As of April 1, 2021, South Korea's automotive industry ranks as the world's fifth-largest passenger car producer and holds the seventh position globally regarding vehicle sales. The sector is on an upward trajectory, constituting 13 per cent of manufacturing production and 12 per cent of overall workforce engagement in South Korea. Projections indicate that by 2032, the Hyundai Motor Group, encompassing Hyundai, Kia, and Genesis, is poised to secure the third spot in sales among manufacturers.

However, it has been reported that the automobile industry in South Korea maintained its positive momentum in July 2023, showing production growth compared to the same period last year. Nevertheless, there was a decrease in domestic sales when year-on-year figures were examined.

In July 2023, the combined automobile production from six prominent domestic automakers (Hyundai Motor, Kia, GM Korea, Ssangyong Motor, Renault Korea, and Tata Daewoo) experienced a notable rise of 8.8 per cent, equivalent to 28,666 units, reaching a total of 352,972 units. Nevertheless, this positive trend was followed by a decline in August 2023, with a decrease of 4.7 per cent or 17,321 units from the June 2023 figures of 370,293 units. The Korea Automobile Mobility Industry Association has reported these statistics.

During the period of January-July 2023, the combined automobile manufacturing reached a total of 2,550,668 units, indicating a 21 per cent increase compared to the corresponding timeframe in the previous year.

Moreover, the South Korean automobile industry functions as a foundational sector that exerts influence over a diverse range of industries, encompassing materials like steel, aluminium and other nonferrous metals, glass and sectors such as transportation, advertising, financial services, and even construction. Over numerous decades, the automotive industry has experienced remarkable expansion, prominently showcasing the nation's economic advancement.

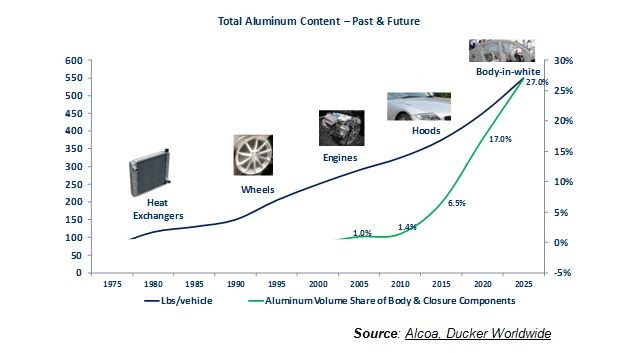

In 2017, the proportion of aluminium in the curb weight of mid-sized cars in South Korea was 8 per cent. It has been projected that aluminium's share will rise to 10.6 per cent by 2030.

Car manufacturers are progressively replacing steel with aluminium as their primary material. Suppliers of aluminium, as well as auto assembly and component manufacturers, are preparing to meet this shift. Aluminium is gaining prominence in the automotive industry as the preferred material, aligning with original equipment manufacturers' (OEMs) strategies to reduce vehicle weight.

Aluminium production in South Korea has been steadily increasing over the years. For instance 2018, the country's aluminium production reached 958,090 tonnes. This surge in production has prompted original equipment manufacturers (OEMs) to capitalize on the abundant aluminium supply by incorporating die-casted aluminium parts in automobiles. Notably, South Korea has emerged as a significant exporter of aluminium die-casting components to China, solidifying its position in this market.

South Korea witnessed a slight decline of 0.2 per cent or 882 units in year-on-year automobile sales. Additionally, there was a notable 9.8 per cent drop, equivalent to 39,558 units, in month-on-month sales, resulting in a total of 365,065 units sold in July 2023. When considering the period from January to July 2023, the cumulative sales reached 2,680,222 units, marking a significant 19 per cent increase compared to the previous year.

In July 2023, sales within the domestic market experienced a year-on-year decline of 5 per cent, equivalent to 26,610 units. Additionally, there was a month-on-month decrease of 16.4 per cent, or 7,204 units, bringing the total sales to 136,089 units.

The industry ascribed the drop in domestic sales to three main factors:

From January to July 2023, domestic sales reached 1,029,826 units, indicating a year-on-year increase of 8.3 per cent.

The export volumes of automobiles witnessed a year-on-year increase of 2.8 per cent, equivalent to 6,322 units. However, on a month-on-month basis, these volumes saw a 4.7 per cent decline, accounting for 11,351 fewer units in July 2023, resulting in a total of 228,976 units.

This annual growth can be attributed to the robust sales of domestic vehicles on a global scale, especially in North America and Europe. Nearly all major automobile brands recorded a rise in export sales, except for Kia and Renault Korea.

Between January and July 2023, the cumulative exports totalled 1,650,396 units, marking a substantial year-on-year surge of 27.4 per cent.

Responses