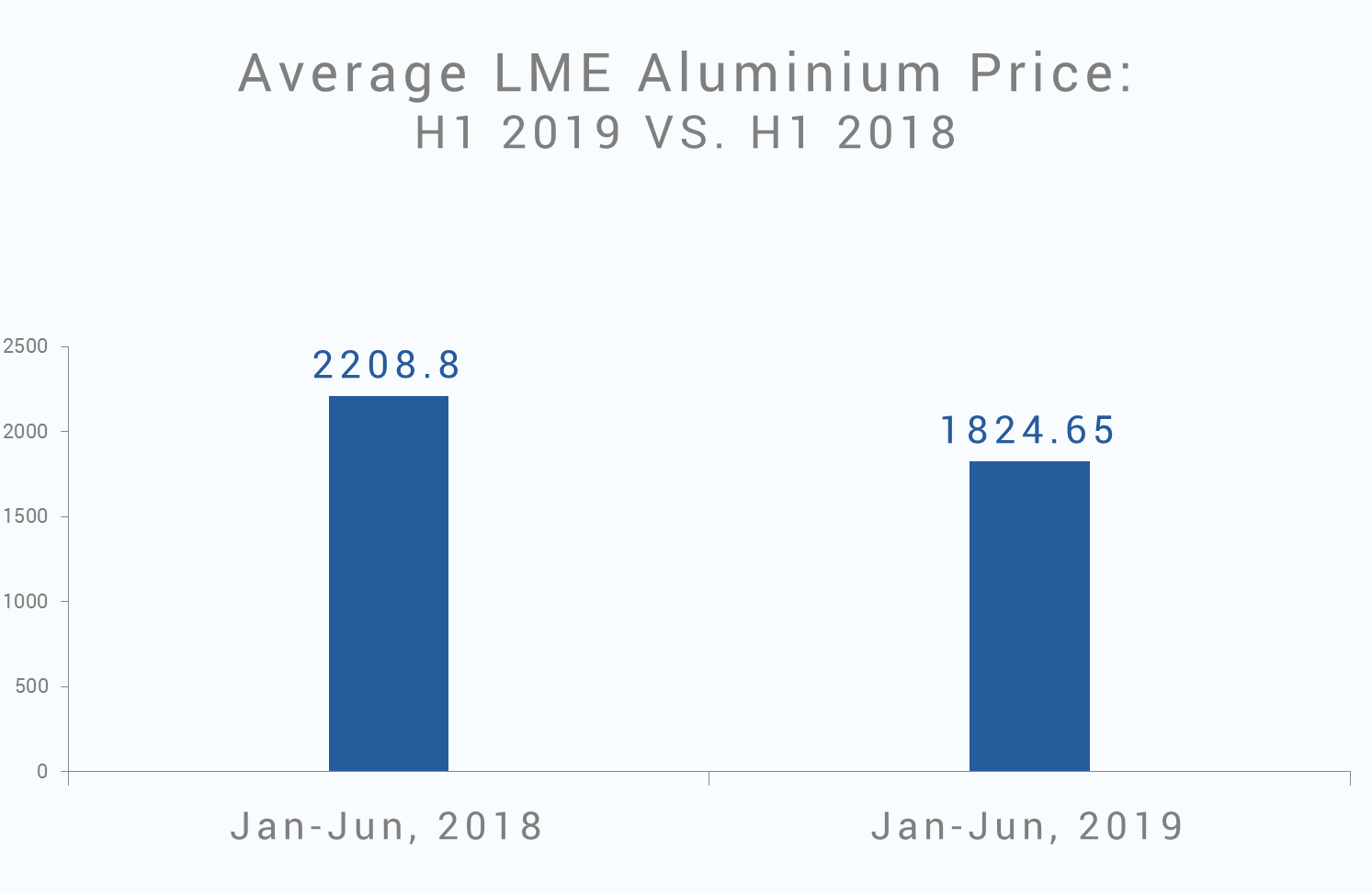

Base metals prices continued to slide in the in the second quarter of 2019, driven by continuous market uncertainty over the prolonged U.S.-China trade war and a slower demand situation. LME aluminium prices at all-time low due to saturation and low demand and continued high aluminium exports from China. Since the supply shock was ruled out with the lifting of sanctions, which could have supported prices, prices are back to being determined by the trends in global economy, especially China. The projection is not bullish with an indication of oversupply of the metals. Along with that, aluminium is losing the cost support due to ample supply and falling prices of alumina. The tariffs could not stop the flow of aluminium from China as it diverted the export destinations. Currently hovering at a level of US$1720 to US$1760 per tonne, it is one of the lowest periods for LME aluminium in last two years. Analysts do not expect a significant recovery of the aluminium price in the second half of the year. LME aluminium price is likely to hover at the US$ 1800 per tonne level..

Aluminum production in the world in January-May 2019 amounted to 26.40 million tonnes, which is almost flat from the same period in 2018, according to preliminary data from the International Aluminum Institute (IAI). China produced about 14.93 million tonnes, slightly up from 14.88 Mt produced in the same period last year.

We expect a deficit aluminium market in 2019. As of June 2019, inventories of aluminium now stand at 1million tonnes in warehouses approved by the LME, one of the lowest. Alcoa projects a global aluminium deficit ranging between 1.5 million and 1.9 million tonnes. The company projected a slower global aluminium demand growth of 2 to 3 per cent in 2019, predominantly due to lower transport and electrical demand growth in China. Lower production expectations in Europe and South America are likely to contribute to a global deficit.

Downstream Aluminium

Downstream sector of aluminium is growing solid with more and more aluminium producers investing in downstream expansions. Global demand is slightly slow in the first five months due to lacklustre demand from China in the electrical and transport sector. 10% import tariffs on aluminium and punitive sanctions on Rusal by the U.S. have also affected the market dynamics as downstream producers in the U.S. had to pay more to source their metal. Growing demand from the transport sector moved the market and is likely to further support the downstream sector. Demand for aluminium downstream products was up 2.1 per cent in North America in the first quarter of 2019 and is likely to remain strong rest of the year driven by the automotive sector.

Rising production and slowing domestic demand is pushing aluminium product export from China and it is growing year on year. Aluminium products exports by China increased 12.9 per cent year-on-year to 1.94 million tonnes in the first four months of 2019.

On the product side aluminium FRP continues to lead downstream demand. FRP accounts for about 32% of the global aluminium usage followed by extrusions at 31%, castings at 22% and wire rods at 8%. FRP demand will continue to grow in 2019 driven by substitution trend in transport and growth in packaging driven by can stock and foil in emerging markets.

End Users

Transportation sector will be driving demands for aluminium in the coming decade as the metal is slowly replacing steel for lightweighting, high performance and fuel economy. The proposed tariff by Trump on Auto and auto parts import is looming large on the aluminium parts makers and auto makers of Europe and Japan. Currently Trump has postponed the tariffs for six months to open the door for further negotiations. However, he might impose the tariffs if the trade situations go worse.

EVs have played a big role in driving aluminium demand in China till Q1 2019. In Q1 2019, aggregate sales of electric vehicles and plug-in hybrids remained explosive, growing 110 per cent to nearly 300,000 units. However, in April, sales of EVs and plug-in hybrids rose about 18 per cent to about 97,000. By May, monthly demand for EVs edged up only 1.8 per cent YoY to around 104,000 units. On March 26, 2019 the Chinese government slashed subsidies for EVs and plug-in hybrids by 50 per cent and it plans to phase out the subsidy program completely by the end of 2020. This has capped the sale of EVs in China and the market is not likely to regain its growth until the policies are changed.

So, aluminium demand from EVs will remain limited in 2019 unless there is a growing demand from Japanese, American or European carmakers.

Recycled Aluminium

Recycled aluminium will continue to play a significant role as more and more end users are focusing on increasing recycled content in their applications. Aluminium primary producers as well as the product manufacturers are investing in expanding their recycling capabilities. Close-loop-recycling will continue to play a significant part.

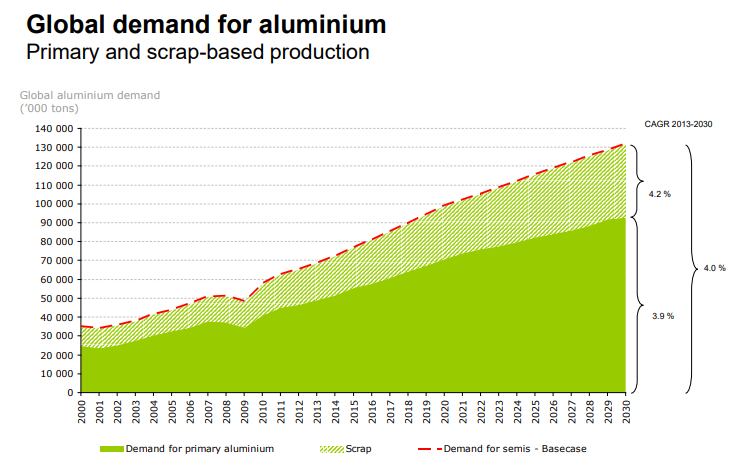

In 2019 total aluminium demand (Primary plus recycled) is projected to rise to around 90 million tonnes. While primary supply is likely to be around 65 million tonnes, about 25 million tonnes would be recovered from recycled scrap.

As for the trade scenario is concerned, China’s strict scrap import policy implemented in 2018 and 50% tariffs on aluminium scrap imported from the US has changed the trade scenario between the two countries. In the first quarter of 2019, the US, the largest scrap exporter, exported 113,000 tonnes of aluminium scrap to China, down 36.5% from 178,000 tonnes exported in Q1 2018.

Aluminium cannot be seen as an independent commodity as the market is driven by forces that have impact on the entire value chain. The entire value chain moves together to bring about a turnaround in the market. H1 2019 can be seen as the settle down period after the disruptions started in 2018 and the aluminium sector will take it slow to bounce back to normalcy.

Responses