Japanese general trading house Marubeni Corp reported that aluminium inventories at Japan’s three major ports (Yokohama, Nagoya, and Osaka) increased for the second consecutive month. As of the latest end of May data, the stocks rose to 331,000 metric tonnes, marking an increase of 3.3 per cent from April 2025.

Continued increase in stocks in addition to premium drop underscores the ongoing weakness in aluminium demand in the Asian country. Moreover, the recent news reporting 0.2 per cent GDP shrinkage in Japan, albeit better than the initial estimation, further reflects the subdued market sentiment.

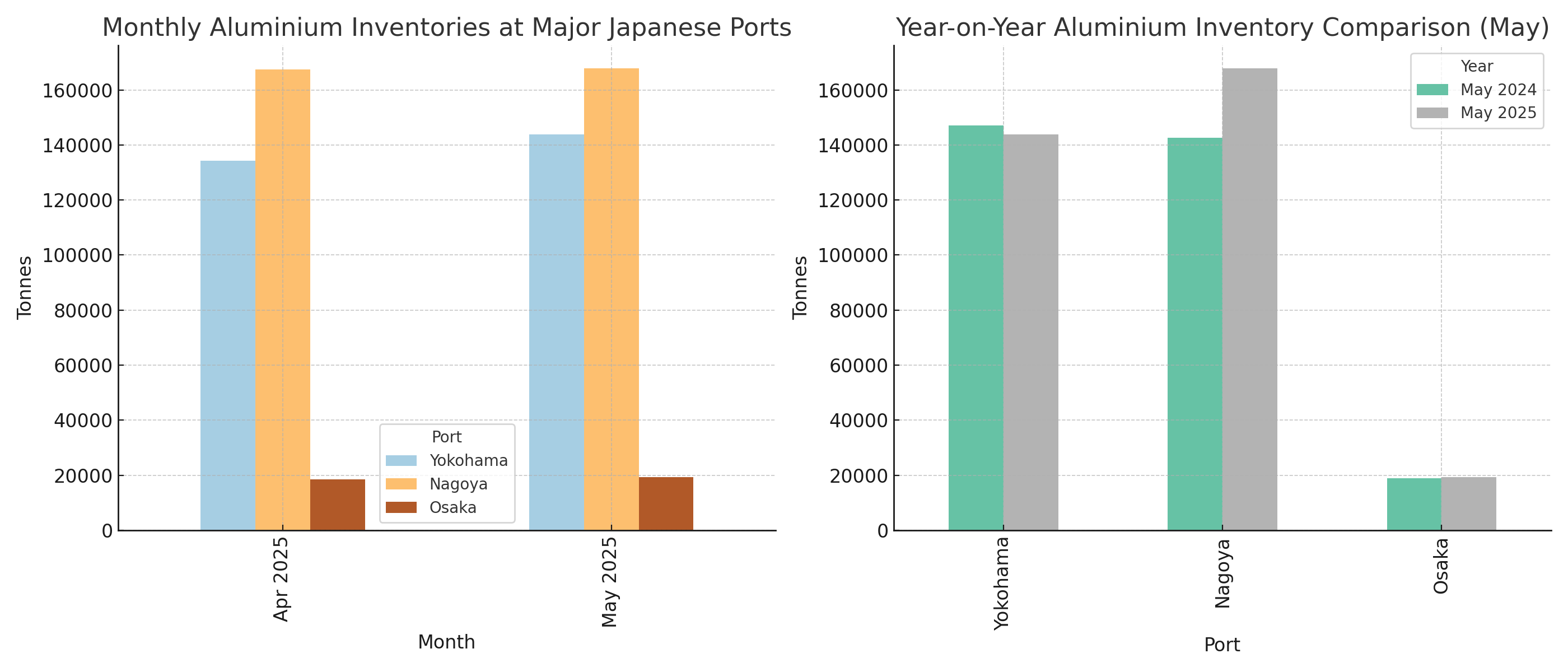

How stocks moved M-o-M

This month-on-month build-up started in April when stocks rose 3.4 per cent. In contrast, inventory levels in February 2025 saw a 3.5 per cent decline from the previous month. This latest buildup thus reverses a short term drawdown in Japan’s aluminium stocks.

As the above graph suggests, aluminium inventories at Japan’s three major ports - Yokohama, Nagoya, and Osaka saw month-on-month increase in May, reaching 143,900 tonnes, 167,900 tonnes, and 19,200 tonnes. In Yokohama and Osaka, stocks rose by 7.15 per cent and 8.5 per cent, respectively, from 134,300 tonnes and 18,500 tonnes, while that in Nagoya saw a modest growth from 167,500 tonnes in April.

Responses