The US dollar index recovered on Thursday as the euro slid against the greenback after Jens Weidmann, the Bundesbank president and a member of the European Central Bank Governing Council, painted a bleak picture of the German economy, saying the country's slump will last longer than thought. LME base metals traded higher across the board on Thursday. LME aluminium inched up 0.08% and SHFE aluminium grew 0.2%.

LME aluminium closed Thursday's trading at US$ 1880.50 per tonne. LME aluminium jumped past the 60-day moving average to a day-high of US$1,924 per tonne on Thursday before it lost most of those gains to end below the 60-day moving average at US$1,906.5 per tonne.

{alcircleadd}

SMM expects the contract to trade at US$1,890-1,920 per tonne today. LME aluminium is expected to see relatively weak performance during the Chinese New Year break.

As on January 31, LME aluminium cash (bid) price stood at US$ 1880 per tonne, LME official settlement price stands at US$ 1880.50 per tonne; 3-months bid price stands at US$ 1903 per tonne, 3-months offer price is US$ 1904 per tonne; Dec 19 bid price stands at US$ 2050 per tonne, and Dec 19 offer price stands at US$ 2055 per tonne.

The LME aluminium opening stock decreased to 1287425 tonnes. Live Warrants totalled at 756050 tonnes, and Cancelled Warrants were 531375 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1912 per tonne.

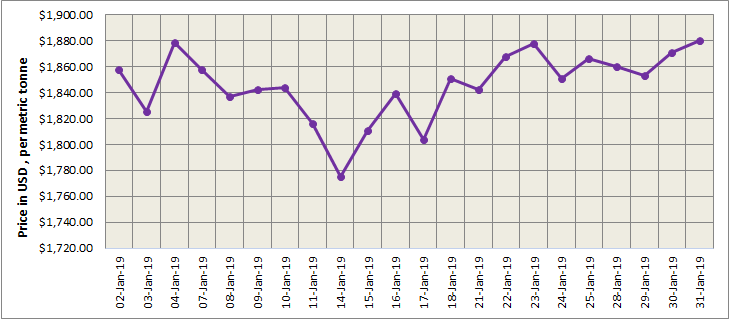

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange increased to US$ 2002 per tonne today from US$ 2004 on January 31.

The SHFE 1903 contract rose a high of RMB13,565 per tonne overnight. It later lost some of those gains to close at RMB13,525 per tonne as longs covered and shorts added their positions. The contract is expected to trade at RMB13,450-13,560 per tonne today with spot discounts at RMB90-50 per tonne.

Responses