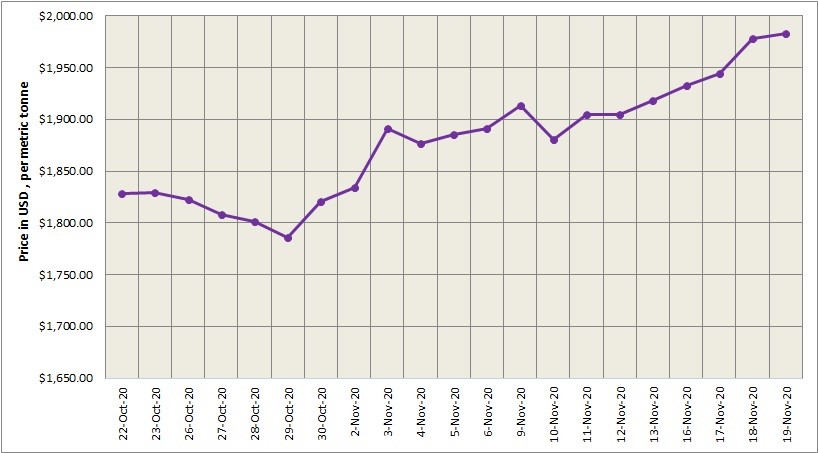

Three-month LME aluminium fell 0.05 per cent to close at US$ 1,989 per tonne on Thursday, November 19, with open interest falling to 724,000 lots. It is expected to trade between US$ 1,970-2,010 per tonne today.

Both LME aluminium cash (bid) price and LME official settlement price grew further on Thursday, November 19, although slower than the previous days, by US$ 5 per tonne to stand at US$ 1,983 per tonne. 3-months bid price and 3-months offer price stood at US$ 1,994.50 per tonne, almost flat compared with US$ 1,994 per tonne on November 18. Dec 21 bid price and Dec 21 offer price exceeded US$ 2,000 per tonne to stand at US$ 2,013 per tonne.

The LME aluminium opening stock decreased from 1409575 tonnes to 1404425 tonnes on November 19. Live Warrants hovered at 1238775 tonnes, while Cancelled Warrants at 165650 tonnes.

LME aluminium 3-months Asian Reference Price stood at US$ 1,991.00 per tonne, as of November 19.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE dropped slightly to stand at US$ 2,403 per tonne on Friday, November 20.

The most-traded SHFE 2012 aluminium contract rose 1.06 per cent on the day to close at RMB 15,755 per tonne, with open interest decreasing 13,268 lots to 143,000 lots. China’s primary aluminium inventories shrank 14,000 tonnes on the week to 615,000 tonnes as of November 19, according to an SMM survey. Low inventories are expected to support aluminium prices.

The most-liquid SHFE 2012 aluminium contract climbed 0.57 per cent to settle at RMB 15,810 per tonne on Thursday night, and is likely to trade between RMB 15,600-16,000 per tonne today. Social inventories still declined slightly on Thursday from last week, and the spot under low inventories maintained a premium.

Responses