The US dollar went flat on Wednesday with the market in consolidation mode, as investors sought more clarity about ongoing US-China trade negotiations. The dollar index, which tracks the greenback against a basket of other currencies, ended flat on the day at 97.95. LME base metals and the SHFE complex mostly extended their decline. LME aluminium fell 0.25% and SHFE aluminium declined 0.04%.

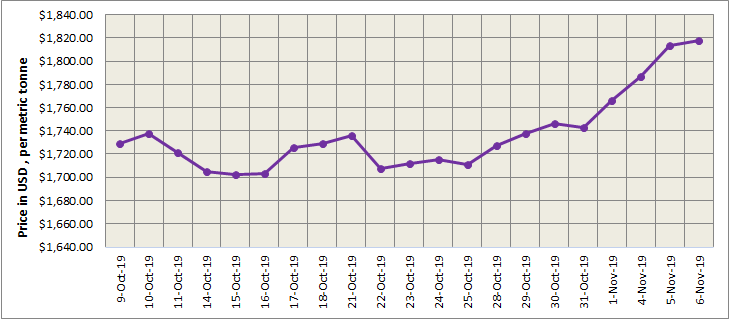

LME aluminium traded higher over the day but lost gains overnight. Three-month LME aluminium lacked continuous upward momentum, ending lower on the day at US$1,803 per tonne. Three months LME aluminium is likely to trade at US$1,790-1,810 per tonne today.

{alcircleadd}

As on November 6, Wednesday, LME aluminium cash (bid) price stood at US$ 1817 per tonne, LME official settlement price stands at US$ 1817.50per tonne; 3-months bid price stands at US$ 1808.50per tonne, 3-months offer price is US$ 1809.50per tonne; Dec 20 bid price stands at US$ 1883 per tonne, and Dec 20 offer price stands at US$ 1888 per tonne.

The LME aluminium opening stock dropped to 951275 tonnes. Live Warrants totalled at 782800 tonnes, and Cancelled Warrants were 168475 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1809 per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE (Shanghai Future Exchange) dropped to US$ 2014 per tonne today November 6, 2019.

The most traded SHFE 1912 contract climbed to a one-month high of RMB13,985 per tonne in afternoon trade, before it gave back all those gains to close flat at RMB 13,955 per tonne, snapping a five-day winning streak. This pointed to weak morale among longs when prices rose towards the RMB14,000 per tonne level. We see limited further upside in SHFE aluminium. The December contract continued to move sideways and finished RMB 5 lower at RMB 13,950 per tonne overnight. The release of SMM aluminium inventories data should be watched today. Trading range of the contract is seen at 13,900-14,000 per tonne today.

Responses