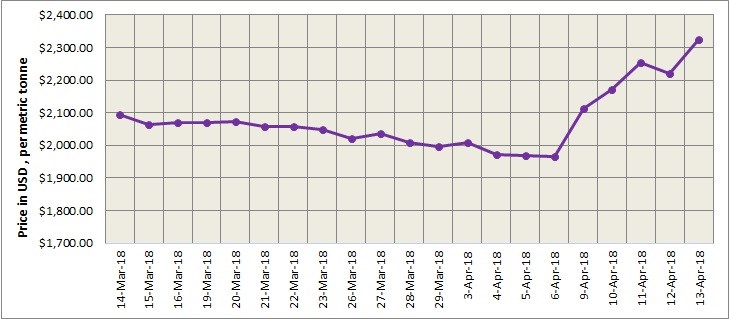

LME aluminium shows some gain after a drop last Thursday. LME aluminium closed at US$2325 per tonne on Friday April 13, up from US$ 2220.5 per tonne on Thursday April 12. SMM expects LME aluminium to trade rangebound at a relatively high level of RMB US$2,260-2,295 per tonne today. Despite the US sanctions on Rusal, a record low SHFE/LME aluminium price ratio is likely to boost China’s aluminium exports and offset the global dip in supply, according to Shanghai Metals Market.

As on April 13, LME aluminium cash (bid) price stands at US$ 2324.50 per tonne, LME official settlement price stands at US$ 2325 per tonne; 3-months bid price stands at US$2302.50 per tonne, 3-months offer price is US$ 2303.50 per tonne; Dec 19 bid price stands at US$ 2245 per tonne, and Dec 19 offer price stands at US$ 2250 per tonne.

The LME aluminium opening stock has dropped to 1345175 tonnes. Live Warrants totalled at 974825 tonnes, and Cancelled Warrants were 370350 tonne.

LME aluminium 3-months ABR price is hovering low at US$2285.33tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased from US$ 2297 per tonne on April 13 to 2301 per tonne on April 16.

According to SMM, SHFE aluminium hit a low of RMB 14,490 per tonne last Friday due to weak fundamentals and is expected to trade at RMB 14,350-14,550 per tonne today. Spot discounts are seen at RMB 80-40 per tonne.

The US dollar index is expected to hover at the current level, while base metals are likely to see mixed trading in the short term.

Responses