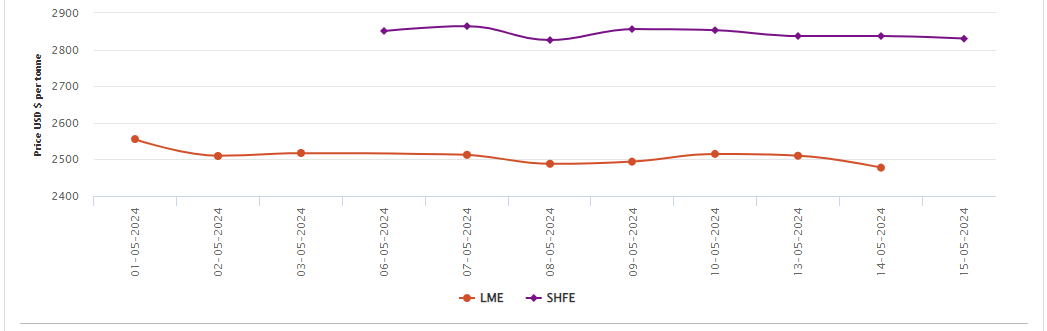

LME aluminum opened at US$2,548 per tonne in the previous trading day, with its low and high at US$2,519 per tonne and US$2,559 per tonnes, respectively, before closing at $2,549 per tonne, up 0.28 per cent.

On Tuesday, May 14, LME aluminium cash bid price and LME aluminium official settlement price decreased for the second day in a row by US$32 per tonne and US$32.50 per tonne to reach US$2,477 per tonne and US$2,477.50 per tonne, respectively.

The fall in aluminium prices on LME could be attributed to the unprecedented surge in opening stocks as Trafigura, a Swiss-based commodity trader, delivered more than 400,000 tonnes of aluminum last week. The LME aluminium stocks total accumulated 425,575 tonnes of aluminium overnight, reaching more than a two-year high.

3-month bid price and 3-month offer price also shrank on the same day by US$13 per tonne and US$12 per tonne to close at US$2,536 per tonne and US$2,538 per tonne. December 25 bid price and December 25 offer price settled at US$2,675 per tonne and US$2,680 per tonne, down by US$5 per tonne from the earlier day.

Continuing to rise, the LME aluminium opening stock amounted to 1,033,625 tonnes versus 902550 tonnes on May 13. Live Warrants and Cancelled Warrants stood at 925,750 tonnes and 107,875 tonnes, respectively. LME aluminium 3-month Asian Reference Price stood at US$2,552.55 per tonne, up by US$27.82 per tonne from US$ 2,524.73 per tonne.

SHFE aluminium price

On Wednesday, May 15, the Shanghai Futures Exchange aluminium benchmark price decreased by US$7 per tonne to stand at US$2,830 per tonne.

Overnight, the most-traded SHFE 2407 aluminum contract opened at RMB 20,490 per tonne, with the highest and lowest prices at RMB 20,525 per tonne and RMB 20,420 per tonne before closing at RMB 20,455 per tonne, down RMB 180 per tonne or 0.87 per cent.

Responses