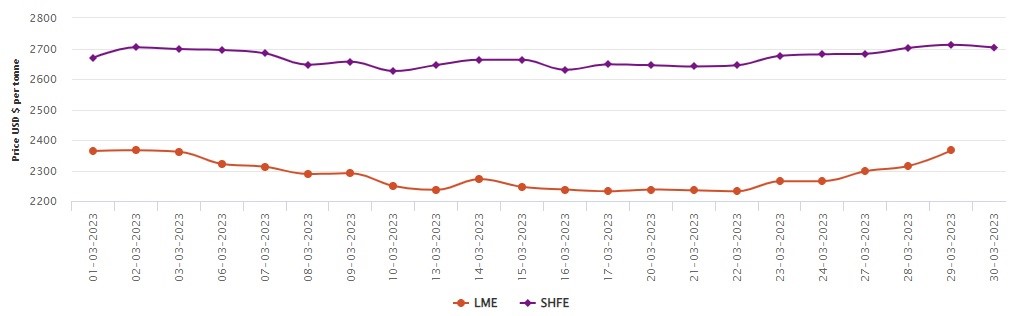

LME aluminium opened at US$2,383 per tonne on Wednesday, with its high and low at US$2,423 per tonne and US$2,366.5 per tonne, respectively, before closing at US$2,380 per tonne, an increase of US$2.5 per tonne or 0.1 per cent.

On Wednesday, March 29, both LME aluminium cash bid price and LME aluminium official settlement price surged by US$51.5 per tonne or 2.22 per cent and US$51 per tonne or 2.20 per cent to halt at US$2,365.50 per tonne and US$2,366 per tonne.

3-month bid price and 3-month offer price escalated by US$49.5 per tonne or 2.09 per cent and US$49 per tonne or 2.07 per cent to halt at US$2,409.50 per tonne and US$2,410 per tonne.

December 24 bid price and December 24 offer price came in at US$2,593 per tonne and US$2,598 per tonne after recording an expansion of US$40 per tonne or 1.56 per cent.

LME aluminium opening stock settled at 529175 tonnes. Live warrants and Cancelled warrants scored at 431825 tonnes and 97350 tonnes.

LME aluminium 3-month Asian Reference Price went up by US$7.68 per tonne or 0.32 per cent to reside at US$2,377.44 per tonne.

SHFE aluminium price

On Thursday, March 30, the SHFE aluminium benchmark price has dipped by US$9 per tonne or 0.33 per cent to rest at US$2,703 per tonne.

The most-traded SHFE 2305 aluminium closed up 0.38 per cent or RMB 70 per tonne at RMB 18,690 per tonne, with open interest up 77 lots to 219,211 lots.

Overnight, the most-traded SHFE 2305 aluminium contract opened at RMB 18,805 per tonne, with its high and low at RMB 18,890 per tonne and RMB 18,710 per tonne before closing at RMB 18,715 per tonne, up RMB 25 per tonne or 0.13 per cent.

Responses