The greenback recovered to 97 following its steepest weekly drop in three months last week. LME base metals ended in negative territory across the board overnight. Aluminium slid over 0.8%. SHFE base metals also traded lower across the board overnight. Aluminium fell close to 0.3%.

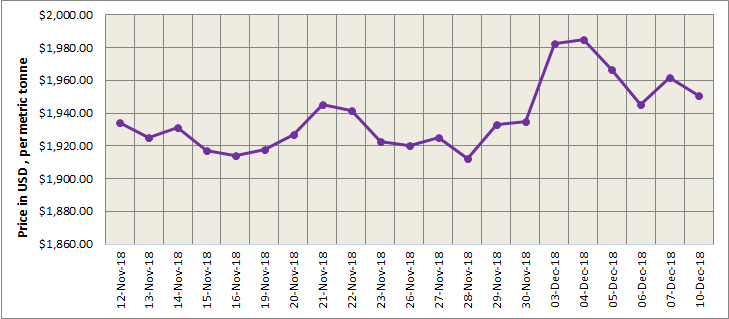

LME aluminium started the week lower than last closing at US$ 1951per tonne. The aluminium contract then rebounded to close at US$1,963 per tonne, near the 20-day moving average on Monday after it slumped to a low of US$1,935 per tonne on gains in the US dollar. LME aluminium is expected to continue to hover among moving averages and to trade at US$1,940-1,955 per tonne today.

{alcircleadd}

As on December 10, Monday, LME aluminium cash (bid) price stood at US$ 1950 per tonne, LME official settlement price stands at US$ 1951 per tonne; 3-months bid price stands at US$ 1950.50 per tonne, 3-months offer price is US$ 1951 per tonne; Dec 19 bid price stands at US$ 2008 per tonne, and Dec 19 offer price stands at US$ 2013 per tonne. LME cash price and three months price now stand on the level.

The LME aluminium opening stock dropped to 1040975 tonnes. Live Warrants totalled at 796350 tonnes, and Cancelled Warrants were 244625 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1948 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 1970 per tonne today from US$ 1972 per tonne on December 10.

A weaker US dollar supported the SHFE 1901 contract, which climbed along the five-day moving average, to an intraday high of RMB 13,680 per tonne yesterday. China's exports of unwrought aluminium and aluminium products rallied in November, and this also buoyed market sentiment. However, weak fundamentals weighed the contract to settle at RMB 13,635 per tonne, below the five- and 10-day moving averages. The contract then traded lower to close at RMB 13,630 per tonne overnight. The prices remained rangebound as social inventories continued to decline while dips in prices of alumina and prebaked anode waned cost support to aluminium prices. We expect the most-traded SHFE aluminium contract to trade at RMB 13,550-13,700 per tonne today with spot prices at discounts of RMB 20 per tonne to premiums of RMB 20 per tonne.

Responses