The US dollar declined amid light holiday trading on Wednesday. The dollar index, which tracks the greenback against a basket of other currencies, lost 0.07% and finished at 97.63. SHFE base metals mostly increased while there was no trading on the LME. SHFE aluminium fell 0.42%.

The London Metal Exchange was closed on December 25 for the Christmas holiday.

{alcircleadd}

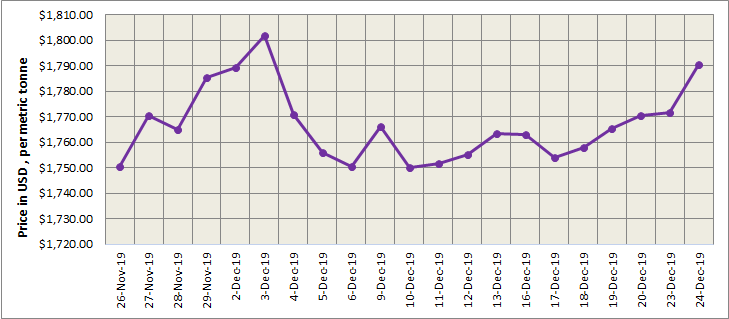

As on December 24, Tuesday, LME aluminium cash (bid) price stood at US$ 1790 per tonne, LME official settlement price stands at US$ 1790.50 per tonne; 3-months bid price stands at US$ 1814 per tonne, 3-months offer price is US$ 1816 per tonne; Dec 20 bid price stands at US$ 1868 per tonne, and Dec 20 offer price stands at US$ 1873 per tonne.

The LME aluminium opening stock decreased to 1484525 tonnes. Live Warrants totalled at 928050 tonnes, and Cancelled Warrants were 556475 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1806.34per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) declined to US$ 2047 per tonne on Thursday, 26 December 2019.

The most traded SHFE 2002 contract crept up to its highest since September 16 at RMB14,285 per tonne in morning trade, before it eased to close the day 0.18% higher at RMB14,235 per tonne.

The SHFE contract slipped to a low of RMB14,135 per tonne and closed lower on the day at RMB14,175 per tonne. The contract is likely to hover between RMB14,100-14,250 per tonne today with spot premiums at RMB130-150 per tonne.

Responses