With the starting of the implantation of actual winter capacity cut for alumina and aluminium yesterday, primary ingot prices registered a jump today. As updated by Shanghai Metals Market, average A00 aluminium ingot price has gained RMB 170/t on November 16 to stand at RMB 15,360/t from RMB 15,190/t yesterday.

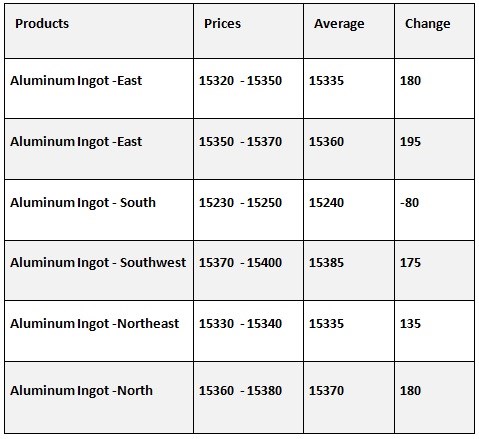

The rise in aluminium A00 Aluminum prices have continued in all other individual markets in China. A00 ingot prices have registered an increase from RMB 135/t to RMB 195/t across all markets. A00 ingot prices have registered a drop only in the south China market. In the spot market aluminium is trading at a discount of RMB 160-120 /tonne. The jump in A00 ingot prices in the individual markets can be seen in the table below:

{alcircleadd}

Chalco, China's leading state-run aluminium firm has not reported any cut in aluminium capacity in the current season. Zhang Bo, CEO of China Hongqiao Group, the largest aluminium producer says the company has closed all aluminium plants as per requirement of local government for the winter capacity cut programme. It is also considering shifting its closed smelting plants to other countries like Indonesia for restarting. The company keeps bearish at long-term price prospect of aluminium but confident about supply-side reforms and demand prospect.

Zhongfu Industrial, another aluminium producer and its subsidiaries announced they would strictly execute the plan of capacity cut from Nov 15, 2017 to March 15, 2018. 72,000 tons of primary aluminium output will be affected in the 4 months.

In the SHFE, bearish and bullish trends have a tight struggle at RMB 15,500 per tonne and 5-day moving average, which needs to be focused on. With changed macro anticipation, SMM projects aluminium price is hard to rebound effectively the short term.

As updated by Shanghai Metals Market, average spot alumina price in China drops to RMB 3655/t today on November 16 after the begining of capacity cut yesterday.

Responses