您想继续阅读英文文章还

是切换到中文?

是切换到中文?

THINK ALUMINIUM THINK AL CIRCLE

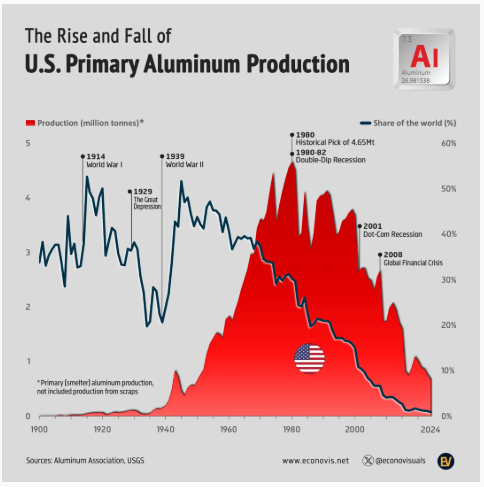

The United States shares a deep, long, and almost personal bond with aluminium as the metal has played a pivotal role in shaping up the nation’s manufacturing base while contributing about USD 228.31 billion to the economy. But at the same time, the industry in the US has weather many highs and lows. The country was once responsible for contributing more than 50 per cent to the world's primary aluminium supply and now it accounts for less than 1 per cent. But has this shift hurt the nation's backbone in the aluminium industry, has it carved out new pathways to sustain its legacy in the sector? Here’s a look at the century-long evolution of America’s aluminium landscape and what's reshaping it.

The journey of aluminium industry in the United States back to World War I (1914-1918) when production was 52,210 tonnes, accounting for more than half of world’s supply. By World War II (1939-1945), the production further grew to 835,000 tonnes. This momentum carried well into the late 20th century, culminating in a peak of 4.65 million tonnes in 1980.

Cut to the late 1990s, aluminium production trend in the US reversed and began to decline, coming in at 3.7 million tonnes between 1998 and 2000. As a consequence, its global share fell to 16 per cent. As the downward trend persisted into the 21st century, the production plummeted to 670,000 tonnes in 2024, representing a mere 0.9 per cent of global output.

So, what happened to the nation which once stood as the world’s power house of primary aluminium production?

The unraveling of an industry

In 1995, the US housed 23 primary aluminium smelters across 14 states. By 2020, 15 facilities shut down and 2 became idle, affecting 45,000 jobs. In 2021, output fell 28 per cent in a single year, pushing the US to ninth position among global primary producers.

In case you wonder why the output volume never revived in the US, here are some of the factors, including high electricity costs. In fact, according to the Aluminum Association, the deregulation of energy prices was the single most important factor that led to the decline in primary aluminium production. The association reported that in 2023, industrial power costs in the states with idled primary aluminium capacity ranged from USD 65.50 per megawatt-hour in Kentucky to USD 82.40 per MWh in Indiana. In contrast, new smelters need a long-term contract at or below USD 40 per MWh to be viable.

Another factor that has caused hindrance to the revival of primary aluminium production in the US includes the influx of low-cost Chinese aluminium into the global market. After China’s entry into the WTO in 2001, global aluminium markets were reshaped by cheap Chinese metal that steadily eroded the competitiveness of US producers.

However, it is important to underpin that even though primary aluminium production collapsed in the domestic market, consumption remained unwavering. In 2024, US consumption of aluminium stood at around 5 million tonnes - more than seven times its domestic primary output. How did they meet the demand? By strengthening its own scrap ecosystem and by leaning heavily on imported metal. In 2024, the nation imported 5.52 million tonnes of aluminium, of which primary aluminium imports were 3.6 million tonnes and semi-finished goods were 1.22 million tonnes, whereas the domestic scrap recovery was 3.47 million tonnes versus 3.31 million tonnes in 2023.

So, if the US can no longer make enough aluminium – it recycles it or buys it.

…and so much more!

SIGN UP / LOGINResponses