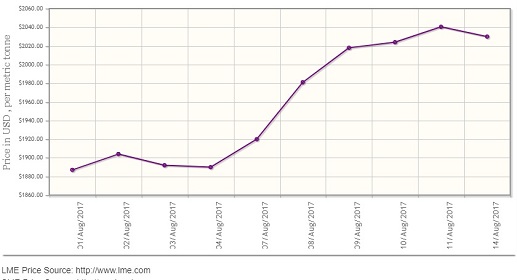

LME aluminium gave up some its recent gains and dipped slightly as the dollar bounced back and the market started digesting the news of Chinese aluminium capacity cuts. The light metal closed at US$2,030 per tonne on Monday, August 14, down from its earlier close of US$2,040.50 per tonne last Friday, August 11.

According to Shanghai Metals Market forecast, LME aluminium will move around the five-day moving average and range at US$2,015-2,035 per tonne on Tuesday, August 15.

{alcircleadd}Reuters’ technical analysis suggests that LME aluminium may retest a support at US$2,021 per tonne, as it temporarily peaked around the top-end resistance at US$2,046 per tonne.

As on August 14, LME official cash buyer aluminium price (Bid Price) stands at US$2,029.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,030 per tonne, 3M Bid Price is US$2,031 per tonne, 3M Offer Price is US$2,031.50 per tonne, Dec1 Bid Price is US$2,070 per tonne, and Dec1 Offer Price is US$2,075per tonne. LME aluminium Opening Stock stands at 1291250 tonnes, total Live Warrants is 1040500 tonnes, and Cancelled Warrant is 250750 tonnes.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price at Shanghai Metal Exchange (SME) has dropped slightly from US$2,334 per tonne on Monday, August 14, to US$2,326 on Tuesday, August 15.

At Shanghai Futures Exchange (SHFE), the most active aluminium future contract SHFE 1710 opened at RMB 16,180 per tonne on Monday, and then fell sharply to RMB 15,680 per tonne as many of the long contracts made an exit. SHFE 1710 aluminium finally ended at RMB 15,780 per tonne. SMM predicts that SHFE 1710 aluminium may drop a little bit more in the short term and move in the range of RMB 15,550-15,800 per tonne on Tuesday, August 15.

Spot aluminium in east China market is expectedto trade at discounts of RMB 140-100 per tonne over SHFE 1708 aluminium on Tuesday.

The market focus will be on the UK retail sales, CPI for July and US retail sales data for July on Tuesday, SMM said.

Responses