Three-month LME aluminium opened at $2,932.5 per tonne yesterday and rose to $2,977.5 per tonne before closing at $2,956per tonne, an increase of $19 percent or 0.65 percent. Open interest rose 1,590 lots to 308,000 lots, and trading volume was 161,000 lots.

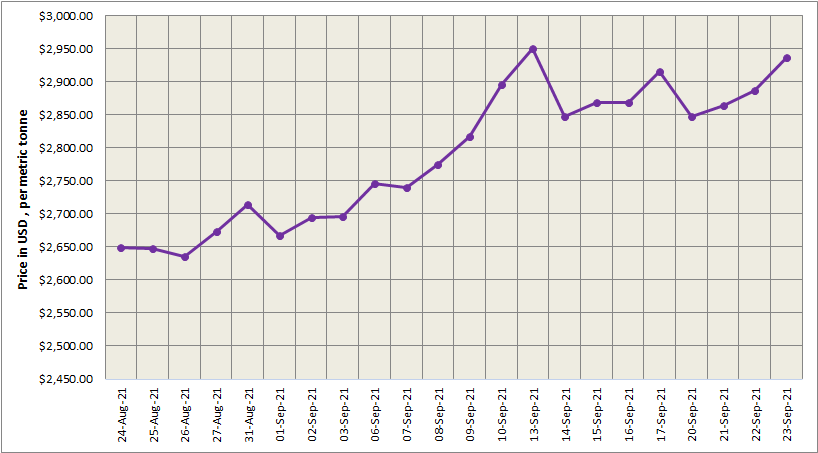

On Thursday September 23, LME aluminium cash (bid) price increased by US$50.5 or by 1.74 percent to stand at US$2,936.50 per tonne. The LME official settlement price surged by 1.73 percent or by US$50 to close at US$2,937 per tonne. 3-month bid price and 3-month offer price closed at US$2,950 per tonne and US$2,951 per tonne. December 22 bid price stood at US$2,603 per tonne and the offer price for the same day was recorded at US$2,608 per tonne.

LME aluminium opening stock September 23 closed at 1289075 tonnes. Live warrants were found to be 702675 and cancelled warrants were recorded at 586400.

LME aluminium 3-month Asian Reference Price stood at US$2,949.38 per tonne as of September 23.

SHFE Aluminium Price Trend

Benchmark aluminium SHFE for Friday, September 24 plunges by US$17 per tonne to settle at US$3,597 per tonne.

The most-traded SHFE 2111 aluminium closed up 2.66 percent or to RMB 23500 per tonne, with open interest up 11000 lots to 307000 lots.

Overnight, the most-traded SHFE 2111 aluminium contract opened at RMB 23,565 per tonne, with the highest and lowest prices at RMB 23,635 per tonne and RMB 23,265 per tonne before closing at RMB 23,425 per tonne, up by 0.24 percent. Open interest rose 1,590 lots to 308,000 lots, and trading volume was 161,000 lots.

Responses