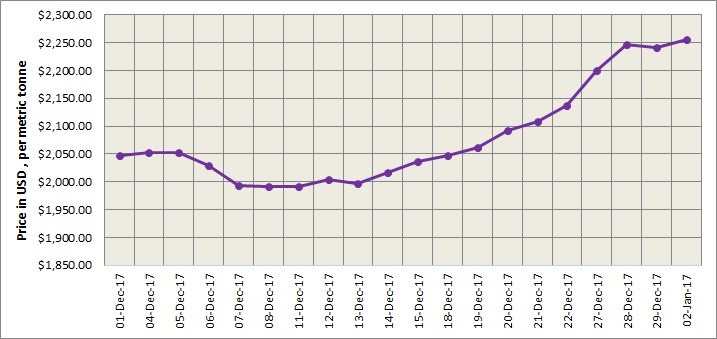

LME aluminium marks a strong start to 2018. The light metal contract which had ended at US$2,241.5 per tonne on December 29, rose by 0.6 per cent to close at US$2,256 per tonne on Tuesday, January 2. Technical analysis suggests that LME aluminium will trade higher in the range of US$2,250-2,285 per tonne today, January 3. However, with China’s refined aluminium inventory including SHFE warrants climbing further to 1.78 million tonnes as of January 2, from levels seen on December 28, the momentum is expected to stay weaker in the short term.

As on January 2, LME official cash buyer aluminium price (Bid Price) stands at US$2,255.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,256 per tonne, 3M Bid Price is US$2,267 per tonne, 3M Offer Price is US$2,268 per tonne, Dec1 Bid Price is US$2,342 per tonne, and Dec1 Offer Price is US$2,347 per tonne.

The Asian reference price for LME aluminium (3-months ABR) stands at US$2,265.82 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange has inched lower from US$2,256 per tonne on January 2 to US$2,255 per tonne on January 3.

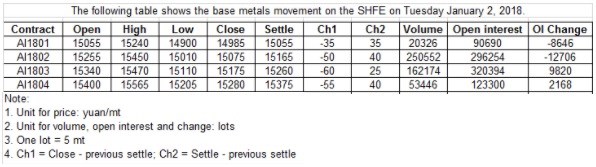

On Shanghai Futures Exchange, SHFE aluminium price movement on January 2, as updated by Shanghai Metals Market, was as follows:

In China, aluminium ingot inventory has surged to record highs, which is expected to keep the lid on SHFE aluminium price uptrend. SMM thinks the most active contract on SHFE will follow LME aluminium and trade higher today at RMB 15,100-15,300 per tonne range. Market participants should opt for short-selling at high price with small positions, SMM recommends.

The discounts on spot aluminium are likely to be at RMB 380-340 per tonne on January 3, SMM said.

Responses