The US dollar snapped a four-session decline after the British pound stalled at lower levels ahead of a vote to extend Britain's March 29 deadline for exiting the European Union. Base metals, expect for LME tin, closed lower and aluminium edged down. SHFE aluminium lost 0.37%.

A rebound in the US dollar weighed LME aluminium to the lowest overnight at US$1,893 per tonne, before it returned to around the five-, 10-, and 20- day moving averages. It finally ended the overnight trading at US$1,902 per tonne. The contract is likely to trade at US$1,850-1,930 per tonne today.

{alcircleadd}

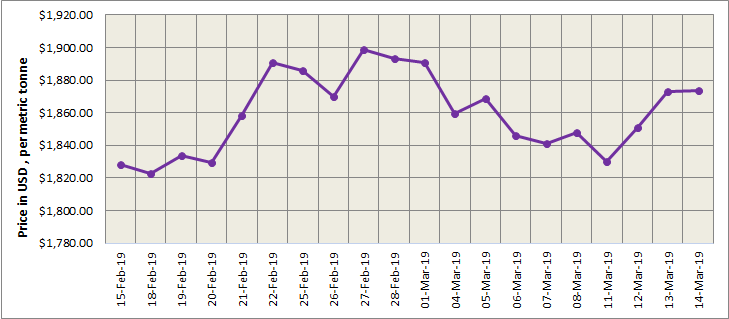

As on March 14, LME aluminium cash (bid) price stood at US$ 1873 per tonne, LME official settlement price stands at US$ 1873.50 per tonne; 3-months bid price stands at US$ 1897 per tonne, 3-months offer price is US$ 1898 per tonne; Dec 20 bid price stands at US$ 2028 per tonne, and Dec 20 offer price stands at US$ 2033 per tonne.

The LME aluminium opening stock dropped to 1189025 tonnes. Live Warrants totalled at 651475 tonnes, and Cancelled Warrants were 537550 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1905 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange slightly dropped to US$ 2024 per tonne today from US$ 2039 per tonne on March 14. China’s National Bureau of Statistics (NBS) said on Thursday that industrial output slowed more than expected in January and February, suggesting a slowdown in the Chinese economy.

An increase of nearly 2,000 lots of shorts in open interests depressed the SHFE 1905 contract to a low of RMB13,620 per tonne around noon yesterday. Support at the RMB 13,600 per tonne level helped the contract rebound and close at RMB 13,650 per tonne. The contract lost gains from overnight, but remained above all moving averages. The SHFE 1905 contract then dropped to a low of RMB 13,565 per tonne overnight as China’s economic data came in weaker than expected. It is expected to trade at RMB13,500-13,800 per tonne today with spot discounts down to RMB 40 per tonne. The contract is likely to test support from the 60-day moving average.

Responses