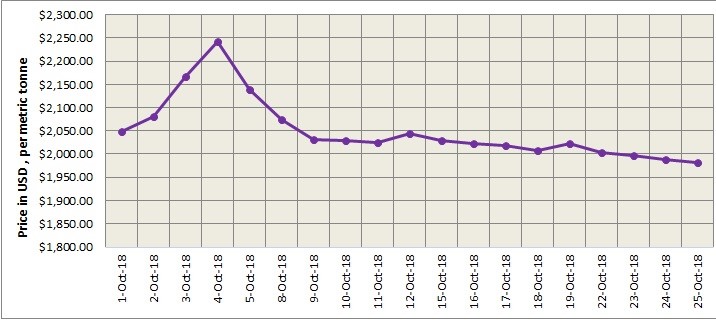

The US dollar strengthened as the euro and pound slipped on Thursday after the European Central Bank (ECB) kept interest rates unchanged in their October policy meeting. LME aluminium dropped below US$2,000 per tonne level and closed at US$ 1981 per tonne. It has closed lower for seven consecutive trading days and is likely to continue its weak performance in the short term. The contract closed near its day lows overnight and is likely to trade within a range of US$1,980-2,020 per tonne today.

As on October 25, Thursday, LME aluminium cash (bid) price stands at US$ 1980 per tonne, LME official settlement price stands at US$ 1981 per tonne; 3-months bid price stands at US$ 1998 per tonne, 3-months offer price is US$ 1998.50 per tonne; Dec 19 bid price stands at US$ 2053 per tonne, and Dec 19 offer price stands at US$ 2058 per tonne.

The LME aluminium opening stock dropped to 1049525 tonnes. Live Warrants totalled at 737400 tonnes, and Cancelled Warrants were 312125 tonnes.

LME aluminium 3-months Asian Reference Price is hovering at US$ 1996 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange dropped to US$ 2026 per tonne today from US$ 2036.5 per tonne on October 25.

The SHFE 1812 contract registered the fifth consecutive trading day of increase yesterday. It settled above the 10-day moving average at RMB14,255 per tonne. It initially jumped to session-highs of RMB14,310 per tonne overnight as longs aggressively added their positions. Then, the contract reversed its earlier gains and broke its five-day winning streak. With a strong dollar and a weak LME counterpart, the SHFE 1812 contract is likely to trade at RMB 14,170-14,300 per tonne today with spot discounts at RMB 70-30 per tonne.

Declines in aluminium social inventories and news about production cuts across smelters supported prices. However, the contract is likely to continue lacking strong upward momentum.

Responses