LME aluminium opened at US$2,388.5 per tonne yesterday, with its high and low at US$2,398 per tonne and US$2,316.5 per tonne, respectively, before closing at US$2,325.5 per tonne, a decrease of US$62 per tonne or 2.6 per cent.

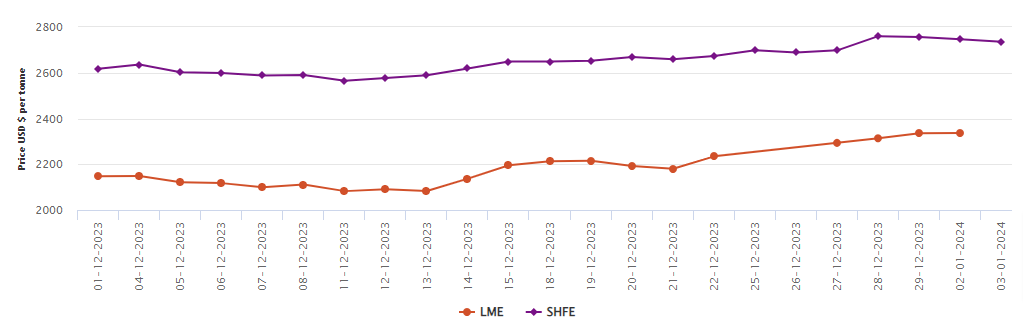

On Tuesday, January 2, both LME aluminium cash bid price and LME aluminium official settlement price moved up by US$1.5 per tonne or 0.06 per cent and US$1 per tonne or 0.04 per cent to clock at US$2,336 per tonne and US$2,336.50 per tonne.

LME aluminium 3-month bid price and LME aluminium 3-month offer price fell by US$3 per tonne or 0.12 per cent to clock at US$2,378 per tonne and US$2,379 per tonne. December 25 bid price and December 25 offer price, on the other hand, surged by US$108 per tonne or 4.32 per cent to peg at US$2,603 per tonne and US$2,608 per tonne.

LME aluminium opening stock came in at 566375 tonnes. Live warrants and Cancelled warrants closed at 374250 tonnes and 192125 tonnes. LME aluminium 3-month Asian Reference Price gained US$14.58 per tonne or 0.61 per cent to rest at US$2,394.12 per tonne.

SHFE aluminium price

On Wednesday, January 3, the Shanghai Futures Exchange (SHFE) aluminium price lost US$21 per tonne or 0.76 per cent to peg at US$2,735 per tonne. Overnight, the most-traded SHFE 2402 aluminium contract opened at RMB 19,670 per tonne, with low and high at RMB 19,400 per tonne and RMB 19,750 per tonne before closing at RMB 19,465 per tonne, down RMB 290 per tonne or 1.47 per cent.

Responses