On the first day of trading after Easter Holidays on April 3, the LME aluminium contract closed at US$ 2010 per tonne , recovering from a near eight-month low of US$1997 a tonne on Thursday, March 29, before the holidays. LME aluminium lost its position of US$2,000 per tonne on today’s trading after seven days of consecutive decline. It is likely to extend its downward trend in light of US China trade tension. SMM expects the contract to trade between $1,975-2,000 per tonne today.

As on April 3, LME aluminium cash (bid) price stands at US$ 2008 per tonne, LME official settlement price stands at US$ 2010 per tonne; 3-months bid price stands at US$ 2026 per tonne, 3-months offer price is US$ 2027 per tonne; Dec 19 bid price stands at US$ 2082 per tonne, and Dec 19 offer price is US$ 2087 per tonne.

The LME aluminium opening stock has increased to 1281475 tonnes. Live Warrants totalled at 1021825 tonnes, and Cancelled Warrants were 259650 tonne.

LME aluminium 3-months ABR price is hovering low at US$ 2024 per tonne.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price on Shanghai Metal Exchange slightly dropped from US$ 2227 per tonne on April 3 to US$ 2222 per tonne on April 4.

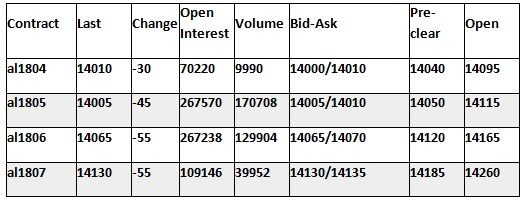

SHFE metals fell across the board, except for copper and nickel. The announcement from the US of possible retaliatory measures on imported goods from China is having a negative impact on trading of all commodities. SMM expects SHFE aluminium to trade between RMB 13,930-14,100 per tonne. Spot discounts are expected to range between RMB 60-20 per tonne. Following is the SHFE aluminium price movement on April 4, as updated by shfe.com.

The US dollar inched up and stood firmly above 90 as US stocks rebounded and as the euro edged down. The US dollar is likely to dip due to US’ Section 301 tariff on China today, while base metals are expected to trade rangebound with pressure today.

Responses