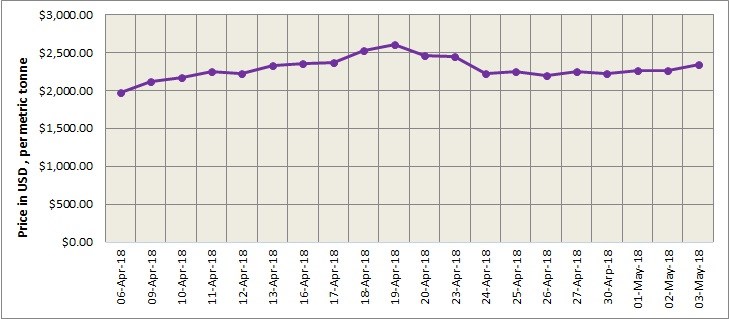

LME aluminium surged high during yesterday’s trading and closed at US$2,349 on Thursday May 3, from US$2269 per tonne on Wednesday May 2. LME aluminium traded around the 20-day moving average overnight and we expect it to trade at US$2,260-2,320 per tonne today.

As on May 3, LME aluminium cash (bid) price stands at US$ 2348 per tonne, LME official settlement price stands at US$ 2349 per tonne; 3-months bid price stands at US$2340 per tonne, 3-months offer price is US$ 2342 per tonne; Dec 19 bid price stands at US$2297 per tonne, and Dec 19 offer price stands at US$ 2302 per tonne.

The LME aluminium opening stock stood at 1319300 tonnes. Live Warrants totalled at 871825 tonnes, and Cancelled Warrants were 447475 tonne.

LME aluminium 3-months ABR price is hovering low at US$ 2325.36 tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased from US$ 2262 per tonne on May 3 to US$ 2279 per tonne on May 4.

The SHFE 1807 contract came off to a low of RMB 14,560 per tonne from a high of RMB14, 735 per tonne overnight following its falling LME counterpart finally closing at RMB 14,590 per tonne. SMM sees limited upward room for SHFE aluminium and expect it to trade at RMB 14,500-14,700 per tonne today. Spot discounts are seen at RMB 70-30 per tonne.

Investors were mostly hesitant and waited for guidance from fundamentals and sanctions on Russian aluminium. SMM expects SHFE aluminium to hover at a narrow range in the short term.

Responses