ABx Group’s Deep Leads rare earth project has taken another technical step forward, with new impurity-removal tests confirming an Al:TREE ratio of less than 0.005 under near-optimum pH conditions (5.9 and 6.2). The results reinforce confidence in ABx’s ability to produce a high-value, low-impurity mixed rare earth carbonate (MREC) at low cost.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

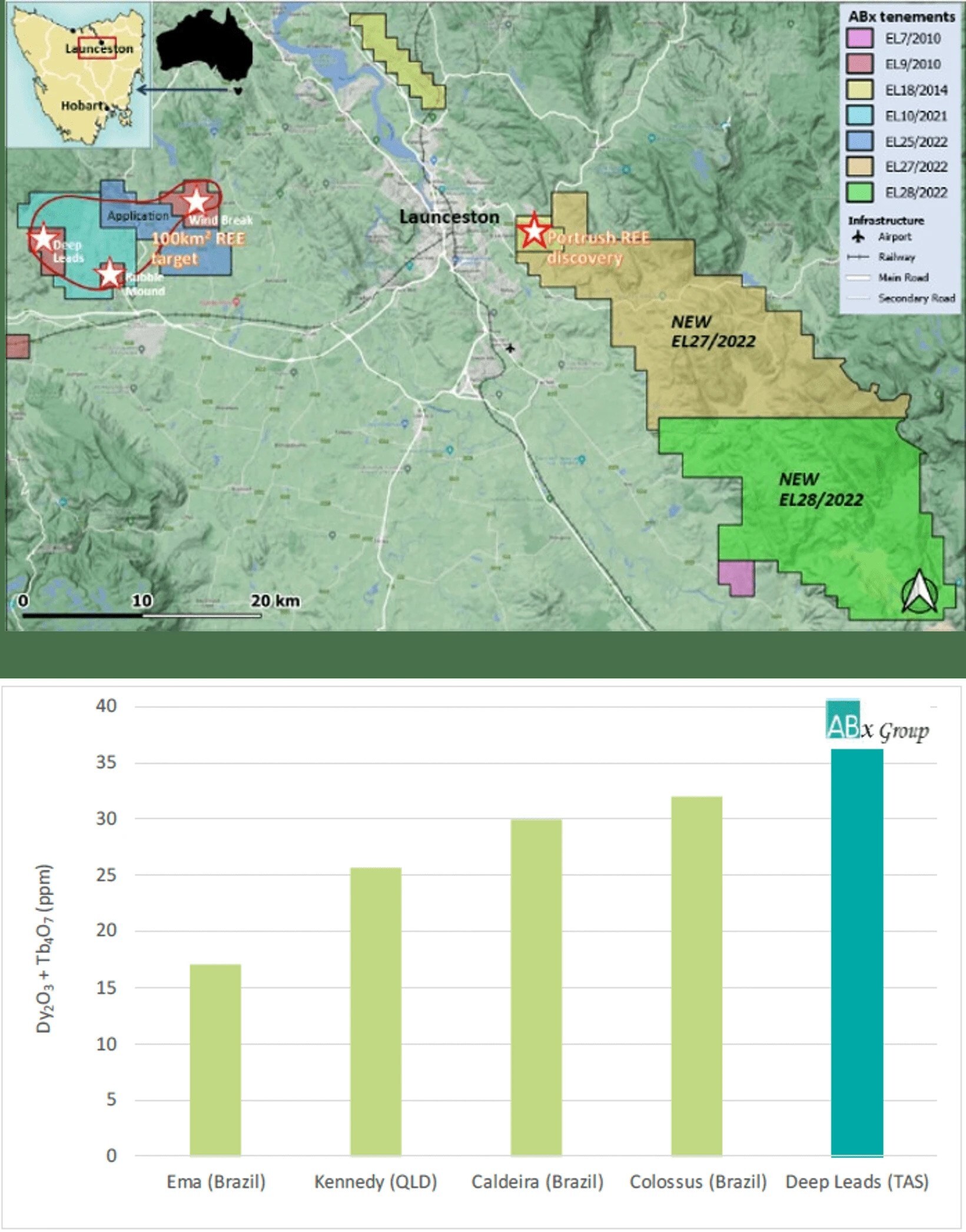

In this latest testwork by ANSTO, two impurity removal (IR) trials have been conducted on rare earth-enriched leach solutions produced from a 1.2 kg sub-sample of the 100 kg bulk sample, taken from trial pit DLP002 within the Deep Leads resource area. The result confirms Deep Leads has an unusual mix of 62-66 per cent dysprosium and 25 per cent terbium.

ABx Director and CEO Mark Cooksey said, “These latest results are extraordinarily good. We are eagerly looking forward to the production of the MREC sample later this month.”

He added, “Because of the very high DyTb content, high extractions, low impurities and a significant resource, ABx Group continues to receive strong interest from potential customers.”

Cooksey also noted that each phase of testwork reinforces the advantages of the Deep Leads resource. These results demonstrate that a high proportion of rare earths can be successfully carried through to an MREC product using low-cost chemistry.

Read More: ABx Group achieves 98 per cent rare earth retention in Deep Leads processing programme

Production sample underway

ANSTO has begun producing the first MREC product from 50 kg of the 100 kg bulk sample, with distribution to customers expected by the end of November. Column leach tests, critical for process design, are scheduled to begin next month.

The Deep Leads – Rubble Mound and Wind Break resource contains 89 million tonnes averaging 844 ppm total rare earth oxides (TREO), including 36 ppm Dy+Tb. This is the highest proportion reported for an Australian ionic clay deposit and among the highest globally. Dy and Tb prices remain elevated, with non-China premiums over three times higher than domestic Chinese prices, underscoring the potential value of ABx’s high-grade MREC feedstock.

Must read: Key industry individuals share their thoughts on the hottest topics

Responses